XRP (Ripple) finds itself at a critical technical crossroads after recent selling pressure pushed the cryptocurrency down to current levels around $2.97. While the downward trend has been persistent, key technical indicators are now suggesting that the selling momentum may be reaching exhaustion, potentially setting up conditions for a reversal in the near term.

XRP Approaches Key Technical Inflection Point

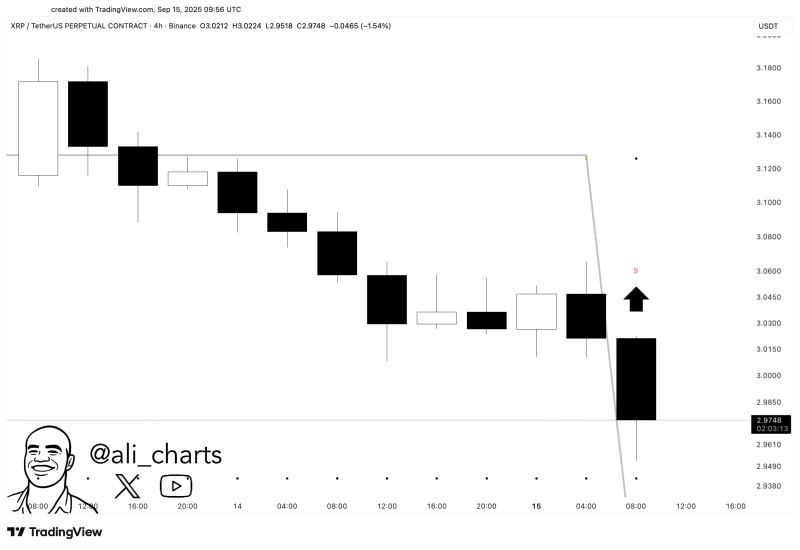

XRP's recent price action has been characterized by sustained downward pressure, but emerging technical signals suggest this trend may be running out of steam. The TD Sequential indicator has generated a buy signal on the 4-hour timeframe, indicating potential trend exhaustion. Famous trader Ali notes this development as XRP currently trades at $2.97, representing a 1.54% decline in the most recent trading session.

The cryptocurrency has established what appears to be preliminary support in the $2.95-$2.97 zone, a level that bulls will need to defend to maintain any reversal prospects. This price area coincides with the technical buy signal, creating a confluence that often attracts institutional and retail buying interest.

Technical Picture Shows Mixed Signals

The current chart setup presents several competing narratives. XRP has experienced an extended sequence of bearish candles, confirming the strength of recent selling pressure and establishing a clear downward trajectory. However, this same extended decline has triggered the TD Sequential "9" count, a technical formation that historically signals potential trend exhaustion and increased probability of a counter-trend bounce.

- Key support levels: $2.95-$2.97 range serving as immediate floor

- Primary resistance: $3.05 represents first upside target

- Secondary resistance: $3.12 marks next significant level

- Downside risk: Break below $2.95 could target $2.90

The alignment of trend exhaustion signals with established support creates an interesting risk-reward scenario for traders considering entry positions.

Market Dynamics Support Reversal Case

Several factors contribute to the potential for XRP to find its footing at current levels. Technical exhaustion following extended declines often creates conditions ripe for counter-trend moves, particularly when accompanied by clear reversal signals like the TD Sequential formation. The broader cryptocurrency market has shown signs of stabilization after recent weakness, providing a more supportive backdrop for individual tokens to recover lost ground.

Additionally, the psychological significance of the $3.00 level cannot be overlooked, as round numbers frequently serve as magnets for both institutional flows and retail sentiment shifts.

Critical Levels to Monitor

The immediate trading range between $2.95 and $3.05 will likely determine XRP's near-term direction. A decisive close above $3.05 would provide bullish confirmation and potentially attract momentum buyers looking to capitalize on the technical reversal signal. Conversely, a breakdown below $2.95 would invalidate the current buy setup and could accelerate losses toward the $2.90 level.

Usman Salis

Usman Salis

Usman Salis

Usman Salis