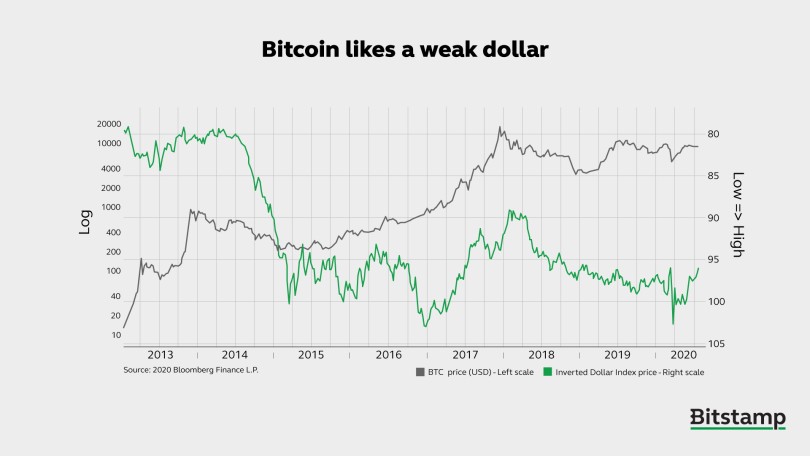

The Popularity of Bitcoin in Times of Weak Dollar

Bitcoin may be rewarded in popularity when the dollar loses its value, but it might not seem as flattering to the blockchain as the popularity spike and the inverse link.

The Bitcoin's price has been rising in the past ten years (from the start of the token) may have been demonstrated by the depreciation of the US dollar, which indicates somewhat slow market prices. This is because Bitcoin's price is typically measured in the US dollar, also the fiat.

Bitcoin and US Dollar During the Economic Crisis

The US dollar endured about 2 percent inflation per annum since the economic turndown – some of the lowest inflation ever seen in the global economy. However, this has risen to nearer inflation of 20%.

Taking this number into account, Bitcoin might be equivalent to $8,470 if we look at Bitcoin's actual price at $10,587.70 with depletion and inflation in mind. However, it looks at the US dollar price of Bitcoin instead of the actual cryptocurrencies.

It is necessary to take into consideration that the custody of funds in the cryptocurrency industry could ensure that the funds remain free from inflation. If an investor placed US dollars in US dollar-backed securities a decade ago, 84 cents would be required.

Bitcoin can expect a 7,723.75 percent ROI from running on the other side of the coin. This suggests not only that the blockchain can survive inflation, but also that in the face of global uncertainty, it has recorded a significant increase in value over the past decade.

1 comments

Bitcoin is a highly speculative investment. Just recently, the price of Bitcoin hit an all-time high of more than $68,000 in November of 2021 before sinking below $42,000 in early January and its pecking at $19-21,000 as at now But will definitely rise (bull) to at least $45,000 before this year ends. This is just one instance in the coin’s history of ups and downs and also a great time to invest and earn in it. Choose Coinbloc.us to get the best out of it at this very moment.