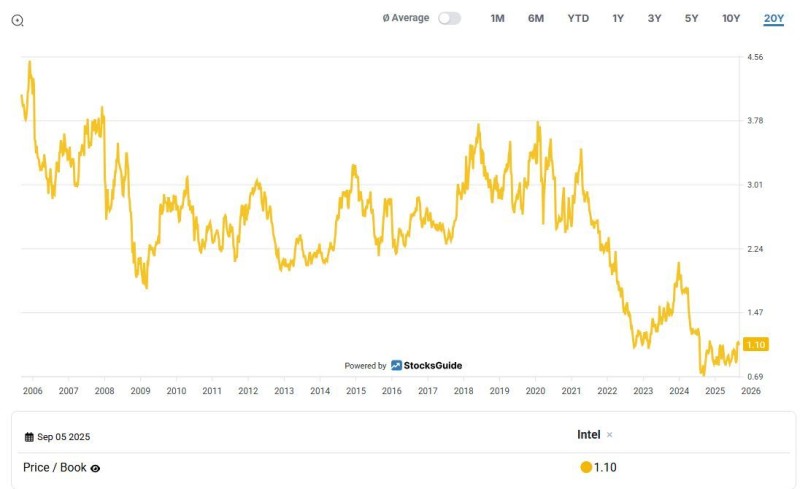

Intel (INTC) has reached a rare valuation milestone, trading at just 1.10x book value — a dramatic drop from its historical average above 3x. This sharp decline raises a critical question for long-term investors: is the chipmaker presenting a deep value opportunity, or is the market correctly pricing in structural decline?

Historic Valuation Collapse Signals Trouble

Intel's price-to-book ratio has plummeted to levels not seen in nearly two decades. The multiple peaked above 4.0 in the mid-2000s, maintained steady levels between 2.0–3.5x from 2015 to 2020, and has since collapsed to 1.1x in 2025.

This dramatic compression, as highlighted by market analyst, reflects years of execution failures, including product delays, eroding margins, and intensifying competition from AMD, NVIDIA, and TSMC.

The company that once dominated semiconductor manufacturing now struggles to maintain relevance in key growth areas like AI and advanced processing.

Two Decades of Multiple Compression

The long-term chart reveals Intel's valuation journey through multiple market cycles. During 2006–2010, the price-to-book ratio fell sharply amid the financial crisis, testing 1.5x levels. The 2015–2020 period showed stability as Intel benefited from PC and server demand growth. However, 2021–2024 marked a sharp downtrend as missed execution targets and capital-intensive expansion plans eroded investor confidence, culminating in today's historic 1.10x discount.

Market Concerns Behind the Discount

Several factors explain Intel's depressed valuation. Manufacturing delays have caused the company to lag behind in advanced process nodes, effectively ceding technology leadership to TSMC. Heavy fab investments combined with pricing pressure have compressed margins significantly. Meanwhile, competitors have systematically captured market share across PCs, AI accelerators, and data center processors. This has triggered a fundamental sentiment shift, with investors questioning whether Intel can truly recover its competitive position.

The Investment Decision: Recovery Play or Value Trap?

The investment thesis presents two competing narratives. Bulls argue that if Intel successfully executes its AI chip strategy and foundry services expansion, the current discount represents an exceptional entry point. Even a modest recovery to 2x book value would deliver substantial returns. However, bears contend that persistent structural challenges make the low valuation justified rather than attractive. If competitive pressures continue, further declines may lie ahead.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah