Chainlink's native token LINK has experienced a dramatic 178% increase in whale transaction activity over the past 24 hours, coinciding with a 10% price surge amid broader market improvements.

Chainlink (LINK) Whales Dramatically Increase Market Activity

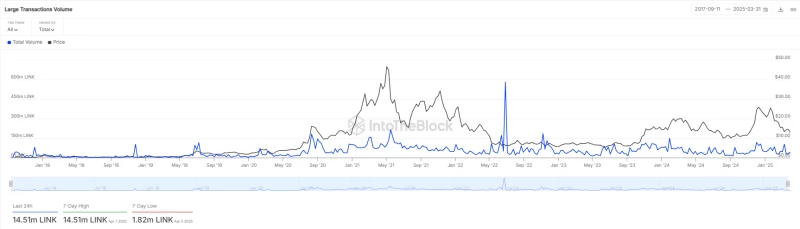

According to data from IntoTheBlock, large transactions for LINK have surged by a remarkable 178% within the past 24 hours. This significant uptick in whale activity translated to approximately $166 million in transaction value, representing about 14.51 million LINK tokens changing hands.

The Large Transaction Volume metric is a crucial indicator that estimates the total volume of an asset being moved by whales and institutional participants within a specific timeframe. When this metric spikes, as it has with LINK, it typically suggests increased activity among institutional players and large investors, commonly referred to as whales in the cryptocurrency ecosystem.

These substantial market participants are either accumulating or distributing their digital assets, and their movements often have significant implications for the broader market. The concentrated attention from whale investors typically impacts the price dynamics of the cryptocurrency they're focusing on, as their activities can substantially alter the balance between supply and demand in the market.

LINK (Chainlink) Price Rallies Over 10% Amid Whale Interest

In the case of LINK, the heightened attention from large investors comes on the heels of a substantial increase in the token's price. This correlation suggests that these institutional players may be aggressively accumulating the token in anticipation of more favorable price movements in the near future. As demand for LINK continues to rise due to this whale activity, there's potential for further price appreciation.

At the time of reporting, LINK was trading at $11.8, representing a 10.2% increase over the previous day's price. The token currently holds a market capitalization of approximately $7.7 billion, positioning it as a significant player in the cryptocurrency market. Despite the impressive price rally, trading volume has declined by 17%, which might indicate a cautious sentiment among some investors or simply a consolidation phase following the rapid price movement.

Chainlink (LINK) Ecosystem Developments Support Potential Breakout

Beyond the whale activity and price movements, several significant developments within the Chainlink ecosystem could help restore investor confidence and potentially fuel a more substantial price breakout in the coming days.

A notable recent integration between Chainlink and payment giant PayPal has been reported, indicating that PayPal now allows its U.S. customers to access the LINK token. This development represents a significant step toward mainstream adoption and could expand the token's user base considerably.

This PayPal integration follows an earlier strategic partnership involving Chainlink and the Abu Dhabi Global Market (ADGM). This collaboration aims to expand Chainlink's network footprint in the United Arab Emirates and drive further adoption of the LINK token in the region. Such institutional partnerships demonstrate Chainlink's growing relevance in both traditional finance and emerging markets.

The combination of increased whale activity, positive price movement, and significant ecosystem developments creates a compelling narrative for LINK's potential continued upward trajectory. As institutional interest grows and more partnerships solidify, the oracle platform's native token may be positioned for a sustained breakout beyond its current price levels.

As with all cryptocurrency investments, however, market participants should remain aware of the inherent volatility and conduct their own research before making investment decisions regarding LINK or any other digital asset.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah