The cryptocurrency market is witnessing another major shake-up as Cronos (CRO) faces severe downward pressure. With key technical levels failing and bearish momentum building, traders and investors are questioning whether this downturn could mark the beginning of CRO's most devastating crash in its trading history.

CRO Faces Steep Downtrend

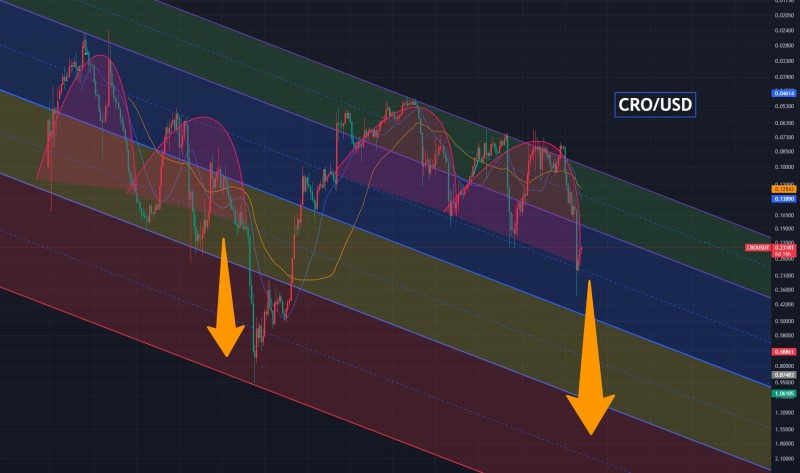

Cronos has plunged into dangerous territory, crashing through critical support levels in what appears to be an accelerating bearish trend. The token's sharp descent into the lower regions of a long-term descending channel has many market observers concerned about further downside potential. Trader CoinBaron recently highlighted this dramatic move, describing it as potentially the "biggest crash in CRO history" and warning that additional declines could be approaching.

The current price action suggests that CRO holders may face continued pressure as the token struggles to find stable footing. Technical indicators are aligning to paint a particularly grim picture for the short-term outlook.

Chart Analysis Reveals Concerning Patterns

The technical analysis presents a troubling scenario for CRO bulls. The token is currently trading within a broad downward channel, with several key developments worth noting. The breakdown through the crucial $0.18–$0.20 support zone has triggered accelerated selling pressure, with this blue-banded area previously serving as a reliable floor for price action.

Downside projections point toward potential targets in the red zone, suggesting possible declines toward $0.08–$0.10 if the current bearish momentum maintains its strength. What's particularly concerning is the repeated failure to reclaim higher resistance levels near $0.20–$0.25, demonstrating persistent seller dominance in the market.

The moving average configuration adds another layer of concern, with both short-term indicators bending decisively lower and reinforcing the overall bearish outlook. This technical setup suggests that CRO remains locked in a strong downtrend with risk heavily skewed to the downside.

Market Forces Behind the Decline

Several interconnected factors appear to be driving CRO's current predicament. The broader cryptocurrency market weakness, including Bitcoin's consolidation phase and widespread altcoin selloffs, has created an environment where tokens like CRO struggle to maintain their value propositions.

Additionally, since CRO maintains strong ties to the Crypto.com ecosystem, any concerns regarding exchange volume, liquidity, or operational matters tend to have direct impacts on token performance. The repeated failure to establish support above the $0.18–$0.20 range has also significantly undermined short-term bullish sentiment among traders and investors.

Historical Context and Future Implications

While CRO has weathered significant corrections in its past, the current breakdown appears particularly noteworthy due to both its technical severity and timing within the broader market cycle. Should the token continue its descent into the red support zone below $0.10, this correction could indeed rival some of the most substantial drawdowns in CRO's trading history.

The market is now watching several critical levels that could determine whether this sell-off continues or finds a temporary reprieve. If price can stabilize around the $0.12–$0.13 area, there's potential for a short-term bounce that could provide relief to beleaguered holders.

However, if selling pressure persists and pushes CRO toward $0.08 and below, the cryptocurrency community could witness one of the most dramatic price collapses in the token's history. A meaningful recovery above $0.20 would represent the first genuine sign that bullish forces are attempting to regain control, but until such a development occurs, caution remains the dominant theme in CRO's outlook.

Peter Smith

Peter Smith

Peter Smith

Peter Smith