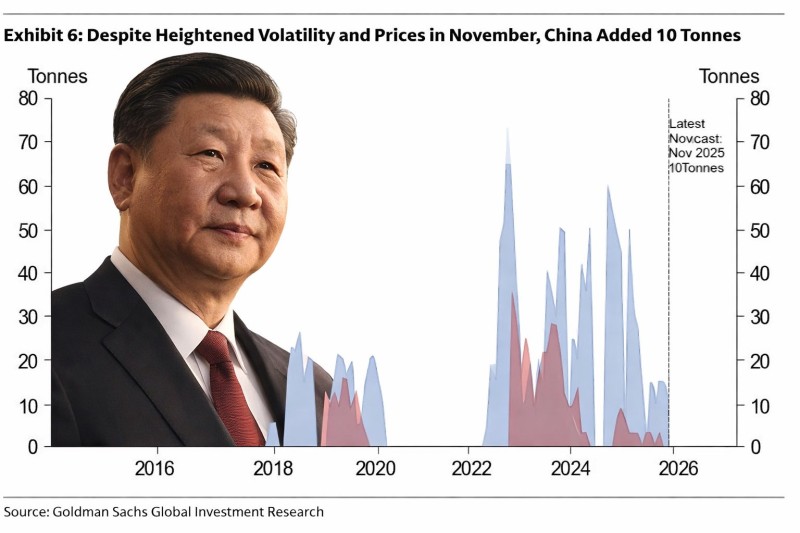

⬤ China's central bank has kept its gold shopping spree going for the 15th month in a row, adding roughly 40,000 troy ounces to its reserves according to recent data. The People's Bank of China hasn't slowed down despite wild price swings that followed gold's record-breaking rally and the sharp selloff that came after.

⬤ The numbers show China picked up about 10 tonnes in November 2025, even as prices bounced around and traders scrambled to adjust their positions after the speculative frenzy earlier in the year. That steady buying pattern tells you Beijing isn't bothered by short-term market drama—they're playing the long game.

⬤ China isn't alone in this gold rush. The World Gold Council reports that central banks worldwide grabbed over 860 tonnes in 2025. Sure, that's down from the 1,000+ tonnes we saw in each of the previous three years, but it still represents serious institutional appetite. These aren't retail investors chasing trends—these are monetary authorities making strategic moves.

⬤ When you see major central banks consistently loading up on gold month after month, it reinforces the metal's status as a go-to reserve asset when markets get shaky. This kind of sustained buying puts a floor under demand and keeps gold firmly planted in the world's reserve portfolios.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets