Dogecoin creator Billy Markus harshly criticizes the crypto market, likening it to a rigged casino and highlighting the prevalence of scam coins.

Dogecoin Creator's Scathing Critique of Crypto Market

In a fiery condemnation, Billy Markus, co-creator of Dogecoin and known by the pseudonym Shibetoshi Nakamoto, has echoed critical sentiments about the current state of the crypto market. Markus agreed with NFT artist and collector Nate Alex, who recently likened the crypto market to a rigged casino where insiders profit at the expense of retail investors.

Nate Alex voiced his concerns on social media, asserting that the crypto market is primarily geared towards onboarding retail investors for the benefit of insiders. He criticized the proliferation of "scamcoins" and the superficial nature of many new projects. Despite his critical view, Alex remains deeply invested in the market, with nearly all his liquid capital tied up in cryptocurrencies. He maintains a cautiously optimistic outlook for the market's trend through the year.

Meme Coins Dominate, Serious Projects Sidelined

The latest cryptocurrency market cycle has seen a surge in meme coins, such as PEPE, BONK, and WIF, which gained significant attention last year. This trend has led to what many describe as a meme cryptocurrency mania, with Solana experiencing a boom in the creation of meme coins. Many of these new tokens are viewed as low-quality, often serving as a means for insiders to capitalize on less discerning investors.

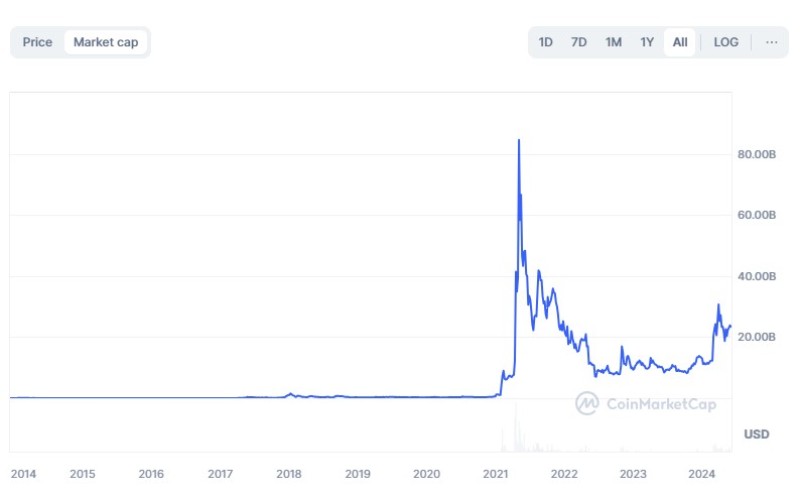

Amid the meme coin frenzy, more established and fundamentally sound projects are receiving less attention and failing to see the same price increases. Even Dogecoin, the largest and most renowned meme cryptocurrency, has not seen a notable surge in interest or trading volume. The market's focus has shifted to smaller, more speculative meme coins, sidelining DOGE and other significant projects.

Dogecoin's Place in the Evolving Market

Despite being the most famous meme coin, Dogecoin's lack of substantial growth in the current market cycle raises questions about its future. The shift in investor interest towards newer, smaller meme coins has overshadowed DOGE, suggesting a potential shift in the dynamics of meme coin popularity.

In conclusion, the divergent paths of established cryptocurrencies and emerging meme coins highlight a fragmented market landscape. While newer, speculative coins draw attention and capital, older and more stable projects struggle to maintain investor interest. Billy Markus' and Nate Alex's critiques underscore the challenges and potential pitfalls of the current crypto environment, serving as a cautionary tale for investors navigating this volatile space.

Usman Salis

Usman Salis

Usman Salis

Usman Salis