Dogecoin (DOGE) has broken above its multi-month descending trendline with rising Open Interest and bullish positioning, though extreme long dominance raises concerns about market sustainability.

Dogecoin just broke through a major resistance level that's been holding it down since December 2023. The meme coin finally pushed past its multi-month descending trendline, and traders are getting pretty excited about what this could mean for DOGE's future.

The breakout looks legit too - it wasn't just a quick spike that got rejected. We saw a proper weekly close above the resistance, which is exactly what technical analysts look for when confirming these kinds of moves. Now that old resistance could actually flip into support, which would be a game-changer for DOGE.

But here's the thing - this breakout needs to stick. If DOGE can't hold above $0.19, we might be looking at a false breakout. The real confirmation would come if it pushes past $0.22 and stays there.

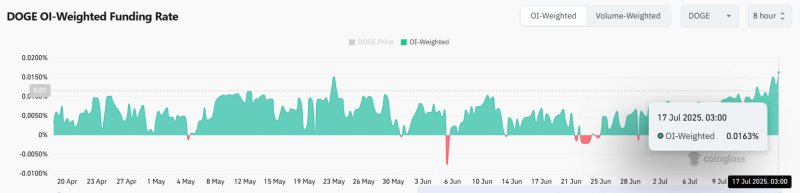

DOGE Price Gets Boost from Positive Funding Rates

The derivatives market is telling us that bulls are taking control. Funding rates have flipped positive, hitting 0.0163% at press time. This means long traders are actually paying a premium to hold their positions, which shows they're pretty confident about DOGE's direction.

When funding rates go positive like this, it usually means traders expect prices to keep climbing. It's a sign of genuine bullish conviction, not just speculative gambling. Of course, if these rates keep climbing too fast, it could signal the market's getting overheated and due for a pullback.

The good news is that this positive funding is happening alongside real buying pressure in the spot market. That's a much healthier setup than when you just see derivatives activity without actual demand for the underlying asset.

DOGE Price Surge Backed by $3.12 Billion Open Interest Spike

Open Interest just jumped 14.03% to $3.12 billion, which is a massive influx of new money into DOGE futures. This isn't just existing traders moving their positions around - this is fresh capital coming in to bet on higher prices.

When Open Interest rises alongside price, it's usually a good sign that the trend has legs. Traders are putting real money behind their bullish thesis, which gives the move more credibility than if it was just a short squeeze or low-volume pump.

The flip side? All this leveraged positioning creates risk. If DOGE stumbles, we could see some nasty liquidations that would amplify any downward move. But for now, the trend is clearly in favor of the bulls.

Dogecoin (DOGE) Price Benefits from Exchange Outflows

Here's something interesting - we're seeing $3.70 million in net outflows from exchanges. That means people are moving their DOGE off exchanges and into their own wallets, which typically happens when they're planning to hold rather than trade.

This is actually bullish for a few reasons. First, it reduces the supply available for immediate selling. Second, it suggests long-term holders are accumulating, not dumping. When coins leave exchanges during a breakout, it often means the move has more staying power.

The outflow trend also tells us that current holders aren't rushing to take profits despite the recent gains. They seem to believe there's more upside coming, which provides a solid foundation for continued price appreciation.

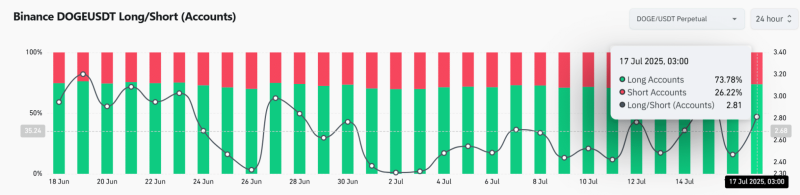

But here's where things get interesting - and a bit concerning. On Binance, 73.78% of traders are currently long DOGE. The Long/Short Ratio has hit 2.81, which is pretty extreme. While this shows massive bullish sentiment, it also raises red flags about potential liquidations.

When positioning gets this one-sided, it can become a problem. If DOGE stumbles, all those leveraged longs could get wiped out pretty quickly, creating a cascade of selling pressure. The market needs to deliver on these bullish expectations, or we could see a nasty unwinding.

This level of long dominance often signals complacency. Traders might be getting too comfortable with the idea that DOGE can only go up from here. History shows us that when everyone's betting the same way, the market has a habit of proving them wrong.

Dogecoin has clearly broken through an important resistance level, and the supporting data looks pretty solid. Rising Open Interest, positive funding rates, and exchange outflows all point to genuine bullish momentum rather than just hype.

The concerning part is how one-sided the positioning has become. With nearly 74% of traders long, DOGE needs to keep delivering gains to avoid a painful correction. The cryptocurrency must hold above $0.19 and ideally push past $0.22 to prove this breakout is the real deal.

Bottom line: DOGE looks good for further gains, but the extreme bullish positioning means there's not much room for error. The next few weeks will show whether this breakout marks the start of a real trend reversal or just another false dawn for the meme coin.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah