- DOGE Futures Market Heats Up with Massive 64% Spike in Trading Interest

- Dogecoin (DOGE) Leaves Other Cryptos in the Dust with 34% Weekly Gain

- Global Macro CEO Thinks DOGE Could Hit New Highs Against Bitcoin

- What DOGE's Massive 63% Open Interest Surge Really Means for Traders

- DOGE Shows Its Independence by Breaking Away From Bitcoin's Recent Weakness

- What's Really Behind Dogecoin's (DOGE) Recent Hot Streak?

Dogecoin's futures trading has exploded by 64% in just one week despite Bitcoin's recent slump, with total open positions jumping from $989 million to a whopping $1.62 billion as the beloved meme coin surged 34% in value.

DOGE Futures Market Heats Up with Massive 64% Spike in Trading Interest

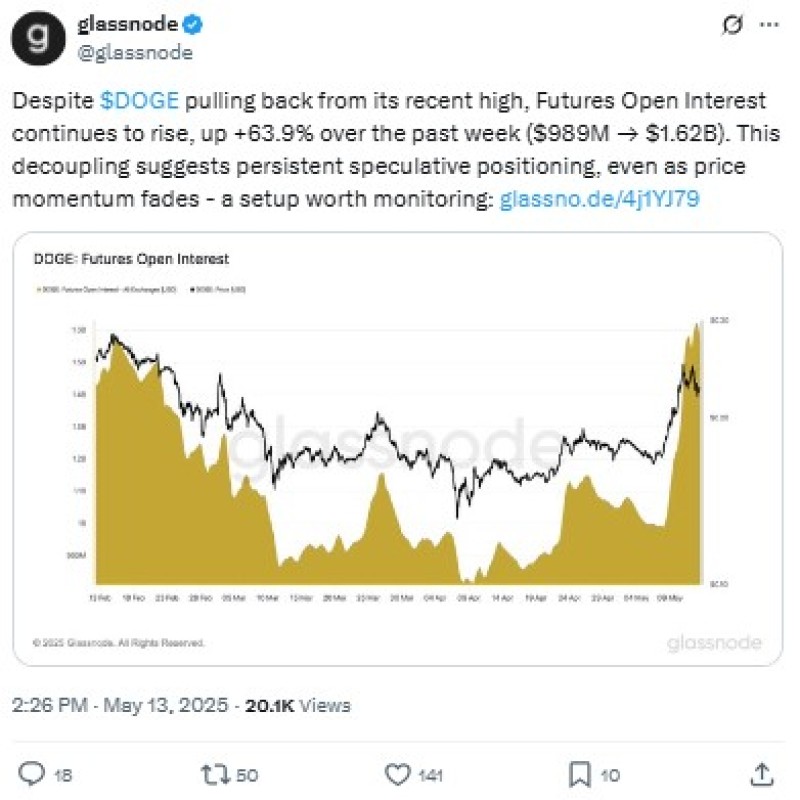

Dogecoin (DOGE) is seeing some serious action in the derivatives market, according to fresh data from Glassnode. In a recent post on X, the blockchain analytics firm reported a jaw-dropping 63% jump in Dogecoin's futures open interest over the past week. What's really turning heads is the timing – this surge happened while Bitcoin was actually sliding from its recent peak.

This trading frenzy has pushed the total value of open DOGE futures positions from $989 million to a hefty $1.62 billion. Glassnode describes this as a "decoupling" from Bitcoin's price movements, pointing to intense speculative positioning. In plain English, traders are making big bets specifically on Dogecoin rather than following the broader crypto market's lead.

Dogecoin (DOGE) Leaves Other Cryptos in the Dust with 34% Weekly Gain

While futures traders are getting excited, Dogecoin's actual price has been on fire too. CoinMarketCap data shows DOGE has shot up by 34% in just seven days. This impressive run has crowned Dogecoin as the best-performing altcoin among the top 10 cryptocurrencies during this period.

The meme coin's ability to rally while other cryptos struggle highlights its unique market behavior. DOGE has always had a knack for dancing to its own tune, often driven by social media buzz, its passionate community, and occasional shoutouts from high-profile fans. This latest price surge just confirms what many DOGE fans already know – this coin plays by its own rules.

Global Macro CEO Thinks DOGE Could Hit New Highs Against Bitcoin

Adding some expert fuel to the Dogecoin (DOGE) fire, Global Macro CEO Raoul Pal recently shared some bullish thoughts on the original meme coin. Pal suggested that DOGE could potentially reach new highs against Bitcoin, essentially saying the meme coin might outrun the market leader in the coming months.

Coming from a former Goldman Sachs exec and respected macro investor, Pal's optimistic take carries some weight in crypto circles. His bullish stance adds a credible voice to the growing number of analysts who've noticed DOGE's recent market outperformance and the surging interest in its derivatives.

What DOGE's Massive 63% Open Interest Surge Really Means for Traders

This huge 63% jump in Dogecoin's futures open interest isn't just a random number – it's a clear signal about market sentiment. Open interest (OI) measures how many derivative contracts are still active and unsettled. When OI rises alongside price, it typically means fresh money is flowing in and the current trend has some serious momentum behind it.

For anyone trading DOGE, this OI surge paired with the price increase suggests growing bullish sentiment. That said, high open interest can be a double-edged sword, sometimes leading to wild price swings, especially when the market changes direction and traders rush for the exits. With $1.62 billion now riding on DOGE futures, we're looking at a lot of leveraged bets that could amplify price movements in both directions.

DOGE Shows Its Independence by Breaking Away From Bitcoin's Recent Weakness

One of the most fascinating aspects of Dogecoin's (DOGE) recent performance is what Glassnode called a "decoupling" from Bitcoin's price movements. Usually, most altcoins follow Bitcoin's lead pretty closely, matching its moves with even more extreme swings. But DOGE has managed to surge 34% during a period when Bitcoin has actually been falling from recent highs.

This break from the norm suggests Dogecoin traders are currently focused on their own story rather than the broader crypto market narrative. The meme coin seems to be trading on its own merits, community developments, and sentiment instead of just shadowing Bitcoin. This kind of independent price action is pretty rare in crypto and highlights DOGE's unique position as one of the most established meme cryptocurrencies with its own dedicated fan base.

What's Really Behind Dogecoin's (DOGE) Recent Hot Streak?

While Glassnode's data clearly shows traders are piling into Dogecoin futures, several other factors might explain DOGE's recent outperformance. The crypto has maintained incredible community support since it was born in 2013, and its iconic Shiba Inu dog meme still resonates with both crypto diehards and mainstream audiences.

Plus, Dogecoin benefits from excellent liquidity and widespread availability on exchanges, making it easy for anyone to jump in and trade. This perfect storm of high name recognition, liquid markets, and a passionate community creates ideal conditions for speculative waves when market conditions line up right. The current surge in both price and futures interest suggests DOGE might be entering another period of heightened attention, potentially setting up for more volatility in the weeks ahead.

With $1.62 billion now betting on Dogecoin's future price movements and big names like Raoul Pal making bullish calls, all eyes are on the original meme coin to see if it can keep its momentum going and possibly challenge previous records – something many traders clearly seem to be banking on.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah