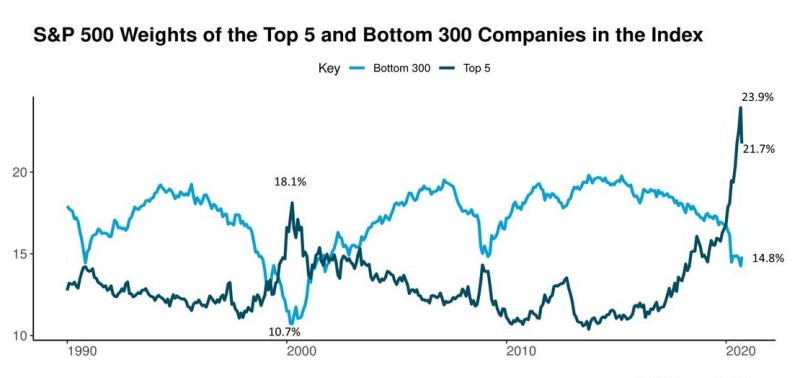

The top 5 companies in the S&P 500 have nearly mirrored the stock prices of the 300 cheapest companies in the index for decades, according to The Leuthold Group Analysis.

S&P 500 Is Dominated by Giants

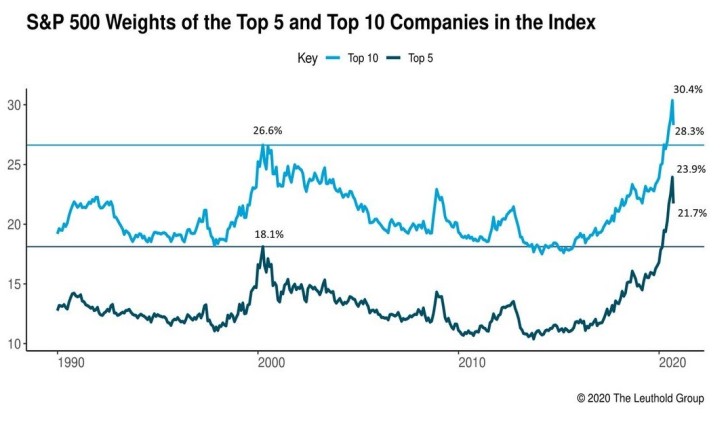

Among other things, the analysis also shows that at the moment the 5 largest companies account for almost 22% of the index, and the 10 largest companies occupy about 28%. It is the largest consolidation in history, surpassing even the heyday of the dot-com bubble.

The Nasdaq 100 has also been dominated by the giants. It is reported that 42% of the index's capitalization is occupied by only 4 largest technology companies, Apple, Microsoft, Amazon and Alphabet.

The September Correction Slightly Shaken the Positions of the Largest Companies

In early September, the share of the largest companies in the S&P 500 Index was even higher, however, due to the past correction, the largest companies have lost a significant share of their capitalization.

Usman Salis

Usman Salis

Usman Salis

Usman Salis