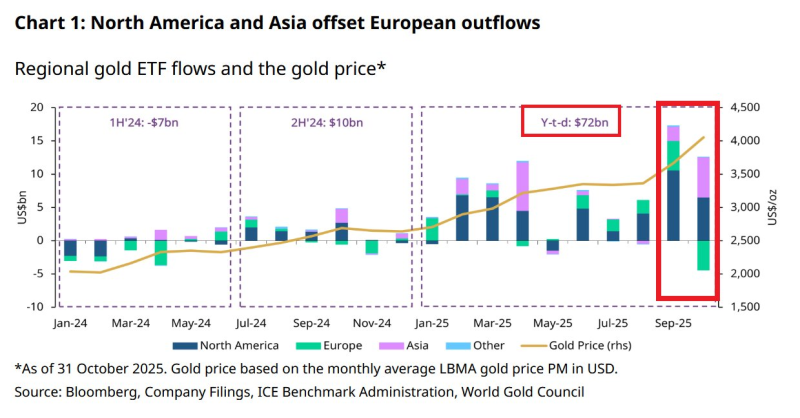

⬤ Investor appetite for gold hit all-time highs in 2025, with physical-backed gold ETFs pulling in $8 billion last month and $17 billion in September alone. Year-to-date inflows reached $72.3 billion—the strongest annual performance ever recorded—as global market uncertainty drove renewed interest in gold as a protective asset.

⬤ Data from Bloomberg, company filings, and the World Gold Council shows North America and Asia led this surge, more than offsetting continued outflows from Europe. Chinese and Indian demand proved especially critical, pushing global gold ETF holdings to multi-year peaks. During this period, gold prices soared to nearly $4,500 per ounce by late September 2025, reflecting both robust ETF inflows and strong physical buying.

⬤ While record inflows signal confidence in gold as an inflation hedge and crisis buffer, they also raise concerns about overconcentration in safe-haven assets. Heavy ETF buying could pull liquidity from riskier markets, potentially amplifying volatility if economic conditions change or central banks shift course. Some analysts caution that any sudden flow reversal might create short-term price pressure, though long-term fundamentals look solid.

⬤ Physical-backed ETFs are experiencing historic inflows driven primarily by China and India. With gold prices climbing toward new records, market sentiment remains strongly bullish, cementing gold's status as the premier refuge asset heading into 2026.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova