Gold futures have slipped from their recent peaks as traders lock in profits following a powerful multi-week rally. The pullback has sparked debate about whether the precious metal is simply pausing for breath or showing early warning signs of a deeper correction.

Sharp Correction After Parabolic Growth

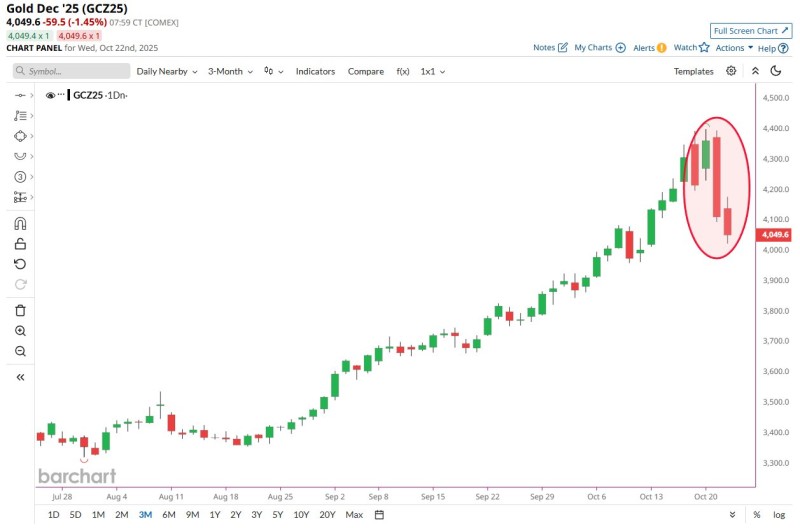

The December 2025 Gold contract chart from Barchart reveals a clear reversal pattern. After climbing steadily from $3,750 in early September to above $4,400, prices have pulled back to around $4,050.

The highlighted area on the chart shows this retracement, with three consecutive red candles signaling increased selling pressure. This decline follows an exceptionally strong trend where gold recorded nearly a 15% rise in under six weeks. Such rapid gains typically trigger short-term profit-taking before markets find their footing again.

Key Levels and Market Sentiment

Immediate support sits near $3,950, an area that previously acted as resistance in September. Holding this zone could prevent further downside. On the upside, $4,300–$4,400 now serves as resistance, the region where traders started unwinding positions. Despite the correction, the medium-term trend remains constructive. Gold continues trading well above its 50-day moving average, suggesting institutional demand hasn't disappeared.

Why Gold Is Cooling Off

Several factors may explain this temporary pullback:

- Stronger U.S. dollar: The dollar's recent recovery has slightly dampened demand for gold as a hedge

- Rising Treasury yields: Higher yields make non-yielding assets like gold less attractive in the near term

- Profit-taking after strong gains: With gold recently touching new highs, traders are cashing in ahead of key economic releases

Most analysts view this as a technical reset rather than a trend reversal.

Market Cooling, Not Cracking

Market data reflects growing short-term caution among traders. However, most technical analysts see this drop as a standard pullback within an extended uptrend, not the beginning of a bear phase. Similar corrections in gold prices have often preceded renewed strength once momentum stabilizes, particularly when U.S. growth data softens or geopolitical tensions rise.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah