While most blockchains struggle to maintain relevance in the fast-moving NFT space, TON has quietly built something different. It's not just surviving - it's thriving, consistently pulling in millions of dollars in daily trading volume while former giants like Solana fade into the background. This isn't another flash-in-the-pan crypto story. TON's rise to second place in NFT trading represents a fundamental shift in how people interact with digital collectibles, and the numbers prove it's here to stay.

The New NFT Hierarchy

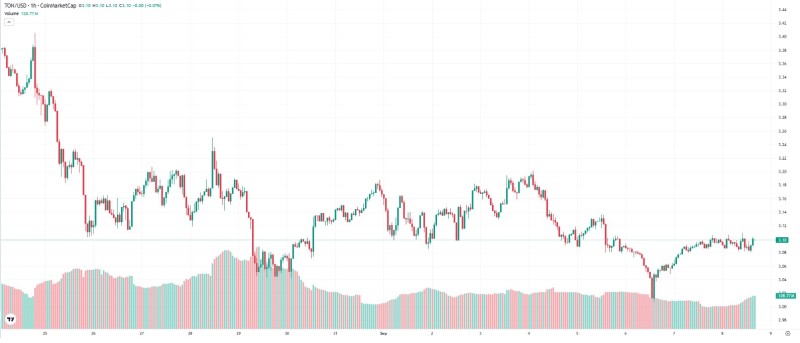

The NFT world has been through some wild changes lately, but one thing has stayed remarkably consistent - TON's grip on second place. According to @s0meone_u_know, TON has locked down the #2 spot in daily NFT trading volumes for months now, and it's not showing signs of slipping. While Ethereum still towers above everyone else, TON's steady performance shows something important is happening beneath the surface.

Trading Volume Breakdown

Here's how the daily NFT volumes looked on September 3rd, 2025:

- Ethereum: $8.8 million

- TON: $1.9 million

- Base: $1.3 million

- Solana: $477,000

- ApeChain: $34,800

Ethereum's dominance is undeniable, but TON's nearly $2 million daily volume puts serious distance between itself and the rest of the pack. It's been holding this position for several months straight, which in crypto time feels like an eternity.

Why TON Actually Works

The Telegram connection is everything here. TON isn't trying to compete with Ethereum on its own terms - it's playing a completely different game by tapping into Telegram's massive global reach. This gives NFT projects instant access to millions of users who might never have considered buying digital collectibles before. The whole experience is designed for normal people, not crypto veterans, with wallets that actually make sense and onboarding that doesn't require a computer science degree.

Beyond the user experience, TON has been smart about building its ecosystem. Gaming projects are choosing it specifically because it offers real utility without the friction that kills most NFT experiments. New collections keep launching because creators can actually reach their audience, and the consistent liquidity means people can buy and sell without worrying about getting stuck holding illiquid assets.

The Competition Isn't Close

Base looked like it had everything going for it with Coinbase's resources and reputation, but it's stuck at $1.3 million while TON pulls nearly $2 million daily. That's a significant gap that keeps growing. Solana's fall is even more dramatic - this was supposed to be Ethereum's main challenger in NFTs, but now it's doing less than $500k per day. ApeChain barely registers as a footnote with its $34.8k volume. These numbers show that building sustainable NFT trading volume is incredibly difficult, making TON's consistency even more impressive.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah