The first half of September just delivered a masterclass in how Bitcoin and Ethereum are moving in opposite directions. While Bitcoin ETFs kept attracting money almost every single day, Ethereum went through a dramatic crash-and-recovery that left everyone scratching their heads.

Bitcoin's Steady March Higher

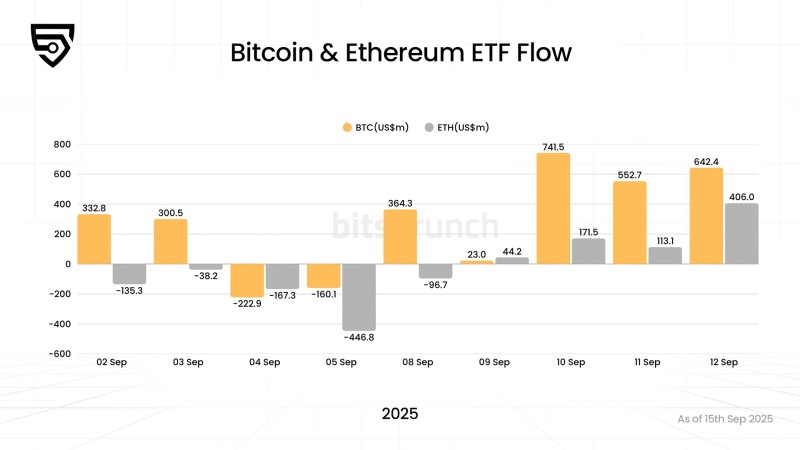

Data from bitsCrunch shows exactly how wild this divergence has become. Bitcoin ETFs have been on an absolute tear since September kicked off. From September 2nd through the 12th, money kept flowing in with barely any breaks. The biggest day? September 10th, when $741.5 million poured into Bitcoin ETFs - the kind of number that makes institutional traders take notice. By September 12th, the total hit $642.4 million in net inflows.

This isn't just random buying. Bitcoin's cementing its reputation as the go-to digital asset when institutions want something that won't keep them up at night. With all the macro uncertainty floating around, that stability is worth its weight in gold.

Ethereum's Wild Ride

Ethereum told a completely different story. September 5th was brutal - ETFs saw $446.8 million walk out the door in a single day. That's the kind of outflow that signals real panic. But here's where it gets interesting: within a week, everything flipped. By September 12th, $406 million was flowing back in.

The whiplash captures Ethereum perfectly right now. On one hand, you've got network upgrades and growing institutional adoption. On the other, there's fierce competition from other smart contract platforms and regulatory uncertainty that keeps spooking investors. The result? Massive volatility that makes Bitcoin look boring by comparison.

Bitcoin's playing the role of the steady veteran while Ethereum's the volatile newcomer with huge upside potential. The consistent Bitcoin flows suggest institutions view it as their crypto safety net. Ethereum's rebound after those massive outflows? That looks like opportunistic buying from traders who saw a chance to get in cheap.

Whether Ethereum can sustain this comeback or if Bitcoin will keep dominating the "safe crypto" narrative is the big question heading into Q4. With central bank policies shifting and regulatory clarity still up in the air, both assets are going to be tested in the months ahead. Right now though, the message is crystal clear: Bitcoin equals stability, Ethereum equals opportunity - and both are essential to any serious crypto strategy.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah