These bots, like a human assistant, use machine learning algorithms to make more effective use of market opportunities, but only if they're running on a system that can support them smoothly.

To get the best performance from your trading bots, it’s wise to use an RDP equipped with the proper hardware, software, and a fast, stable internet connection. Better yet, buy RDP with Bitcoin for added security and privacy of your financial information.

Once set up, you can choose a trading bot that suits your trading style from the best AI trading bots for beginners, including 3Commas, Cryptohopper, and Pionex, and move step by step towards maximizing your profits.

How to Use AI Bots for Trading?

To perform tasks such as market analysis, automated trading, and strategy execution, an AI bot for trading requires a robust and stable environment, which makes RDP an ideal choice.

RDP is a server with high hardware power that you can access remotely to run your trading bots 24 hours a day, 7 days a week, without the need for your system to be always on.

This stable and high-speed environment reduces latency in trade execution, allowing the bots to perform more accurate analyses and enter trades at the right time.

Plus, choosing Bitcoin as a payment method for RDP purchases guarantees privacy and enables quick, direct transactions. Therefore, the optimal choice is to buy RDP with Bitcoin from OperaVPS and take advantage of the reliable services this platform offers.

Once you have this secure setup in place, you can choose the trading bot that best fits your strategy, connect it to your platform, and enjoy smooth, high-performance trading powered by RDP.

Summary Table of Best AI Bots for Crypto Trading

| Bot | Key Features | Ease of Use | Supported Strategies | Pricing |

| Cryptohopper | 24/7 trading, Copy trading, Strategy designer, Backtesting | Easy to Medium | DCA, Grid, Arbitrage, Trend Following | Free + Paid plans (from 24.16$/mon) |

| 3Commas | DCA bots, Grid bots, Paper trading, Smart trading, TradingView integration | Medium | DCA, Grid, Smart Trade, Take Profit, Stop Loss | Paid plans (from 39$/mon) |

| Pionex | 16 built-in bots, No API integration required, Low fees, Smart trade terminal | Easy | DCA, Grid, Arbitrage, Smart Trade | Free |

| HaasOnline | Custom bots, Backtesting, Edge computing, HaasScrip | Advanced | Arbitrage, Scalping, Market Making, Trend Following | Paid plans (from 7.50$/mon) |

| TradeSanta | Long & short strategies, 24/7 automated trading, Easy setup with templates | Easy | Long, Short, Grid, Take Profit, Stop Loss | Paid plans (from 18$/mon) |

| Coinrule | No-code automation, 250+ customizable rules, Backtesting, Portfolio tracking | Easy | Trend Following, DCA, Grid, Breakout, Custom Rules | Free + Paid plans (from 29.99$/mon) |

| Shrimpy | Portfolio management, Social trading, Automated rebalancing | Easy | Portfolio rebalancing, Copy trading | Free + Paid plans (from 15$/mon) |

Top 7 Best AI Trading Bots for Beginners

In this section, you'll discover the top trading bots that can make your trading experience easier, faster, and more efficient.

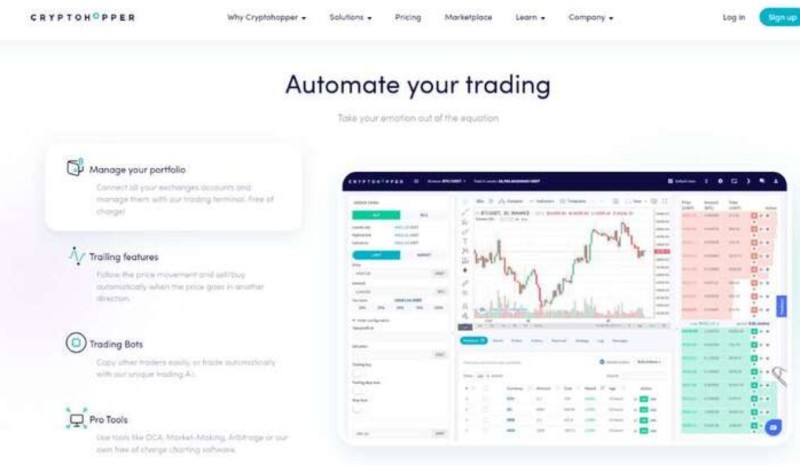

1. Cryptohopper

Cryptohopper is one of the best AI bots for crypto trading, supporting 16 major exchanges including Binance, Poloniex, and KuCoin, with over 500,000 users.

Since it’s cloud-based, Cryptohopper runs continuously on online servers without relying on your device. Using a Cryptohopper-compatible RDP ensures faster, more stable performance, allowing you to keep your bot active and manage trades without interruptions.

Cryptohopper Key Features

- Supports 75 cryptocurrencies (e.g., Bitcoin, Ethereum, Litecoin)

- 24/7 automated trading

- Social and copy trading options

- Customizable strategies and backtesting

- Backtesting and Strategy Designer to test and build custom strategies

- Trading terminal for managing multiple accounts

- User-friendly interface, no programming needed

- Free personalized bot creation

- 3-day free plan to test features

- Suitable for beginners and professionals

Cryptohopper limitations

- Requires purchase of a paid plan after 3 days

- No direct phone support (ticket only)

- Additional cost for professional signals

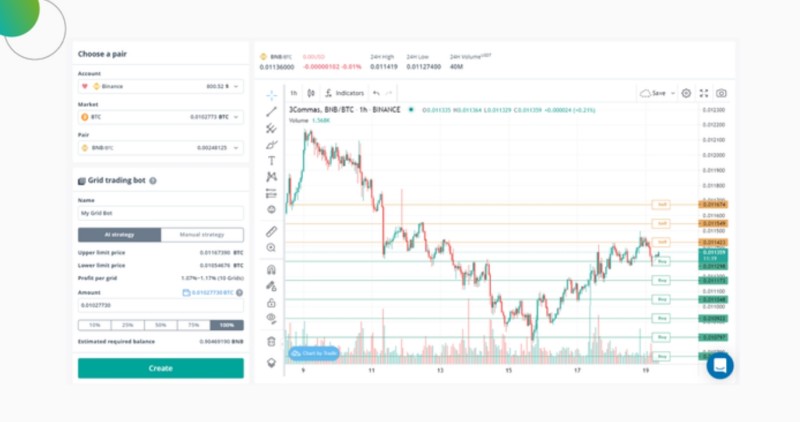

2. 3Commas

With support for various bots, 17+ exchanges, and TradingView integration, 3Commas is a comprehensive solution for AI trading bots for beginners.

However, to have a smooth experience when using this tool to its full potential, you need a supportive system that is completely secure and fast. If you buy RDP with Bitcoin, this environment is ready for your trades.

3Commas Key Features

- Available on Web, Mobile, and Desktop

- Automate complex strategies with precision

- DCA Bot for cost averaging

- Grid Bot for profiting from market fluctuations

- Smart Trade with stop loss and take profit tools

- Paper Trading for risk-free strategy testing

- TradingView integration for automated actions

- Access to all exchanges in a single integrated ecosystem

- Simple, user-friendly account management

- Affordable pricing

3Commas limitations

- Free plan lacks smart bots

- High cost for professional signals and full subscription

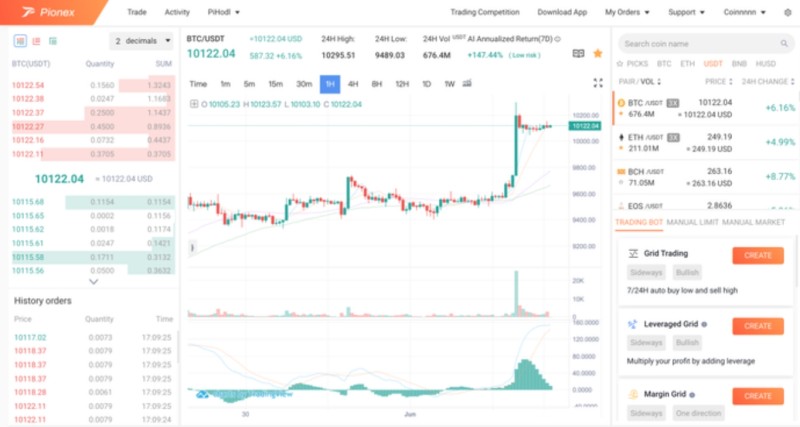

3. Pionex

Pionex is an advanced trading app that has 16 built-in intelligent bots that can meet the needs of beginners to professionals.

AI trading bots for beginners in Pionex apps are provided at no additional cost to users, which are very good at automating trading strategies and minimizing manual trading efforts.

Pionex Key Features

- 16 free trading bots, including Grid, DCA, and Arbitrage

- Smart Trade Terminal

- Built-in bots, no API integration required

- Automate trading

- TradingView charts

- High security for data and funds

- Low trading fees (0.05% per trade)

- Full trading order history

- Fully customizable interface

- Simple user interface without programming

Pionex limitations

- Fewer features compared to competitors

- Inability to withdraw with fiat

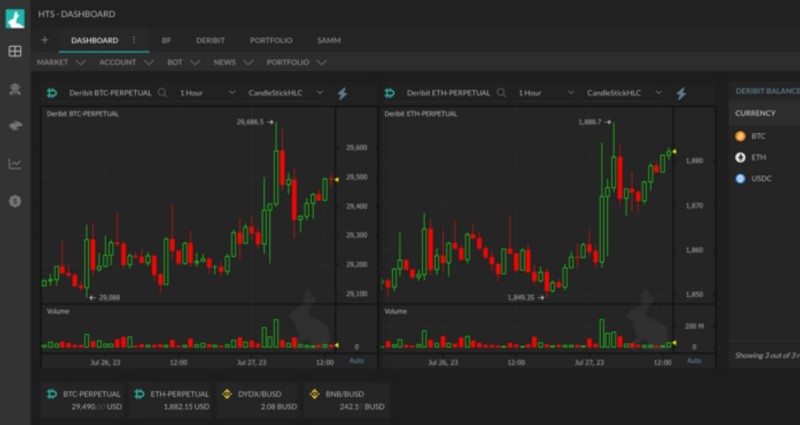

4. HaasOnline

If you're a novice day trader seeking AI trading bots for crypto with diverse strategies and the ability to create custom bots, HaasOnline is the best AI bot for trading.

With Edge Computing and TradeServer, it provides high processing speed and security, which can be further optimized using RDP.

Creating custom bots and running local bots requires robust infrastructure. So, buy rdp with bitcoin and connect to a powerful server to bypass payment restrictions and optimize the execution of your custom bots.

HaasOnline Key Features

- Supports 20+ popular exchanges (Binance, OKX, Kraken, etc.)

- Run bots locally or on TradeServer Cloud

- Create custom scripts

- Edge Computing for reduced latency

- HaasScript for advanced trading algorithms

- Visual editor for beginners (drag-and-drop)

- Supports strategies like Arbitrage and Scalping

- Powerful simulation and backtesting engine

- High security and fast processing

- Flexible pricing plans for different user levels

HaasOnline Limitations

- Relatively high cost

- No Free Trial

- Complex user interface

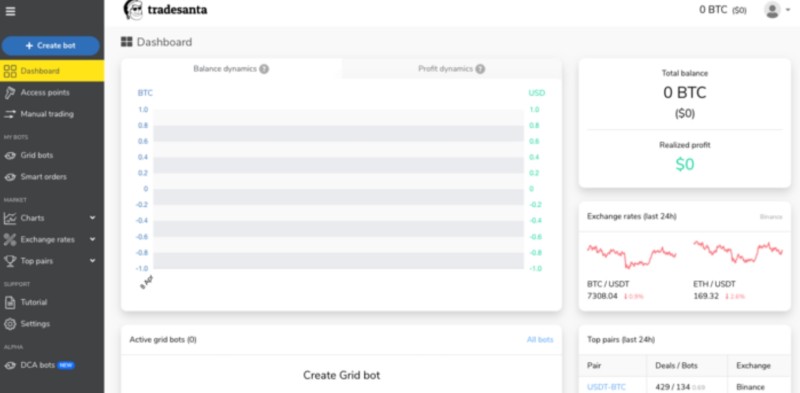

5. TradeSanta

TradeSanta is an AI trading bot for crypto trading that simplifies the trading process and helps users capitalize on market fluctuations.

Features like affordable pricing, user-friendly mobile and desktop interfaces, risk management tools, and live chat support make TradeSanta an ideal option for beginners.

Of course, with RDP, you can use all the features of this bot more securely and quickly, which makes it a superior AI bot for crypto trading.

TradeSanta Key Features

- Supports major exchanges: Bybit, OKX, HitBTC

- Long & short strategies with customizable indicators

- 24/7 automated trading, even when your device is off

- Easy, code-free setup with pre-made templates

- Backtesting to test and optimize strategies

- Ability to lock in profits and limit losses intelligently

- Simple setup using pre-designed trading templates

- Suitable for a quick start without the need for complex settings

- Affordable plans with annual discounts

TradeSanta Limitations

- Not ideal for advanced/pro users

- No custom strategy coding

- Limited access to the free trial (3 days)

- Malfunctions during internet outage or shutdown

- Requires appropriate infrastructure (RDP) for stable execution

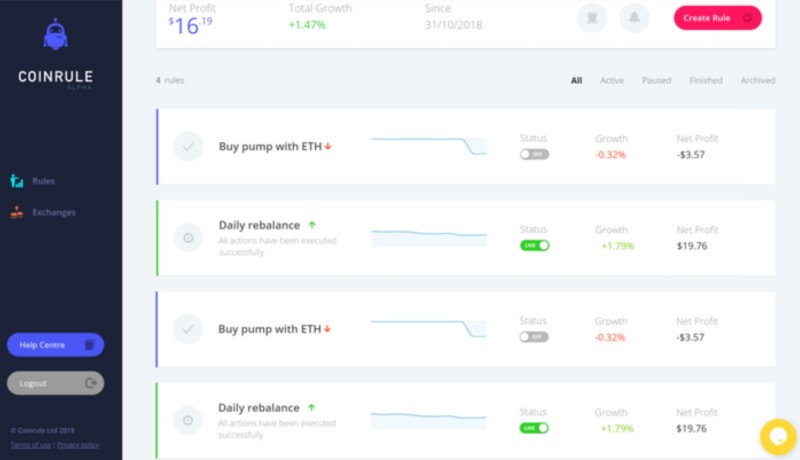

6. Coinrule

If you are looking for a platform to automate your strategies without coding, and ease of use is your priority, Coinrule is one of the best AI trading bots for beginners that you can choose.

Creating trading bots, customizing automated trades, and using new indicators to trigger actions are just a few of the features that make Coinrule a modern solution for smarter trading.

Coinrule Key Features

- Integration with major exchanges, including Binance, Kraken, OKX

- No-code rules for automated trading

- Automated 24/7 trading without manual intervention

- 250+ customizable rules

- Backtesting to test and optimize strategies

- Portfolio tracking and analysis

- Custom alerts for market movements

- Leverage options for advanced users

- Advanced security (2FA, encryption)

- Paper trading and backtesting options with a free plan

- User-Friendly Interface

Coinrule Limitations

- Requires Basic Knowledge

- Limited Advanced Features in Free Plan

- Relies on pre-set rules

- High Subscription Costs for Advanced Features

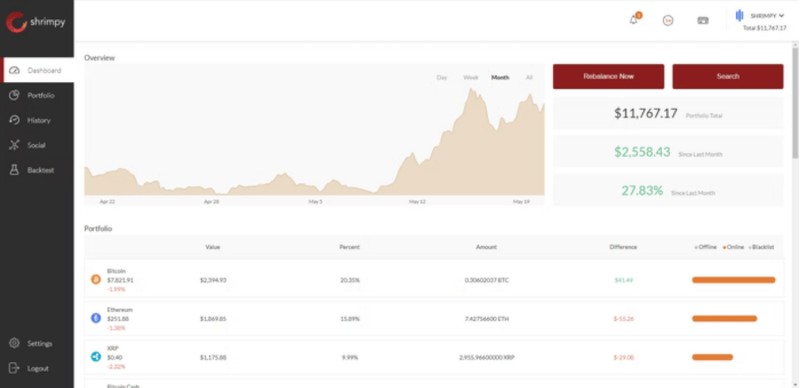

7. Shrimpy

Novice traders who want to get started with social trading and copy trading ideas early on should consider Shrimpy among AI trading bots for beginners.

This bot focuses on long-term portfolio management through social trading, allowing users to automate trades, backtest strategies, and follow top traders or become trusted traders themselves.

As a beginner, to quickly copy social strategies and achieve desired returns without delays, having a strong and fast infrastructure is essential, and RDP provides just that.

Shrimpy Key Features

- Portfolio Management & Rebalancing

- Social Trading to copy top traders' strategies

- Supports exchanges like Binance, Coinbase Pro, Kraken, and OKX

- Automated Trading

- Build personalized portfolios based on investment goals

- Cross-Exchange Performance Monitoring

- Easy-to-use platform for even beginners

- Affordable Pricing

Shrimpy Limitations

- Limited Customer Support

- No Mobile App

- Limited Features on Free Plan

- Dependence on Exchange APIs

Key Benefits of AI Trading Bots

Automatic Anticipation of Market Changes: AI bots quickly adapt to market shifts using real-time data, optimizing trading tactics for emerging opportunities.

24/7 Automated Trading: AI trading bots operate continuously, ensuring the continuous execution of trades and never missing profitable opportunities.

Data-Driven Decision-Making: AI bots base decisions on large-scale data analysis, removing emotional bias and enhancing trade accuracy.

Faster and More Accurate Trading: Bots execute trades with unmatched speed and precision, capitalizing on fleeting market movements.

Reduced Risk and Missed Opportunities: By analyzing multiple markets simultaneously, AI bots minimize risk and seize every opportunity without delay.

Improved Risk Management and Portfolio Optimization: AI trading adjusts strategies and diversifies portfolios, balancing risk and reward for optimized returns.

Backtesting, Optimization, and Sentiment Analysis: AI bots backtest strategies using historical data, adapting to market trends and sentiment for improved future performance.

These benefits can enhance your trading performance. Even if you buy RDP with Bitcoin, you gain added security and high availability, enabling uninterrupted execution of your strategies.

How to Choose the Right AI Trading Bot for Your Needs?

An AI bot for trading is like your travel companion, so you should choose a bot that aligns with your trading goals and risk tolerance.

So, to make the best decision, you should follow these steps:

- Set your investment objectives and risk level to start trading.

- Look for key features such as automation, copy trading, backtesting, and paper trading.

- Ensure support for different trading strategies.

- Make sure the bot’s strategies align with your trading style and goals.

- Check compatibility with major exchanges like Binance, Coinbase, and KuCoin.

- Opt for a simple, intuitive platform that’s easy to use.

- Review subscription costs and hidden charges.

- Choose a bot with strong security (2FA, encryption) and reliable support.

- Look for bot that allows strategy and parameter adjustments.

- Check the bot community comments and feedback, and analyze their reliability and performance.

- Check user reviews and bot performance history.

Review AI trading bots for beginners and select one that aligns with your goals. Connect it to your trading platform and leverage RDP's power, speed, and security to maximize the bot's potential for executing profitable strategies.

Challenges and Risks of Using AI Trading Bots for Crypto

Trading bots offer many advantages, but their reliance on AI algorithms means flaws can lead to significant financial losses.

Overfitting on historical data prevents bots from spotting new market opportunities, while server outages or software bugs can disrupt automated strategies.

Key challenges of AI crypto trading bots every trader should know:

- Complex monitoring of machine learning algorithms and behavior prediction

- High dependence on initial settings

- Performance relies on the quality of learning data

- Risk of hacking and fraud due to interconnected bots, APIs, and platforms

- Lack of control over algorithm learning and understanding

- False signals from improper algorithm calibration

- Poor real-world performance due to overfitting on historical data

- Inability to adapt to sudden market changes

- Disruptions due to technological failures

- High computational resource requirements

Some challenges, like high computational needs and hacking, can be addressed by buying RDP with Bitcoin and staying aware of common crypto mistakes to avoid, such as sharing private keys, using unsecured networks, or falling for phishing scams.

To tackle others, delegate only specific tasks, such as data analysis or strategy implementation, to bots while maintaining human oversight. This ensures more control over your trading and minimizes risks from bot malfunctions.

Conclusion

Using AI trading bots can provide traders with a fast, precise, and emotion-free trading experience. However, to fully optimize these bots, it is essential to use a RDP with the right resources and secure connections to trading platforms.

Choosing the right bot, based on trading strategies and security features, can help reduce risks and improve returns in financial markets.

Editorial staff

Editorial staff

Editorial staff

Editorial staff