Though cryptocurrencies are quickly becoming a common sight in investor portfolios, the fact remains that they are still an extremely volatile asset class. Investors must assess the risk-return reward before putting their hard-earned cash into a coin. It’s always prudent, at least for beginners, to stick to popular coins that are fundamentally strong, like Ethereum.

Even though Bitcoin comes out at the top in terms of market capitalization, Ethereum closely follows at number two. Ethereum is trusted by a strong line-up of institutional investors and leaders like Mark Cuban.

Although BTC and ETH are both cryptocurrencies, they have several differences. While this is still up for debate, experts believe that ETH is fundamentally stronger than BTC.

Over time, buying cryptocurrencies like ETH and BTC has become awfully simple. Investors interested in buying Ethereum can now do so with their credit cards. While this may sound convenient at first, there are a few things investors should consider.

Considerations to Keep in Mind While Buying Ethereum with a Credit Card

Crypto exchanges have been quick to offer investors a range of payment options in a bid to facilitate the easy purchase of cryptocurrencies. A welcome move, no doubt. However, investors must also pay attention to a few things that could make these transactions a little less attractive.

Don’t Skip Due Diligence When Selecting the Exchange

Dozens of crypto exchanges have been established every year over the last couple of years. As of August 2021, Coinmarketcap lists 303 exchanges that have a high transaction volume, but these aren’t the only exchanges. Countless small exchanges exist today that offer investors good service.

However, some can be shady and scams are a common occurrence in the cryptoverse. Investors must do their due diligence before selecting an exchange. It’s possible to buy Ethereum with a credit card easily on most exchanges, but transacting through an untrustworthy exchange can put the investor’s money at risk.

Complacency can be costly, and countless investors have become victims of scams while investing in cryptocurrencies. Even in 2021, when information regarding best practices for cryptocurrency transactions has become easily accessible, scams continue to recur.

As recently as April this year, the Turkish exchange Thodex shut down abruptly and duped investors of $2 billion. This amount, unfortunately, is significantly lower than amounts involved in other, much bigger scams.

If there are two exchanges an investor needs to choose from, one of which is an established exchange that doesn’t allow investing with a credit card, and another not-so-established exchange that does allow investing with a credit card – it’s always wise to select the former.

It’s better to pay via a bank transfer or PayPal and put some extra time into transferring the funds between accounts if required rather than losing the entire sum.

Use a VPN

Cybersecurity is important when you transact online. The importance of cybersecurity isn’t limited in scope to just credit card transactions. Any transaction, including mobile payments and online banking transactions, should be encrypted so a cybercriminal cannot access the sensitive information being transmitted.

A VPN (virtual private network) encrypts the data being transmitted by a device over the network that it is connected to. VPNs are a non-negotiable cybersecurity tool when executing transactions over networks that the user doesn’t control.

Cybercriminals use a range of techniques such as man-in-the-middle attacks or SQL injection to steal a user’s data. If a user is connected to a public network while buying cryptocurrency from an exchange, a cybercriminal may be able to steal the sensitive information that would allow them to transfer funds to their own account.

Good VPNs that use at least AES 256-bit encryption can help avoid this problem. While it’s best to always use a personal network when making transactions online, sometimes a coin may offer the investor an opportunity to take a position at an attractive price.

Since crypto prices don’t stay put for more than a few minutes, the investor would want to capitalize on the opportunity right away. If the only option is to use a public network, a VPN can protect the user’s information from cybercriminals.

Fees Charged by the Credit Card Company

The convenience of using a credit card can sometimes put a deep hole in the investor’s pocket. Some credit card companies levy multiple fees on credit card transactions, especially on cryptocurrency exchanges.

The most unreasonable-sounding of these fees is the cash advance fee. Some cards treat crypto purchases made on a crypto exchange as a cash advance, i.e., it is equivalent to withdrawing cash from an ATM using the card.

The problem with cash advances is that the fee is typically quite high. Cash advances invite a 3%–5% fee (or a minimum of $10) on the amount of advance. Therefore, if an investor buys crypto worth $1,000 with a credit card, they’ll end up paying about $30–$50 in cash advance fee.

Unfortunately, the financial perils of the crypto investor may not end here. If the investor doesn’t pay off the cash advance right away, the credit card company will levy interest on the advanced amount.

The interest rate, as anybody could have guessed, is unbelievably high. It’s not uncommon for a card issuer to charge as much as a 25% cash advance fee.

This isn’t the end of the laundry list of fees that credit cards charge. If the investor and the vendor (i.e., the exchange) are in different countries, the credit card company may charge a foreign transaction fee.

Foreign transaction fees don’t apply to all cards though, so investors will need to check if their card levies foreign transaction fees.

There’s one more thing to consider — rewards and bonuses. Since crypto purchases are treated as cash advances, they aren’t eligible for purchase rewards and don’t count towards spending that’s required to earn the sign-up bonus either.

Exchange Fees

As hard as it may be for some to believe, there are a few more fees that investors need to consider when using a credit card to buy crypto. This time, it’s not the credit card company, but the exchange grabbing a piece of the pie.

Exchanges generate income in multiple ways. Their primary source of income is the cut they take out each transaction, regardless of the payment method used. However, credit card users pay an extra fee in addition to the platform’s normal trading fees.

The amount of fees is exchange-specific. Therefore, take a few moments to read through the exchange’s fees section to learn about how much it charges for using credit cards as a payment method.

Typically, an exchange will charge a commission fee, credit card fee, and an exchange rate spread. Collectively, these can sum up to as much as 10% (or more) in fees. Note that these fees are in addition to the fees that the credit card company charges.

Investors that don’t scan through the exchange’s fee structure may not even realize that they have paid extra fees for using a credit card. This is because the exchange factors those fees into the asset’s trade price rather than explicitly adding them to the investor’s final payment amount.

High Risk in Some Cases

It’s safe to say that everybody agrees on cryptocurrencies being extremely volatile. Investors must therefore only invest money they can afford to lose.

Now, this is where credit cards become a problem. Sometimes, investors may be tempted to take a large position believing that the price will move favorably even if they don’t actually have those funds. Any prudent investor will view this transaction as a bad decision. However, sometimes new investors just can’t resist the urge to make a quick buck.

The first problem here is that the entire amount used from the credit card will immediately begin to accrue a cash advance fee.

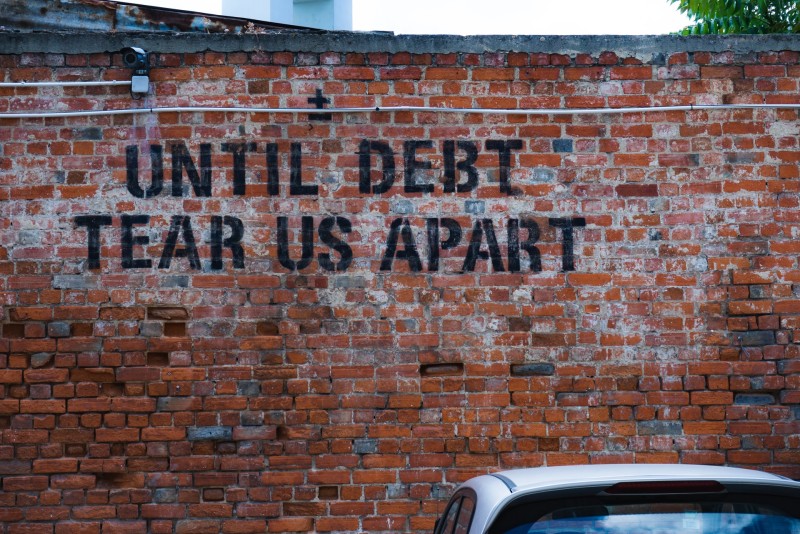

Plus, if the price doesn’t move in favor of the investor, it can be mentally taxing on the investor. Imagine being in a tough spot financially and feeling that you may need to take on extra credit card debt worth a few thousand dollars soon.

In worst cases, if the price drops significantly, the investor will need to start making payments towards the credit card debt. Meanwhile, the balance amount will continue to accrue interest. Not only does the investor lose capital, but they also pay a very hefty interest expense on the capital that has already been eroded.

Fancy Using a Credit Card?

Evidently, buying crypto with credit cards is an expensive proposition. Investors will need to generate at least double-digit returns (think 15%+) just to break even after factoring in the fees they pay for using a credit card. Granted, a credit card offers convenience, but is the cost of using it worth the convenience it offers? In most cases, the answer is a resounding no.

Editorial staff

Editorial staff

Editorial staff

Editorial staff