According to TD Securities' senior commodity strategist Daniel Ghali, gold (XAU) remains uniquely positioned to benefit regardless of the U.S. dollar’s movement, while silver (XAG) is experiencing a significant supply squeeze.

Gold (XAU) Defies Market Norms Amid U.S. Dollar Strength

In a February 21 interview, Ghali highlighted how the ongoing strength of the U.S. dollar is paradoxically supporting gold prices. He noted that despite rising U.S. interest rates and a strong dollar, gold has continued its impressive rally, mirroring historic surges seen in 1933 and 2009.

“The strength in the U.S. dollar is acute enough to catalyze buying activity in gold (XAU) as a currency depreciation hedge, particularly out of Asia,” he said. This trend, active over the past two years, has intensified since January 2025.

Tariffs and Physical Gold (XAU) Flows Add to Market Anomalies

Ghali pointed out significant distortions in the commodities market, particularly in gold's physical movement between London and the U.S. “The return from moving physical gold (XAU) has been abnormally large over the past months,” he explained. However, this trend is now showing signs of easing for gold, though silver (XAG) and other precious metals remain affected.

Despite this unusual setup, Ghali warned that gold’s current bullish momentum may be short-lived. “It’s a rare occurrence, but for as long as it lasts, it creates a strong context for gold (XAU),” he noted.

Silver (XAG) Faces a Historic Supply Crisis

Turning to silver (XAG), Ghali described the metal’s position as unique, with a structural deficit persisting for the fifth consecutive year. The supply-demand imbalance has been driven by surging global demand, particularly from the solar industry.

However, the silver (XAG) market is now shifting from a demand-driven boom to a liquidity crisis. “The pull of metal from London into the U.S. has drained the world’s largest bullion vaulting system, disrupting day-to-day trading activity in physical markets,” Ghali said.

Silver (XAG) Prices Under Pressure Despite Long-Term Bullish Outlook

With London trading conditions tightening, Ghali anticipates that silver (XAG) prices will need to rise to attract new supply. “We think it can get even tighter, and ultimately flat prices in silver need to rise to incentivize metal to come back into London from unconventional sources,” he added.

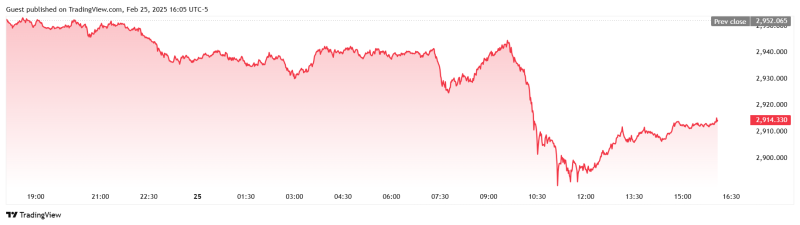

On Tuesday, gold (XAU) briefly dipped but remained above $2,900 per ounce, with spot prices last trading at $2,914.33 per ounce, down 1.28% on the day.

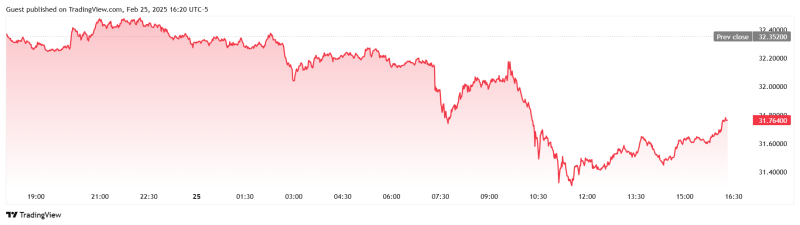

Silver (XAG) saw a more pronounced decline, falling from $32.484 to a session low of $31.291 per ounce. Spot silver (XAG) last traded at $31.764, marking a 1.82% loss on the session.

Usman Salis

Usman Salis

Usman Salis

Usman Salis