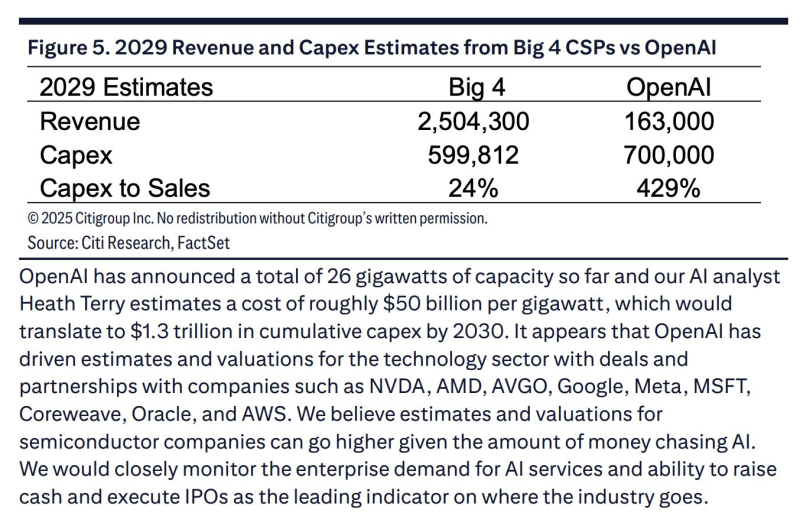

⬤ OpenAI's about to go on a spending tear that'll make Big Tech look modest. Citi Research is projecting the company's capital expenditures will hit $700 billion by 2029—more than Amazon, Microsoft, Google, and Alibaba's cloud divisions combined. Why the massive cash burn? OpenAI needs serious computing muscle to keep scaling its AI models, and that's gonna send shockwaves through semiconductors, cloud infrastructure, and enterprise AI markets. We're talking infrastructure buildout at a pace nobody's seen before.

⬤ Here's where it gets wild: Citi's number-crunchers say OpenAI's infrastructure could gobble up 26 gigawatts of power by 2030, with total capex potentially reaching $1.3 trillion. That's nation-state level spending. But there's a catch—this breakneck expansion's piling up debt faster than revenue can keep pace. Citi's analysts aren't mincing words: managing this debt load while simultaneously scaling operations could become OpenAI's biggest headache. The math's getting dicey.

⬤ Companies heavily tied to OpenAI—think Advanced Micro Devices (AMD)—should buckle up for a bumpy ride. As OpenAI weaves its AI models deeper into the tech ecosystem, stocks with major OpenAI exposure are gonna swing harder with every quarterly report and infrastructure update. Smart investors might wanna rebalance their portfolios, dialing back on OpenAI-heavy plays to dodge the volatility that's coming with these astronomical capex numbers and that growing debt mountain.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi