Solana (SOL) just posted a massive 30% monthly gain, sitting pretty at $242 right now. But here's the thing - while everyone's talking about that juicy $284 target, some warning signs are flashing that might put the brakes on this rally.

SOL's Hot Streak: Why This Rally Might Cool Down

Let's be real - Solana's been absolutely crushing it lately. That 30% jump in just one month has got everyone excited about the next leg up to $284. But charts don't lie, and they're showing some concerning signals that suggest we might see a pullback before SOL makes its next big move.

The biggest red flag? Solana's MVRV Z-Score just hit 1.34 on September 12 - the highest we've seen in six months. For those who don't know, this metric basically tells us when an asset might be getting a bit too hot. And historically, whenever this score peaks like this, we've seen some nasty corrections follow. Just look at July and August - similar spikes led to double-digit drops.

But here's where things get interesting. Unlike those previous corrections, something different is happening this time around.

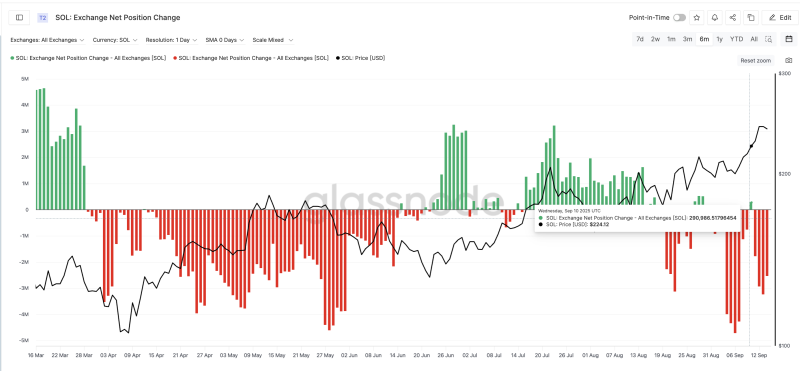

SOL Holders Aren't Panicking - They're Accumulating

Since September 10, exchange balances have been bleeding red, which means people are actually pulling their SOL off exchanges rather than dumping it. That's huge. During those earlier corrections, we saw the opposite - tons of tokens flooding exchanges right before the price tanked.

This time, the smart money seems to be accumulating, not running for the exits. That could mean any dip might not be as brutal as what we've seen before.

Technical Charts: Short-Term Pain, Long-Term Gain for SOL?

Looking at the 4-hour charts, there's clear bearish divergence happening. Price keeps making higher highs, but the RSI is actually making lower highs - classic sign that momentum is fading. Usually on shorter timeframes like this, it just means we're due for a breather, not a full-blown crash.

The levels everyone's watching? $239 and $237 are the key support zones. If SOL slips below $237, then we might see it test $230 or even $224. But here's the kicker - none of this changes the bigger picture.

SOL already broke out of its ascending channel, and that breakout target is still sitting pretty at $284. That's a solid 17% gain from where we are now. As long as SOL doesn't crash below $199, that target is still very much in play.

Peter Smith

Peter Smith

Peter Smith

Peter Smith