Bitcoin plummets to its lowest level since February, hitting $53,499 as crypto liquidations near $665 million, driven by Mt. Gox and German government actions.

Bitcoin Dips Below $54K Amid Significant Liquidations

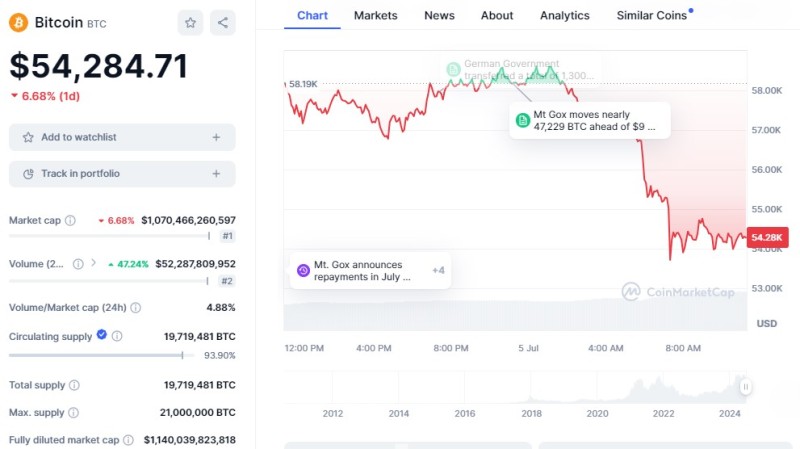

Bitcoin has experienced a dramatic drop, hitting a four-month low of $54,284 on Coinbase early on July 7. This decline comes as news of Mt. Gox's latest cold wallet transfer hit the markets, causing widespread concern among traders.

The significant drop in Bitcoin's value can be attributed to the transfer of 47,229 BTC, worth around $2.6 billion, by the collapsed crypto exchange Mt. Gox. This move has sparked fears of increased sell pressure in the market, further amplified by the German government's recent sale of 7,583 BTC worth $419.5 million since June 19.

Crypto Liquidations Surge to $665 Million

According to CoinGlass data, cryptocurrency liquidations have surged to $664.5 million over the past 24 hours, marking the highest level in two months. This includes $584 million in long positions and $82 million in short positions, with long Bitcoin positions accounting for $222 million of the total. The sudden liquidation wave has added to the market's volatility, causing panic among traders.

The Bitcoin downturn has had a ripple effect on other major cryptocurrencies. Ether (ETH) dropped almost 10%, hitting $2,898 and falling below the crucial $3,000 level it had maintained since mid-May. Similarly, Solana (SOL) saw a nearly 10% drop, trading at $127. This widespread decline highlights the interconnected nature of the crypto market and the broad impact of Bitcoin's movements.

Fear Grips the Crypto Market

Market sentiment has turned notably negative, with the Crypto Fear and Greed Index reflecting a score of 29 out of 100, indicating "Fear." This is the lowest level of positive sentiment toward crypto since January 2023. Traders are increasingly wary of further declines, particularly in light of anticipated sell pressure from Mt. Gox creditors.

Analysts, including Markus Thielen from 10x Research, predict that Bitcoin could fall as low as $50,000 due to the ongoing sell pressure. Thielen's analysis reflects a growing concern that the market has not yet reached a bottom and may experience further volatility in the near term.

Conclusion

As Bitcoin and other cryptocurrencies face significant selling pressure and liquidations, market participants remain on edge. The actions of large holders, such as Mt. Gox and the German government, continue to influence market dynamics, underscoring the importance of monitoring such movements closely. For traders and investors, staying informed and cautious is key in navigating the current crypto landscape.

Peter Smith

Peter Smith

Peter Smith

Peter Smith