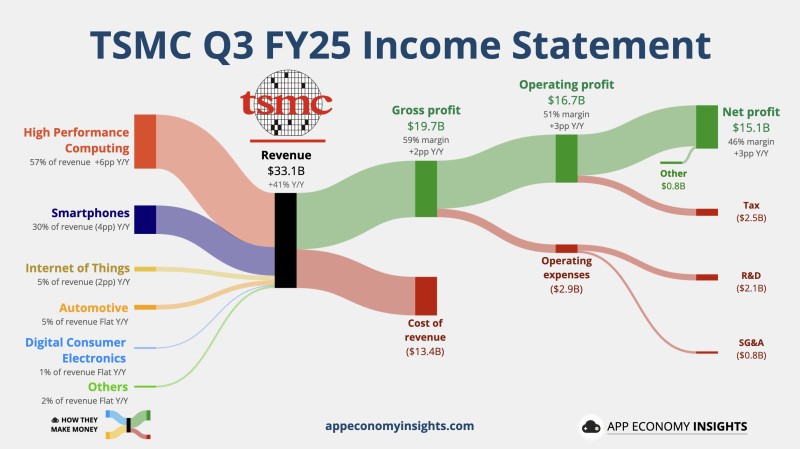

Taiwan Semiconductor Manufacturing Company delivered exceptional third-quarter results in FY25, reinforcing its position as the world's leading chip manufacturer. The company's performance reflects the explosive growth in artificial intelligence infrastructure, with demand for advanced semiconductors reaching unprecedented levels. Revenue climbed to $33.1 billion, surpassing analyst expectations by $1.5 billion and marking a 41% increase from the previous year.

Record Revenue Powered by AI Infrastructure

According to App Economy Insights trader, TSMC's CEO C.C. Wei noted that "conviction in the AI megatrend is strengthening." This confidence is reflected in the numbers, particularly in High-Performance Computing, which now represents 57% of total revenue - a six-percentage-point jump from last year.

The surge stems from insatiable demand for AI accelerators and cutting-edge chips that power data centers and generative AI applications. Meanwhile, smartphones contributed 30% of sales but saw their share decline by four percentage points, signaling a clear pivot toward AI-centric infrastructure. Internet of Things and Automotive segments each accounted for 5% of revenue, while Digital Consumer Electronics contributed just 1%.

Profitability Reaches New Peaks

The company's financial performance was equally impressive across profitability metrics:

- Gross profit hit $19.7 billion with a 59% margin, up two percentage points year-over-year

- Operating profit reached $16.7 billion at a 51% margin, climbing three percentage points

- Net profit came in at $15.1 billion with a 46% margin, also up three percentage points

These gains were achieved through disciplined cost management, with R&D spending at $2.1 billion to maintain leadership in next-generation manufacturing nodes, total operating expenses of $2.9 billion, and taxes of $2.5 billion.

Investment and Forward Guidance

Capital expenditures totaled $9.7 billion for the quarter, slightly higher than Q2's $9.6 billion, as the company continues expanding capacity for 3nm and 2nm production. More significantly, management upgraded its full-year FY25 revenue growth outlook from approximately 30% to the mid-30% range, reflecting strong confidence in sustained AI-driven demand through the remainder of the fiscal year.

Industry Impact and Strategic Position

TSMC's results underscore its critical role in the global semiconductor ecosystem. The company serves as the primary manufacturing partner for industry giants including Nvidia, AMD, and Apple, making it both an essential enabler and a potential constraint for the AI revolution. As cloud providers, enterprises, and automotive manufacturers pour resources into artificial intelligence capabilities, TSMC's dominance in advanced node production positions it to capture long-term growth even as traditional markets like smartphones mature and slow.

Usman Salis

Usman Salis

Usman Salis

Usman Salis