In a remarkable turn of events, the gold market witnessed an unprecedented surge in bullish sentiment, fueled by a historic buying spree from hedge funds.

Hedge Funds Bolster Gold Market with Unprecedented Buying

Recent trade data highlights an extraordinary surge in speculative bullish positioning in the gold market, reaching a two-year high as hedge funds embark on an unparalleled buying spree. The latest report from the Commodity Futures Trading Commission reveals a substantial increase in money managers' speculative gross long positions in Comex gold futures, soaring to 1,73,994 contracts for the week ending March 12.

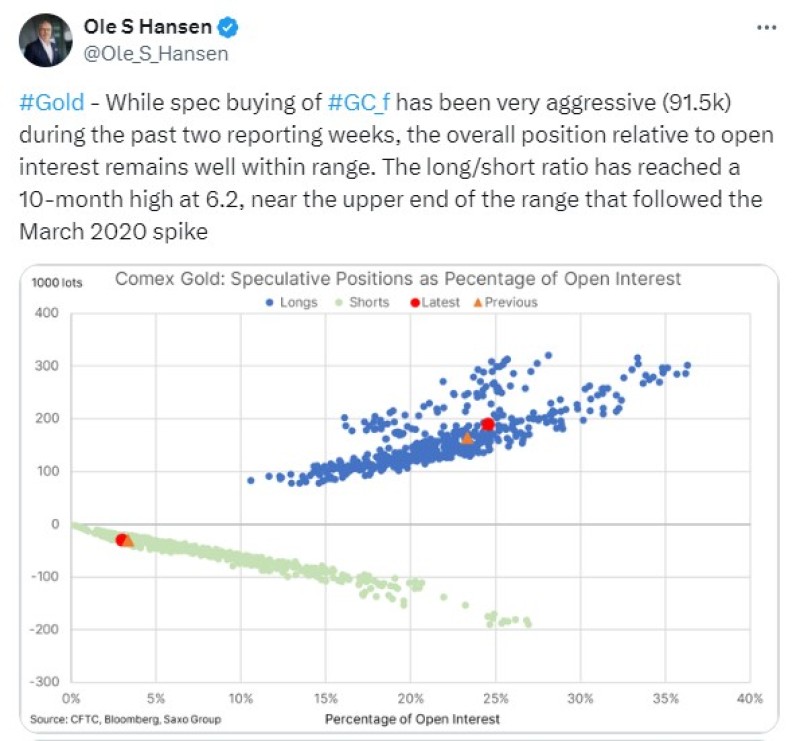

Conversely, short positions witnessed a decline, dropping by 2,432 contracts to 32,911. This surge in bullish sentiment catapulted the gold market to a net long position of 141,083 contracts, marking its highest level since early March 2022, coinciding with a historic peak in XAU prices, surpassing $2,200 per ounce.What Ole Hansen, head of commodity strategy at Saxo Bank, also notes on his Twitter @Ole_S_Hansen

XAU Resilience and Analyst Perspectives

Ole Hansen, sheds light on this remarkable trend, emphasizing hedge funds' acquisition of a staggering 285 tonnes of gold within the last fortnight. Despite this unprecedented buying frenzy, Hansen underscores that XAU's overall positioning relative to open interest remains within a manageable range.

Fred Hickey, the mastermind behind The High-Tech Strategist investment newsletter, echoes similar sentiments, cautioning against the potential risks associated with heightened net length in XAU. Nonetheless, Hickey also highlights historical precedents where bullish bets surged substantially higher during previous bull markets.

XAU Relative Undervaluation and Investment Potential

While gold's elevated positioning captures attention, analysts like Michele Schneider from MarketGauge advocate for its relative undervaluation, particularly when juxtaposed with the soaring Dow Jones Industrial Average.

Schneider underscores XAU's potential for growth, emphasizing its attractiveness compared to equities. Moreover, the surge in demand for gold-backed exchange-traded products, exemplified by SPDR Gold Shares (NYSE: GLD), signals a growing investor appetite that is poised to sustain upward momentum in gold prices.

Cautionary Notes and Market Dynamics

Despite the bullish fervor, analysts at TD Securities warn of potential exhaustion in the market as XAU prices consolidate above $2,150 per ounce. With macro trader positioning aligning closely with market expectations for the Federal Reserve's monetary policy stance, the upside potential in XAU may be constrained. TD Securities emphasizes the pivotal role of the upcoming Fed meeting in shaping market sentiment and price trajectories.

Silver's Emerging Potential Amidst XAU Ascendancy

While XAU commands attention with its record-breaking rally, silver emerges as an intriguing prospect in the precious metals market. Despite gold's dominance, silver's bullish positioning gains traction, propelled by rising prices and renewed interest.

The surge in money-managed speculative gross long positions in Comex silver futures underscores growing optimism, bolstered by silver's breakout above $24 per ounce. Analysts anticipate further upside potential for silver, buoyed by momentum in copper prices and a renewed focus on industrial demand.

In summary, amidst gold's unprecedented surge fueled by hedge fund activity, the precious metals market presents a landscape ripe with opportunities, with both XAU and silver poised for further upside potential. However, cautious optimism prevails, with market dynamics and upcoming events poised to influence price trajectories in the days ahead.

Peter Smith

Peter Smith

Peter Smith

Peter Smith