Nvidia Corporation faces fresh challenges as Chinese regulators launch an antitrust investigation into the semiconductor giant's business practices. The probe comes at a critical time for the company, which has been riding high on AI demand but now confronts increasing geopolitical pressures that could impact its global operations and market access.

Chinese Regulators Target Nvidia's Business Practices

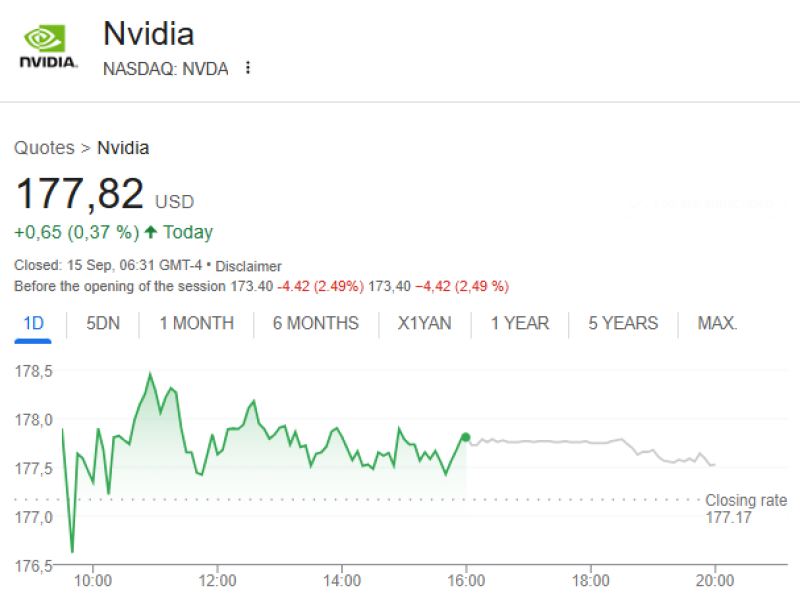

Nvidia (NASDAQ: $NVDA) dropped to $173.07 in pre-market trading, falling 2.67% or $4.75, after news broke of China's State Administration for Market Regulation (SAMR) launching an antitrust probe. According to reports from Amit, Chinese regulators have identified preliminary violations of anticompetition law and initiated deeper investigations into the company's operations.

While no penalties have been announced, the timing is significant as US and Chinese officials restart trade negotiations. For Nvidia, China represents both a crucial customer base for GPU sales and an essential part of its supply chain infrastructure. Increased regulatory scrutiny could limit the company's flexibility in forming partnerships with Chinese firms and complicate its expansion plans in the region.

Technical Analysis Shows Market Concerns

The stock chart reveals immediate market anxiety about the regulatory news. After weeks of strong performance driven by AI sector enthusiasm, Nvidia faces a sharp pre-market decline. The current price near $173 approaches key support levels around $170-172. A break below this zone could push the stock toward the next psychological support near $165. To restore positive momentum, Nvidia needs to reclaim resistance at $180, with the current gap down demonstrating how quickly investor sentiment can shift when regulatory headlines intersect with geopolitical tensions.

Key Vulnerability Factors

- AI Market Dominance: Nvidia's leading position in AI chips has made it a focal point for geopolitical tensions

- Export Restrictions: Existing US limitations on advanced chip exports to China have already impacted sales projections

- Competitive Pressure: Chinese companies developing domestic AI accelerators may receive regulatory support to challenge Nvidia's market position

Investment Outlook

Despite maintaining its leadership in AI semiconductors, Nvidia faces heightened volatility from regulatory and trade risks. Investors should monitor developments from both SAMR and ongoing US-China trade discussions to gauge the potential impact on the company's operations and market access. The situation highlights how quickly external factors can influence even the strongest performers in today's interconnected global technology landscape.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah