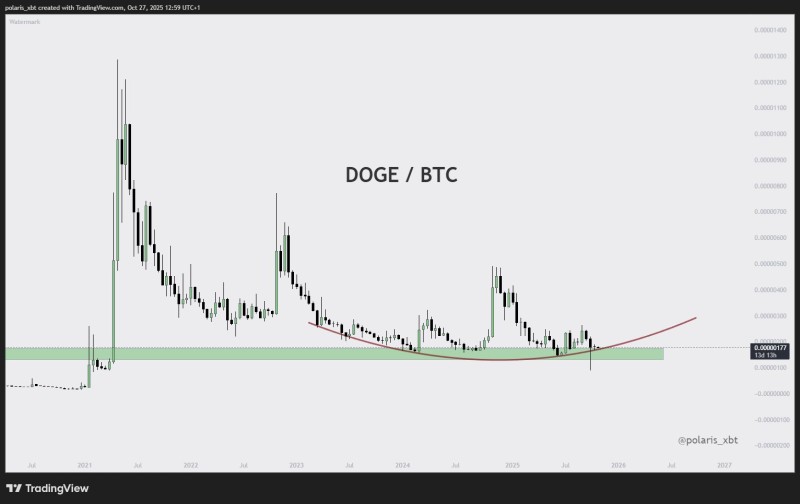

After almost two years of drifting sideways, Dogecoin's chart against Bitcoin is starting to look more promising. The price has been gradually climbing from its 2024 lows, forming what looks like a rounded bottom—a pattern that often comes before sustained upward momentum.

While Bitcoin has been hogging the spotlight and DOGE has been flying under the radar, history suggests these quiet periods often come right before capital rotates into altcoins. And when that happens, Dogecoin tends to be one of the first movers.

What the Chart Shows

Crypto analyst polaris_xbt believes this could set up a strong rebound in early 2026, potentially ending the current consolidation phase. The DOGE/BTC weekly chart reveals a large-scale bottoming structure that's been forming over several years. There's a clear green accumulation zone where buyers have consistently stepped in, and a red upward curve showing the market slowly shifting from decline to recovery.

Key levels and observations:

- Support Zone (0.00000100–0.00000180 BTC): This green band has been a reliable accumulation area since 2021, with buyers defending the price repeatedly

- Rounded Trendline: The red arc suggests steady recovery momentum, marking a shift from bearish exhaustion to renewed interest

- First Resistance (around 0.00000400 BTC): This level was hit during DOGE's 2022 and mid-2025 rallies and will be the first major hurdle

- Invalidation Level: A breakdown below 0.00000100 BTC would signal deeper trouble and delay any bullish outlook

- Target Zone: Breaking above 0.00000400 BTC could open the door to much higher levels

History Repeating?

Dogecoin's performance against Bitcoin has followed a pretty consistent pattern across multiple cycles. Every time DOGE hit this green accumulation zone, it later outperformed Bitcoin massively during altcoin rotation phases.

Back in 2017–2018, DOGE bottomed around this level before a 10x rally. In 2020–2021, accumulation near the same zone led to one of crypto's wildest surges. Now, in late 2025, DOGE is back in this range again—potentially setting up for another big move.

Right now, Bitcoin is still dominating the market, which limits money flowing into altcoins like DOGE. But these conditions often come right before rotation phases—when liquidity starts moving into higher-risk assets once BTC stabilizes.

Long-term holders seem unfazed by the current stagnation. On-chain data shows increased wallet dormancy and steady accumulation, which reduces selling pressure. Plus, Dogecoin's loyal community and speculative appeal could quickly reignite momentum once the broader market shifts toward risk-taking in 2026.

Dogecoin's chart against Bitcoin is telling a familiar story: deep cyclical accumulation followed by the calm before the storm. The rounded bottom structure and repeated defense of key support levels suggest DOGE might be ready to kick off a new phase of strength relative to Bitcoin. If history repeats, early 2026 could be when things get interesting.

Peter Smith

Peter Smith

Peter Smith

Peter Smith