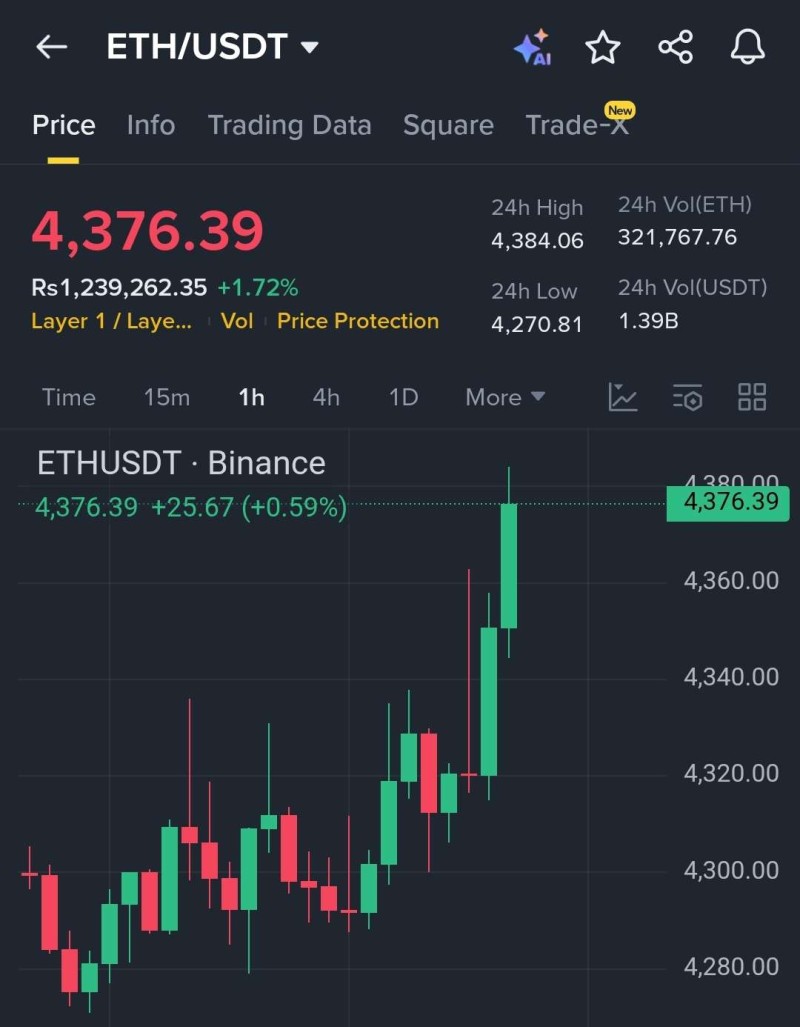

Ethereum (ETH) continues to capture trader attention as bulls drive the price toward daily highs. After successfully defending the $4,270 support level, ETH has rallied back to the $4,376 zone, demonstrating renewed market strength and investor confidence in the leading altcoin.

ETH Bulls Take Control Near Key Resistance

Famous Analyst suggests Ethereum's current setup indicates higher targets could be within reach if bulls can clear the immediate resistance. On Binance's ETH/USDT chart, consecutive green candles indicate aggressive buying pressure as the price tests the critical $4,385 resistance level.

This zone could determine whether bulls maintain their grip on the market or face temporary setbacks.

The current price action shows ETH forming higher lows while consolidating near resistance - a pattern that often signals an impending breakout. With the 24-hour trading range spanning from $4,270 to $4,384, Ethereum has shown impressive recovery from its recent lows.

Technical Analysis and Trade Setup

Key Levels:

- Support zone: $4,300 – $4,320

- Immediate resistance: $4,385

- Major resistance: $4,450

- 24h range: $4,270 – $4,384

Trade Setup:

- Entry Zone: $4,320 – $4,350

- Stop Loss: $4,270

- Take Profit targets: $4,420, $4,480, and $4,550 This configuration provides traders with a favorable risk-reward ratio while maintaining protection against potential pullbacks.

Ethereum Price Forecast and Next Resistance Targets

Ethereum's strength aligns with broader cryptocurrency market momentum, benefiting from correlated bullish sentiment as Bitcoin also posts gains. The ongoing demand for ETH staking and increased network activity further reinforce the bullish case. If Ethereum successfully breaks above $4,385, traders could witness acceleration toward $4,500 and potentially $4,550. However, failure to maintain levels above $4,300 might trigger a retest of the $4,270 support zone, requiring careful monitoring of price action in the coming sessions.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah