Gasoline futures are flashing a clear signal to inflation watchers: the heat is fading. Wholesale gasoline prices have declined 16.49% year-over-year—a significant contraction that aligns with a broader narrative of disinflation and weakening demand. Combined with falling crude prices and macro headwinds like demographic shifts and rising debt, markets may be entering a structurally deflationary era.

Gasoline Slips Further as Structural Deflation Pressures Mount

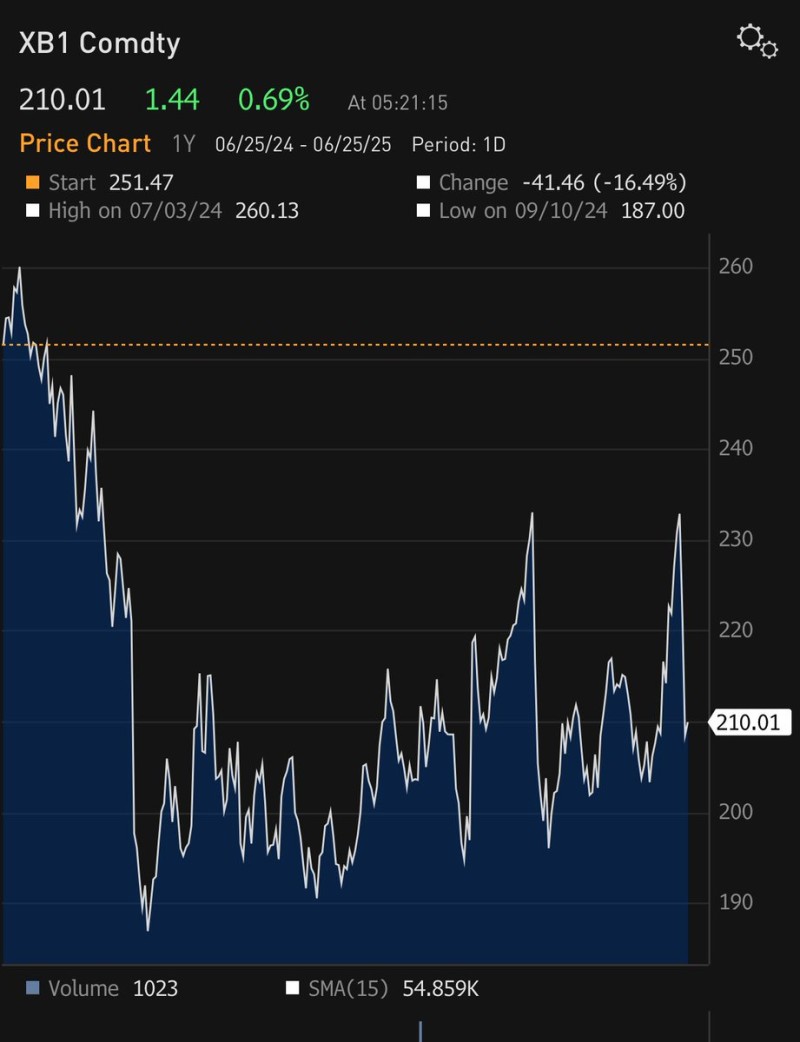

According to a recent post by market strategist James E. Thorne, wholesale gasoline prices (XB1) have dropped 16.49% year-over-year, signaling what he calls a “forward-looking inflation gauge.” As of June 25, 2025, the price stands at $210.01, reflecting a daily gain of 1.44 points (0.69%) but still sharply below the annual starting point of $251.47.

The commodity reached a yearly high of $260.13 on July 3, 2024, before falling to a low of $187.00 on September 10, 2024. Despite recent volatility, the price remains well below key resistance levels.

Volume and Technical Metrics Add Context to Market Mood

On the technical side, current volume stands at 1,023 contracts, indicating relatively muted trading activity. The 15-day Simple Moving Average (SMA) is shown at 54.86K, highlighting a potential divergence between short-term trading interest and longer-term market behavior.

Thorne contextualizes the move within broader structural deflationary trends, citing excessive debt, innovation, and demographics as long-term forces pushing inflation downward. He adds that crude oil is already in a bear market, strengthening his argument that current inflation concerns may be overstated or misdiagnosed.

Peter Smith

Peter Smith

Peter Smith

Peter Smith