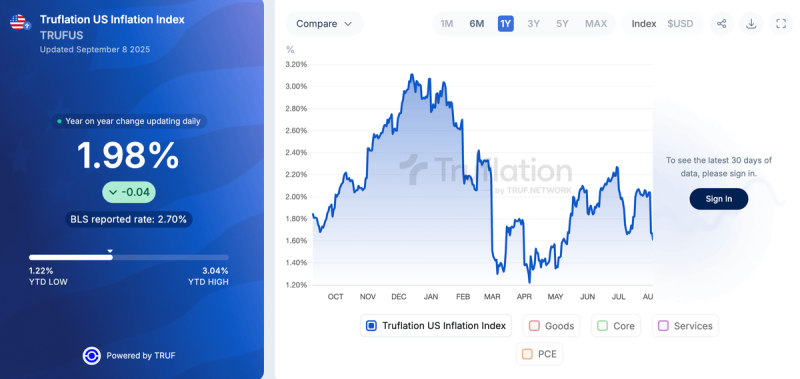

US inflation just broke through a critical threshold that could reshape everything. The Truflation index hit 1.98% on September 8th - the first sub-2% reading this year and a stark contrast to the official 2.70% rate from government data. This isn't just another data point.

What the Charts Tell Us

Traders like @DefiWimar are already calling it: if this trend holds, the Fed might have no choice but to fire up the money printer again.The year has been a rollercoaster. January saw inflation spike past 3%, but it's been falling ever since. We've seen everything from 1.22% lows to 3.04% highs - that's serious volatility. The key level everyone's watching? 3.12%, which would signal an inflationary "bullish takeover." Right now, we're nowhere near that.

Why Everything's Cooling Down

Three big factors are driving this decline. Energy costs have pulled back from their highs, giving consumers some breathing room. The Fed's rate hikes are finally working - people are spending less on houses and big purchases. And wage pressures that scared policymakers in 2024 are starting to ease up.

What This Means for Your Money

If inflation stays this low, the Fed's whole playbook changes. Rate cuts could come faster than anyone expected. That's potentially huge for stocks, crypto, and gold. The market's already sniffing around for signs the central bank will blink first. The question isn't whether policy will shift - it's how soon.

Usman Salis

Usman Salis

Usman Salis

Usman Salis