Description: Cardano (ADA) just hit $0.69 after a solid bounce from support, with buy signals flashing – but there's a catch with its DeFi numbers dropping.

Cardano (ADA) is having a pretty decent day, climbing back up to $0.69 after getting knocked down to $0.65 earlier this week. It's one of those classic crypto rebounds that makes you wonder if we're finally done with all the selling pressure that's been hammering the market lately.

The whole crypto space has been a bit of a mess recently, thanks to all the drama around US tariffs and Trump's legal battles. You know how it goes – when traditional markets get spooked, crypto usually follows. But ADA seems to be shaking it off pretty well, which is actually quite impressive given how brutal things have been.

What's really interesting here is that this isn't just some random pump. The technical indicators are actually backing up this move, and traders are starting to pay attention again. But here's where it gets complicated – while the price action looks good, there's some concerning stuff happening behind the scenes with Cardano's DeFi ecosystem that we can't ignore.

ADA's Technical Setup is Looking Pretty Solid Right Now

Let's talk about what's actually driving this bounce in Cardano (ADA). The SuperTrend indicator just flipped bullish, which is basically a fancy way of saying the technical analysis crowd is getting excited. When this indicator changes from red to green, it usually means the trend is shifting in favor of buyers.

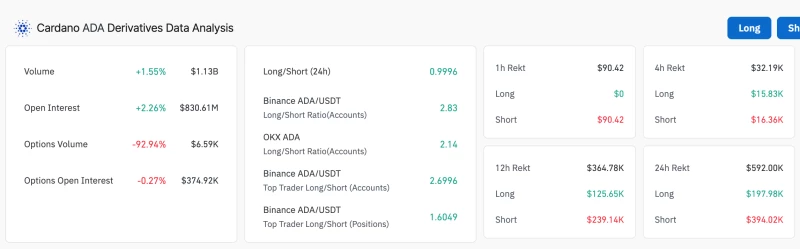

But it's not just one indicator telling this story. The derivatives market is showing some real interest too – Open Interest jumped 2.2% to $831 million in just 24 hours. That's actual money flowing into ADA positions, not just hopeful thinking. Plus, daily trading volume is still sitting above $1 billion, which tells you there's genuine activity here, not just some low-volume fake-out.

Here's something that caught my eye: on Binance, futures traders are going long on ADA at a 2.83 to 1 ratio. That's a pretty strong bullish bias. And get this – more short positions got liquidated ($394,000) than long positions ($198,000) over the past day. When shorts start getting squeezed like this, it often leads to some pretty explosive moves higher.

The whole setup reminds me of those moments when everyone's been betting against something, and then suddenly the tables turn. Those short squeezes can be nasty if you're on the wrong side of the trade.

But Hold Up – ADA Still Has Some Hurdles to Clear

Now, before we all get too excited about Cardano (ADA), let's pump the brakes a bit. The RSI is still hanging out below 50, which means we're not quite in confirmed bullish territory yet. It's like being at the starting line but not having fired the gun yet.

The real test is going to be whether ADA can break through $0.70. That's the level everyone's watching right now. If it can push through there with some decent volume, then we might actually have something sustainable on our hands. But if it gets rejected again, well, we could be looking at another trip back down to support.

Here's where things get a bit messy, though. The MACD indicator has been flashing sell signals since May 17. So you've got one indicator saying "buy" and another saying "sell" – classic crypto confusion right there. It's like having your GPS and your friend giving you different directions at the same time.

And let's not forget about the bigger picture stuff. All this uncertainty around tariffs and court rulings isn't going anywhere anytime soon. Even though an appeals court hit pause on the ruling that blocked Trump's tariffs, nobody really knows what's going to happen next. That kind of uncertainty usually keeps a lid on risk assets like crypto.

The Real Problem: Cardano's DeFi Scene is Struggling

Here's where things get really interesting – and not in a good way. While ADA's price is bouncing around looking somewhat healthy, the actual usage of the Cardano network is telling a different story. The Total Value Locked (TVL) in DeFi protocols has dropped from around $414 million on May 11 down to just $317 million now. That's a pretty significant chunk of money that just walked away.

Now, TVL might sound like some boring technical metric, but it's actually super important. It basically tells you how much money people are willing to lock up in Cardano's smart contracts. When that number goes down, it usually means people are either losing confidence or finding better opportunities elsewhere.

Think about it this way – if you had money earning yield on Cardano and you pulled it out, you probably had a good reason. Maybe you found better rates somewhere else, or maybe you just don't trust the platform as much as you used to. Either way, it's not great news for the ecosystem.

This is actually a bigger deal than most people realize. In the DeFi world, TVL is like a report card for how useful and trusted a blockchain is. Ethereum dominates because tons of money is locked up in its protocols. If Cardano can't keep money flowing into its DeFi ecosystem, then ADA might struggle to justify higher prices in the long run.

The thing is, Cardano has always marketed itself as this super-sophisticated, academically rigorous blockchain that does everything the "right way." But if developers and users aren't actually using it for real financial applications, then all that fancy technology doesn't mean much. It's like building the world's most advanced sports car that nobody wants to drive.

What's really concerning is that this TVL decline is happening at a time when the broader DeFi market is actually doing pretty well. So it's not like there's a general exodus from decentralized finance – people are just choosing other platforms over Cardano. That's a competitive problem that won't be solved by price pumps or technical indicators.

For ADA to have any kind of sustainable bull run, they really need to figure out how to get developers and users excited about building on Cardano again. Otherwise, we might just be looking at another classic crypto pump that fades once the technical momentum runs out of steam.

Usman Salis

Usman Salis

Usman Salis

Usman Salis