Dogecoin (DOGE) jumped 7.5% to $0.254 but faces a massive $39 million sell-off and key resistance levels that could kill the rally.

Dogecoin's having a moment right now. The memecoin shot up 7.5% in just 24 hours, pushing back above $0.254 and getting traders excited again. But here's the thing – this rally might not last as long as people hope.

While everyone's celebrating DOGE's comeback, the data tells a different story. Multiple warning signs are flashing red, suggesting both short-term and long-term trouble ahead. The biggest red flag? Spot traders just dumped $39 million worth of DOGE, and that's never a good sign when you're trying to maintain momentum.

DOGE Price Hits Major Resistance Wall

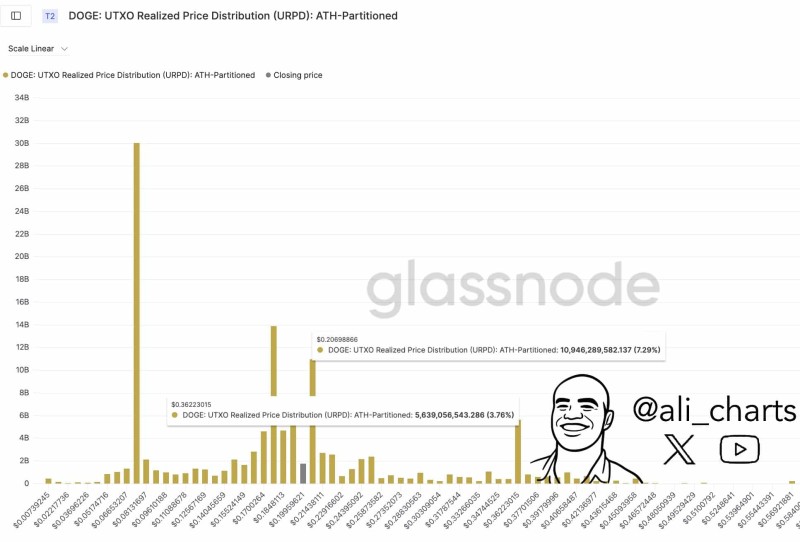

Looking at the technical picture, DOGE managed to flip that stubborn $0.20 level from resistance to support – that's actually pretty impressive. But now there's an even bigger problem waiting at $0.36. According to Glassnode's data, this level has been like kryptonite for DOGE bulls.

Here's what makes $0.36 so dangerous: it's already crushed DOGE rallies twice before. The chart doesn't lie – every time DOGE gets anywhere near this level, sellers come out of the woodwork. The last time DOGE tried to break through back in January, it got absolutely demolished, falling all the way down to $0.15407. That's a brutal 57% drop that wiped out months of gains.

Right now, DOGE is trading above another tricky level at $0.2478. This particular resistance has already rejected the price three times, making this the fourth attempt. In trading, the more times you test a level, the higher the chances it'll hold again. If DOGE can actually close above $0.2478 and stay there, then maybe the bulls have a chance. But history suggests otherwise.

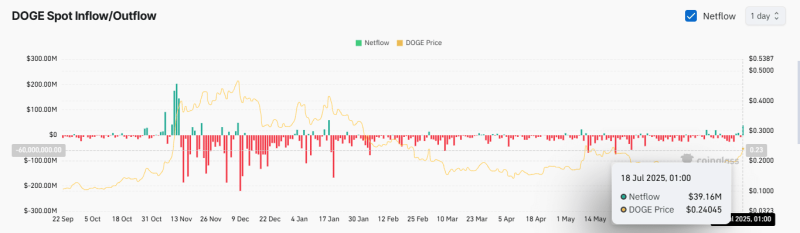

DOGE Faces $39M Selling Pressure

The most concerning development isn't happening on the charts – it's in the actual trading data. CoinGlass numbers show that spot traders sold $39 million worth of DOGE in the past day. That's the biggest single-day dump since January 17th, when traders absolutely destroyed the market with $589.38 million in sales.

This selling isn't random panic either. Smart money is taking profits right around these resistance levels, which means they saw this rally coming and positioned themselves accordingly. When institutional players and experienced traders start heading for the exits, retail investors usually get left holding the bag.

The next few days will be crucial. If the selling continues, DOGE is probably heading lower. But if buyers step in and start accumulating again, maybe there's still hope for breaking through that $0.2478 resistance.

DOGE Price Action: What Happens Next?

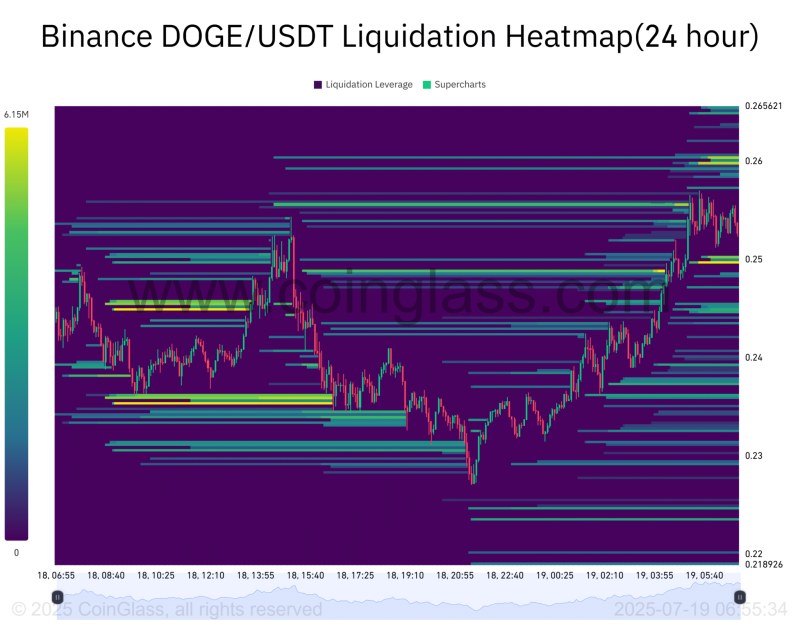

The liquidation heatmap shows an interesting setup that could go either way. There are two major liquidity zones that could drive some serious volatility:

Above current prices, between $0.259-$0.260, there's about $11.21 million in sell orders waiting. Below, between $0.249-$0.250, there's $11.61 million in buy orders sitting there like a safety net.

This creates a trading range that could produce some wild swings. If DOGE pushes higher first and hits those sell orders, it might bounce right back down to the buy zone. That could actually be healthy – shaking out weak hands while building a stronger foundation.

But if DOGE drops first and hits the lower liquidity cluster, the buying pressure might push it back up toward the sell zone above. The problem is, without solid support below these levels, any break lower could get ugly fast.

Bottom line: DOGE is at a critical moment. The $39 million sell-off shows smart money is nervous, and those resistance levels ahead look pretty intimidating. Bulls need to prove they can hold above $0.2478 and ideally break through it convincingly. Otherwise, this rally might just be another fake-out in DOGE's volatile journey.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah