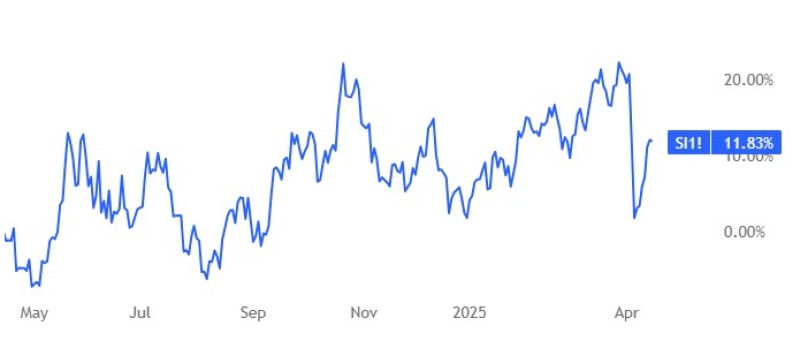

Silver prices remain stable around $32.30 per ounce as investors evaluate mixed signals on US trade policies, pausing after four consecutive sessions of gains.

Silver (XAG) Pauses Rally as Trade Signals Remain Mixed

Silver prices held steady at approximately $32.30 per ounce on Tuesday, taking a break following a four-session rally. Investors are currently processing conflicting indications regarding US trade policy and attempting to understand the broader economic implications these policies might have on precious metals markets.

The pause in silver's upward momentum comes amid complex developments in US-China trade relations. US President Donald Trump has exempted key technology products from newly implemented reciprocal tariffs, providing some relief to specific market sectors. Additionally, reports suggest the administration is considering a pause on the planned 25% auto import levies, which could reduce immediate economic pressures.

Silver (XAG) Market Watches US-China Trade Tensions

Despite these potentially positive developments, significant uncertainty continues to cloud the trade landscape. The US Commerce Department has launched national security investigations focusing on semiconductor and pharmaceutical imports, raising concerns about further trade restrictions that could impact global economic growth and consequently affect silver demand.

Chinese President Xi Jinping has expressed growing concern over the escalating trade tensions between the world's two largest economies. In a statement that resonated across financial markets, Xi emphasized that "no one wins in a trade war," highlighting the potential negative consequences for global economic stability and growth prospects.

Silver (XAG) Investors Monitor Fed's Stance on Tariff-Induced Inflation

On the monetary policy front, Federal Reserve Governor Christopher Waller attempted to calm market concerns by suggesting that any inflation resulting from the implementation of new tariffs would likely be transitory rather than persistent. This assessment provides some reassurance to silver investors, as precious metals often serve as inflation hedges during periods of rising prices.

Waller's comments went further to emphasize the Federal Reserve's readiness to implement additional interest rate cuts if necessary. The central bank appears to be prioritizing sustained economic growth over addressing short-term inflationary pressures, a stance that typically supports precious metals prices including silver.

Silver (XAG) Outlook Balanced Between Trade Risks and Monetary Policy Support

The current price stability in silver reflects a market balancing multiple factors. On one hand, potential trade restrictions could dampen global economic activity and industrial demand for silver. On the other hand, accommodative monetary policy from the Federal Reserve, particularly if additional rate cuts materialize, generally creates a supportive environment for precious metals.

Silver's dual nature as both an industrial metal and a store of value makes it particularly sensitive to this interplay between economic growth concerns and monetary policy expectations. The industrial applications of silver mean that economic slowdowns can reduce demand, while its precious metal status makes it attractive during periods of monetary easing and potential currency devaluation.

As investors continue to monitor developments in trade policy and central bank communications, silver prices may remain range-bound until clearer directional signals emerge. The metal's ability to hold ground around the $32.30 level suggests underlying support despite the current uncertainties in the global economic landscape.

Peter Smith

Peter Smith

Peter Smith

Peter Smith