One of the most valuable assets on the Earth, oil, has a great impact on the global financial market. The price of oil depends on a large variety of factors, and this definitive guide explains what exactly drives the value of this resource. We will take a detailed look at the history of oil price formation, find out who produces it, and discuss a few aspects which play a role in the oil market.

The History of Oil and Its Price

Before we dive into the long history of oil price formation, let’s overview the major milestones in oil production until the Second World War:

- Around three thousand years B.C.: People in the Middle East started to use oil as fuel, to manufacture weapons, to make fixtures and building material, such as bitumen, and asphalt. Oil was collected from the surface of open water.

- 347 A.D.: Oil wells were drilled in the ground for the first time in China. Hollow bamboo trunks were used as pipes.

- 7th century A.D.: The "Greek fire," the superweapon of the time, was made on the basis of oil in Byzantium or Persia.

- 1264: The Italian traveler Marco Polo, while driving through the territory of modern Azerbaijan, noted that local residents collected oil leaking from the ground. Oil trade began around this time as well.

- Around 1500: Oil was first used for street lighting in Poland. Oil was exported from the Carpathian region.

- 1848: The world's first modern-type oil well was drilled on the Absheron Peninsula near Baku.

- 1849: Canadian geologist Abraham Gesner first obtained kerosene. Soon after, in 1857 kerosene lamp was invented. This invention made it possible to preserve the world stock of whales, since kerosene, which replaced whale oil, has become a more popular and convenient source of energy for lighting homes. Before the mass production of kerosene, a gallon (about 4 liters) of whale fat cost about $ 1.77. After the mass adoption of kerosene lamps, the price dropped to $0.40, while kerosene was sold at $0.07 per gallon. The world whaling industry was in deep crisis.

- 1859: The beginning of oil production in the USA. The first well (21 meters deep) was drilled in the state of Pennsylvania. It allowed producing 15 barrels of oil per day.

- 1962: People started measuring oil in barrels as they were used to transport oil. A barrel of oil is 42 gallons (about 168 liters).

- 1870: It was the time for the first attempt to create an oil monopoly. John Rockefeller founded the Standard Oil company, which led to the adoption of the world's first antitrust law in the United States. In 1911, the US Supreme Court decided to divide Standard Oil into 39 small companies to prevent it monopolizing the oil sector.

- 1878: Thomas Edison invented the light bulb. The massive electrification of cities and a decrease in kerosene consumption for a short time plunged the global oil industry into a state of depression.

- 1886: German engineers Karl Benz and Wilhelm Daimler created a car powered by a gasoline engine. Previously, gas was only a by-product of the production of kerosene.

- 1890: German engineer Rudolf Diesel invented a diesel engine capable of operating on by-products of oil refining process. Today, the majority of industrial countries actively restrict the use of diesel engines, which causes significant damage to the environment.

- 1896: Henry Ford created his first car. Oil was considered to be a raw material for the production of gasoline.

- 1903: The Wright brothers performed the first flight on the plane. Starting in the 1920s, oil was used in aircraft.

- 1904: The largest oil-producing countries were the United States, Russia, Indonesia, Austria-Hungary, Romania, and India.

- 1908: The first oil fields in Iran were discovered. The Anglo-Persian Oil Company was established (which later was turned into British Petroleum).

- 1914-1918: World War I – the battle for the control of oil fields.

- 1918: Soviet Russia was the first in the world to nationalize oil companies.

- 1932: Oil fields were discovered in Bahrain.

- 1938: Oil fields were discovered in Kuwait and Saudi Arabia.

- 1939-1945: The Second World War. Germany failed to gain control of oil fields in Romania, the Trans Caucasus, and the Middle East.

After World War II

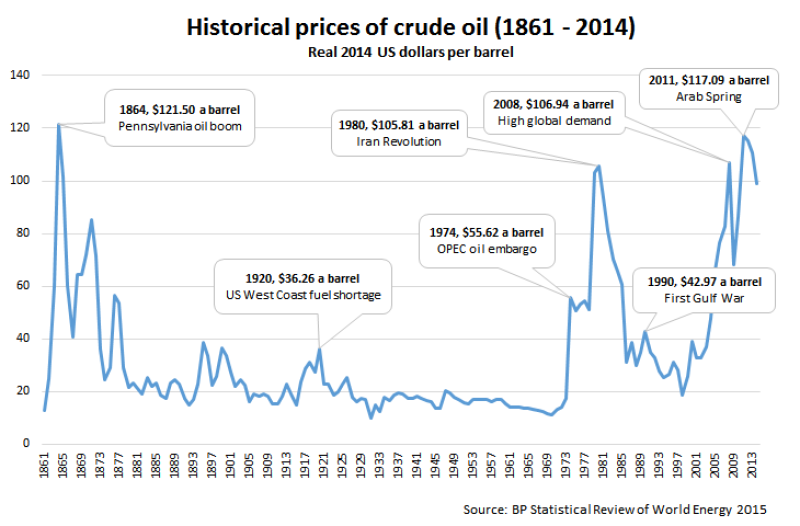

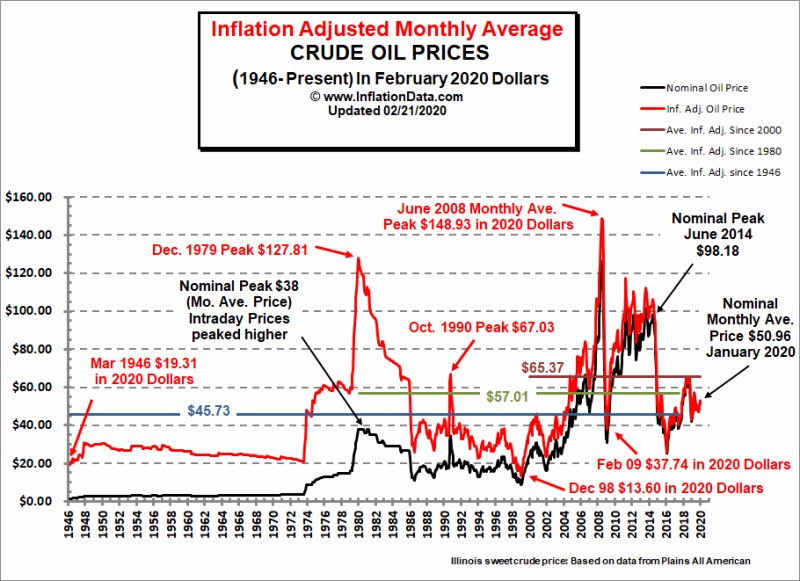

From 1948 until the end of the 1960s, crude oil prices ran somewhere in the range between $2.50 and $3.00. The value of oil rose from $2.50 in 1948 to about $3.00 in 1957. When evaluating the price with a help of 2010 dollars, an alternate story develops with cost of raw oil fluctuating between $17 and $19 during the greater part of the period. The clear 20% cost increase in nominal cost simply kept up with inflation.

From 1958 to 1970, costs remained close to $3.00 per barrel; however, in genuine terms, the cost of raw petroleum declined from $19 to $14 per barrel. However, in 1971 and 1972, the universal maker endured the extra impact of a more fragile US dollar.

Organization of Petroleum Exporting Countries was founded in 1960 by five participating countries: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Two of the delegates at the initial gathering considered the Texas Railroad Commission's strategy for controlling cost through impediments on extraction. Before the end of 1971, six more members had joined the group: Qatar, Indonesia, Libya, United Arab Emirates, Algeria, and Nigeria. These countries experienced a consistent decrease in the buying power of a barrel of oil from the conception of OPEC until 1972.

It took OPEC 10 years from the moment of its foundation to understand the degree of its power over oil price formation.

In 1972, the cost of raw petroleum was less than $3.50 per barrel. The Yom Kippur War began with the Syria and Egypt's attack on Israel on October 5, 1973. While these countries reduced production by 5,000,000 barrels per day, different nations had the option to produce a million barrels. Before the end of 1974, the ostensible cost of oil had quadrupled to more than $12.00. The extraordinary impact of deficiency on cost became apparent when the price was increased by 400 percent in six brief months.

From 1974 to 1978, the world raw petroleum cost was kept within the range, from $12.52 to $14.57 per barrel. When the expansion was balanced, world oil costs were experiencing a moderate decrease. At the time, OPEC limited extraction to 30 million barrels per day.

1980-90’s

In 1979 and 1980, the unstable situation in Iran and Iraq prompted another round of growth of cost of unrefined petroleum. The Iranian turmoil brought the loss of about 2.0-2.5 million barrels per day in oil extraction between November 1978 and June 1979. At a certain point, oil production nearly stopped.

The Iranian transformation was the immediate reason for the highest oil prices in the post-WWII history. However, this effect was somewhat limited. In September 1980, Iran, previously weakened by the social unrest, was attacked by Iraq. In November, the joined creation of the two nations was just a million barrels per day. As an outcome, overall unrefined petroleum creation was 10% lower than in 1979.

The loss of production volume and the Iraq-Iran War caused raw petroleum costs to dramatically increase. The nominal cost went from $14 per barrel in 1978 to $35 per barrel in 1981.

The fast growth in costs of unrefined oil from 1973 to 1981 would have been less was it not for the United States that decided to control the prices. The undeniable consequence of the value controls was that U.S. consumers paid around 50% more for imports than domestic production, and U.S. producers earned way less than international players.

During 1979-1980, when prices were growing insanely, Saudi Arabia's oil minister Ahmed Yamani cautioned OPEC that high prices will lower the demand, but no one listened to him. The increase in oil price forced people to adapt to new conditions:

- Better insulation in houses;

- More energy efficient production facilities;

- Stronger and more efficient cars.

All that caused the reduction in oil consumption.

From 1980 to 1986, non-OPEC extraction reached the level of 6 million barrels per day. From 1982 to 1985, OPEC attempted to set production quotas to make prices stable.

By mid-1986, Saudi Arabia increased extraction from 2,000,000 to 5,000,000 barrels per day. Raw petroleum costs plunged, falling below $10 mark per barrel. In spite of the fall in costs, Saudi Arabia's income stayed about the same with higher volumes making up at lower costs.

In December 1986, OPEC strived to set the target at $18 per barrel but was failing by January of 1987, and costs continue to fluctuate. The cost of raw petroleum spiked in 1990 with the lower extraction, vulnerability related to the Iraqi intrusion of Kuwait, and the resulting Gulf War.

Following what got known as the Gulf War to free Kuwait, costs of raw petroleum started t gradual decrease. In 1994, oil cost arrived to its lowest value since 1973.

1990’s

The price cycle at that point turned up. The United States economy was stable, and the Asian Pacific region was blasting. From 1990 to 1997, world oil consumption expanded to 6.2 million barrels every day. The Asia's share in this consumption constituted to all but 300,000 barrel per day and has a significant impact on cost stabilization in 1997. Declining Russian creation added to the cost recovery. Sometime between 1990 and 1996, Russian creation declined in more than 5,000,000 barrels per day.

The cost fluctuation came to an end in 1997 when the effect of the financial emergency in Asia was overlooked by OPEC.

Costs started to recover in mid-1999. In April, OPEC diminished production quotas by another 1.719 million barrels. Although not all producing countries managed to follow the quota, OPEC creation dropped by around 3,000,000 barrels per day between mid-1998 and the mid-1999. Such restrictions managed to raise costs to more than $25 per barrel.

XXI century

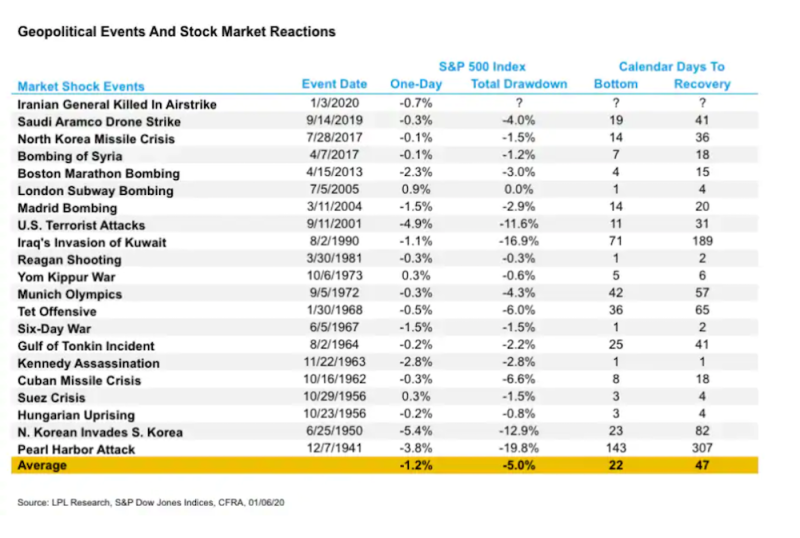

In 2001, a debilitated US economy and growth in non-OPEC creation forced costs to decline. OPEC started the series of cuts and reduced the production rate by 3.5 million barrels by September 1, 2001. Without taking into account the 9/11 terrorist attack, this would have been enough to talk about the descending pattern on the market.

Not long after the attack, oil costs dove. OPEC and some Russian makers chose to cut the creation. This had the ideal impact on oil costs moving into the $25 range by March 2002. By the end of the year, the oversupply was no longer an issue. Issues in Venezuela prompted a strike at PDVSA forcing Venezuelan creation to drop. After that, OPEC expanded quotas by 2.8 million barrels per day in January and February 2003.

Other major factors contributing to higher prices included a weak dollar and the rapid growth of Asian economies and their petroleum consumption.

In 2008, after the beginning of the longest U.S. recession since the Great Depression, the oil price continued to soar. Spare capacity dipped below a million barrels per day, and speculation in the crude oil futures market was exceptionally strong. Trading on NYMEX closed at a record $145.29 on July 3, 2008. In the face of recession and falling petroleum demand, the price continue a downward trend throughout the remainder of the year reaching a mark of less than $40 in December.

The change of oil price in 2010 along with world events is shown on the chart below:

Many economics experts may believe that the time of the lowest oil prices was in the early 1980s after the mid-1986 value breakdown. However, one can disagree with this point of view — the time of lowest costs in dollars, was in late 1998 and mid-1999, during the Asian Financial Crisis. Indeed, rate of $20.37 was recorded on March 18, 2020, which surpassed the monthly average level of $17.67, $19.45, and $18.69 in December of 1998, January of 1999, and February of 1999, respectively.

Where Is Oil Produced?

Oil-producing countries can be divided into four groups according to the share of the revenue from oil sales as part of gross domestic product (GDP):

- High share (43–49%) - Saudi Arabia, Kuwait, Qatar, Nigeria;

- Medium share (17–27%) - Norway, Algeria, Venezuela, Iran;

- Small share (up to 10%) - Mexico, Indonesia, Malaysia, China;

- Minimal share - the USA (0.5%), the UK (1.5%), Australia (1.5%), Canada (3.4%).

Of course, oil revenues are most significant in OPEC countries (up to 60% of all export revenues).

The problem of many countries rich in oil resources, such as Venezuela, Nigeria, and a number of other OPEC member countries, is that using these resources, their governments were not able to ensure long-term economic growth and a high standard of living. This phenomenon is called the “curse of natural resources.” The essence of this phenomenon is that there is particular correlation between the availability of natural resources and the rate of economic growth.

Amoco analysts estimated that the Gulf states contain two-thirds of the world's oil reserves. The Gulf states in 2001 accounted for 22.8% of all US oil import. Oil fields with 112.5 billion barrels of oil have been explored in Iraq. According to the BP Statistical Review of World Energy, Iraq has the second-largest oil reserves in the world, second only to Saudi Arabia (261.8 billion barrels). Kuwait's reserves are estimated at 98.6 billion barrels, Iran - 89.7 billion barrels, Russia - 48.6 billion barrels. At the same time, the cost of Iraqi and Saudi oil is the lowest in the world.

How Is Oil Price Formed?

Over the 20th century, the cost of U.S. oil was regulated via the production and cost controls. After the World War II, U.S. oil costs at the wellhead arrived at the midpoint of $28.52 per barrel balanced for swelling to 2010 dollars. Without price control, the U.S. cost would have followed the world cost of around $30.54.

Until recently, the global oil market was the seller’s market, and, as a result, the price of oil was determined on the basis of production costs in the worst fields, the operation of which is necessary to satisfy the demand.

Since Middle Eastern oil was the cheapest in terms of production costs, there was a continuous struggle between the countries-owners of subsoil and mining oil companies for the distribution of income. In the early stages, oil-producing countries received only payment for the use of irreplaceable natural resources (royalties) and part of the income tax. Subsequently, they were able to achieve equal profit sharing.

After the nationalization of the oil industry, oil-producing countries began to receive 80-90% income from oil production. But when the oil market turns from a seller’s market to a buyer's market, the pricing principles also change. The price of oil is built on the principle of "netback," i.e., “reverse account” prices: the costs of refining and transporting oil to the refinery, insurance costs, and other costs associated with the stages of transportation and refining are excluded from the price of petroleum products. A similar pricing method made it possible to link the prices of interchangeable energy carriers (coal, gas, fuel oil).

At the present stage, prices are determined based on exchanges from the ratio of supply and demand, as well as taking into account many other factors (i.e., political, financial, technological, oil reserves, etc.). Even weather conditions could contribute to the change in price (e.g., cold and warm winters). Finally, the ratio of prices for currency, gold, etc. can also affect oil prices.

Prices are determined on three major exchanges (New York, London, Singapore). The main types of contracts are futures and options; short-term forward contracts and swap transactions (with interchangeable delivery) are also used.

The most significant factors to consider in estimating the cost of oil are:

- The rate of change in GDP;

- Scientific and technological progress (new technologies, materials, means of communication, alternative energy sources, etc.);

- The state and forecast of reliable and potential oil reserves;

- Free oil production capacities in a number of countries, primarily in OPEC member countries.

- Institutional changes in the oil sector, as well as changes in oil legislation;

- The level of stocks in bunkers and storage facilities;

- Changes in exchange rates, etc.

The role of less significant factors in the globalization of the economy is substantially changing. While preceding 1998, the influence of political factors on oil supply was very significant (i.e., OPEC's embargo policy, military conflicts in the Middle East), the oil stock of a later period has a different nature. Here, changes in the exchange rate, interest rates on loans, and the wide participation of financial institutions in world oil trade become more noticeable.

The rate of change in strategic and commercial oil reserves in the United States has become another significant factor. The USA's announcement of intending to reduce or increase the size of reserves has an immediate reaction on the exchange. Meanwhile, the ration of supply to demand requires more detailed calculations.

The rise in prices is also affected by the high utilization of world oil refining capacities. 70–90 years ago, when the degree of utilization of oil refining capacities was 70–80%, this factor was not taken into account. But since 2004, the utilization capacity of American refineries has exceeded 91%, Canadian - 97%, Mexican - 98%. The optimal load level for a market economy is considered to be 85–90% and the load level is 95% (achieved in the USA in 2005).

Is It Easy to Predict Oil Price?

The short answer is ‘No.’ When forecasting oil prices, you should know that:

- Oil is a special product, the prices of which do not heavily depend on such things as the magnitude from the real costs of production and other objective components of its value;

- The dynamic interaction between factors affecting the price is still hard to predict even for the community of expert traders;

- There is still no integrated system of regulation of the oil market exists, so it’s impossible to synchronize the interests of key producers and consumers of goods and transit countries;

- Market predictability is not ensured by the development of acceptable price range;

- Majority of specialists failed to predict the single “sharp” price turn accurately. For example, a price rise during the first (1974) and second (1974–80) waves of the energy crisis, as well as a price drop in 1986 and 1998 and continuous price increase in 2008;

Bottom Line

As the modern world consumes more and more energy, each new barrel of oil is more expensive than the previous one – after all, the ‘easiest’ oil in production has already been pumped out and used. Based on this observation, the concept of "oil peak" was introduced: it states that at some point, production will peak and decline due to the depletion of the fields.

However, opponents of this theory point out that technology does not stand still. For example, innovations in this area allowed the United States to start producing oil and gas from shale, which was previously considered impossible. Thus, we will not produce less oil - it will simply grow in value. Of course, the second variable is demand. The ongoing recession this year raises doubts about the future of 'black gold': consumers are increasing energy efficiency and can switch to other sources, such as natural gas and various types of renewable energy. In 2012, oil accounted for 31% of global energy consumption. In 1973 - as much as 46%.

Perhaps, over time, the oil will become cheaper simply because it will not be so needed. Advocates of this view point recommend selling oil papers. They warn that the inflated cost of energy companies could lead to an economic crisis if fossil fuel prices rise to the point where it becomes unprofitable to pay emission fines for greenhouse gases.

Peter Smith

Peter Smith

Peter Smith

Peter Smith