After weeks of watching money flood out of Bitcoin ETFs, the tide finally turned. Spot Bitcoin funds pulled in $145 million over two consecutive days, marking the first positive stretch in nearly a month. With BTC hovering around the $70K level and total ETF assets sitting near $90 billion, the question on every trader's mind is simple: are the institutions back, or is this just a head fake?

Bitcoin ETFs Break Three-Week Outflow Streak

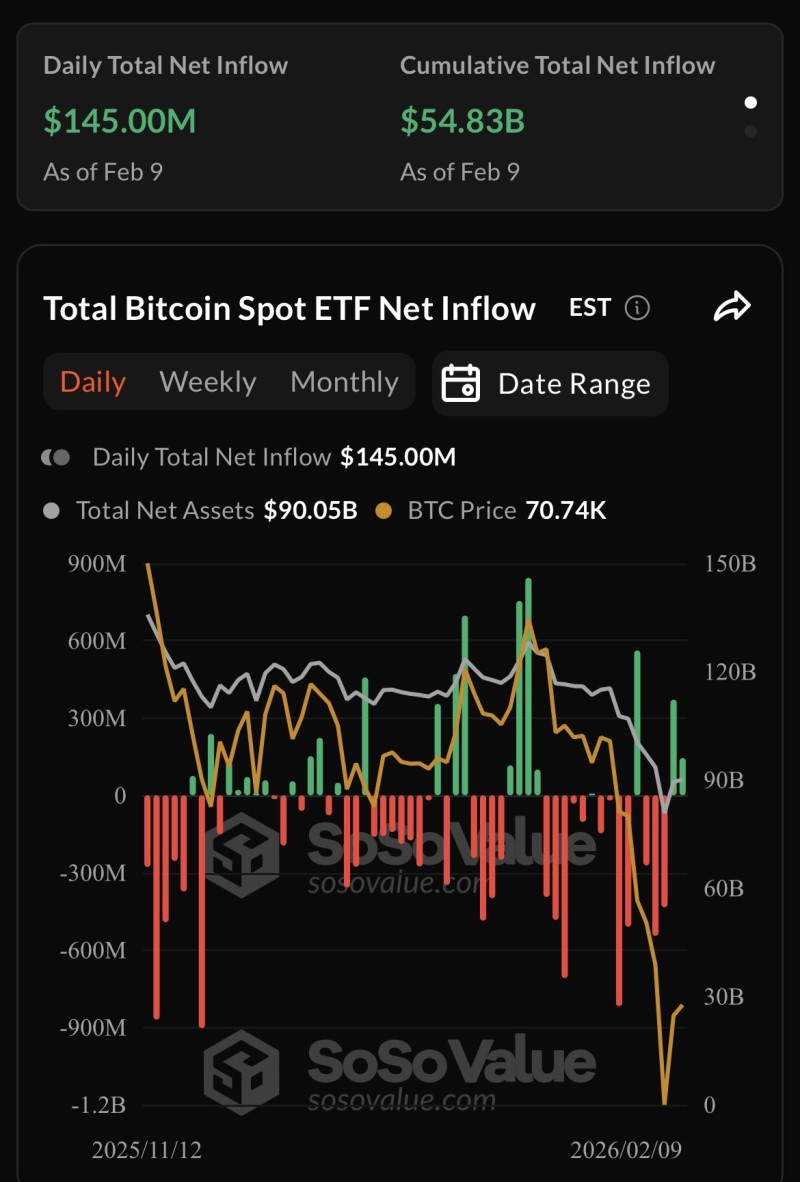

Spot Bitcoin exchange-traded funds posted their second straight day of positive flows, ending a nasty three-week run of withdrawals. According to data shared by Coin Bureau, the funds attracted $145 million in fresh capital on Monday alone. Chart data shows cumulative net inflows have now reached roughly $54.83 billion, with total ETF assets standing near $90.05 billion as of February 9.

Meanwhile, BTC price was trading around $70,740—holding steady near a critical psychological level. The inflow bars turned green after weeks of deep red, confirming a clear shift in short-term capital flow. Earlier sessions saw brutal withdrawals, some topping $900 million in a single day, so this reversal isn't just noise—it's a real change in momentum.

The latest sessions reversed direction, suggesting returning demand for regulated exposure rather than a single isolated inflow.

What ETF Flows Tell Us About Bitcoin's Next Move

ETF flow behavior has been tracking BTC price action like a shadow lately. When flows went negative, prices dropped. Now that money's coming back in, Bitcoin's stabilizing near $70K. We've seen this movie before—check out Bitcoin & Ethereum ETF Flows Tell Different Stories This September and Bitcoin, Ethereum Spot ETFs See $257.94M in Outflows for similar patterns. Analysts covering BTC Price Shows Early Recovery as Bitcoin Targets $80K Reclaim also noted institutional positioning starting to shift.

Why This Matters for the Broader Crypto Market

Renewed ETF demand is a big deal because spot Bitcoin products are the main on-ramp for institutional capital into crypto. Sustained inflows usually show up during stabilization phases, while heavy outflows align with corrections. Continued inflows alongside BTC holding near $70K suggest improving sentiment across the broader digital asset market—and that could mean smart money is quietly building positions again.

Usman Salis

Usman Salis

Usman Salis

Usman Salis