Dogecoin (DOGE) shot up 14% to $0.24 in just 24 hours, with big players loading up and pushing the meme coin through a key resistance level that traders had been watching.

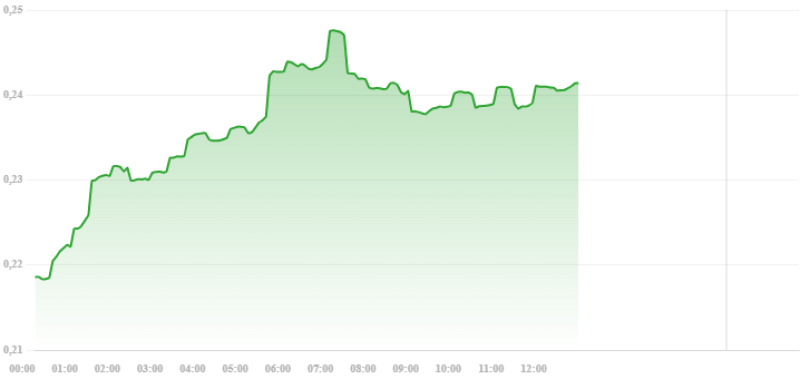

Dogecoin had quite the day on July 18, climbing from $0.21 all the way to $0.24 – that's a solid 14.02% gain that caught plenty of attention. The jump wasn't just random either. Whale buyers were going crazy, institutions were pouring money in, and the whole meme coin space was heating up, which helped push DOGE above that stubborn $0.22 resistance level everyone's been talking about.

Trading got pretty wild too. Volume hit 752.69 million during the breakout, which was about 7.8% higher than usual. When DOGE finally broke through $0.22, it created some solid support around $0.22-$0.225 – basically a new floor for the price. Open interest jumped 12.36% to $4.04 billion, showing that traders are really positioning themselves for what comes next.

DOGE Price Smashes Through Key Level

The real action started when DOGE finally broke that $0.22 resistance at 21:00 UTC on July 17. Once that happened, it was like opening the floodgates – long positions started piling in, algorithms kicked in, and the price shot from $0.22 to $0.24 pretty quickly. The whole thing created a $0.04 trading range with some serious 17.6% volatility.

Things got interesting in the final hour too. DOGE was bouncing between $0.236 and $0.24 in what looked like classic profit-taking followed by smart money buying the dip. That's usually a good sign that the big players aren't done yet.

The whale data tells the story – 1.2 billion DOGE got accumulated since July 16, according to WhaleTrace. That's not small change, and it shows the big holders are still bullish on where this is headed.

What's Next for DOGE Price?

Here's where it gets really interesting. Bit Origin just secured $500 million in funding specifically for DOGE treasury operations. That's a pretty big deal and suggests institutional players are taking Dogecoin seriously as a treasury asset.

Right now, DOGE has solid support at $0.22-$0.225 and is bumping up against resistance around $0.245-$0.248. The whole meme coin market is on fire too – it's up to $72 billion total, gaining $17 billion just this month.

With all this institutional interest, whale buying, and the technical setup looking decent, analysts are eyeing the $0.26-$0.28 area as the next target. Of course, holding above $0.22 is going to be key – lose that and things could get messy pretty quick.

Usman Salis

Usman Salis

Usman Salis

Usman Salis