The crypto world just witnessed a milestone that could reshape everything we know about digital money. Ethereum's stablecoin ecosystem has exploded past $168 billion, marking not just a new all-time high, but a fundamental shift in how the world stores and moves value in the digital age.

The Stablecoin Takeover Is Real

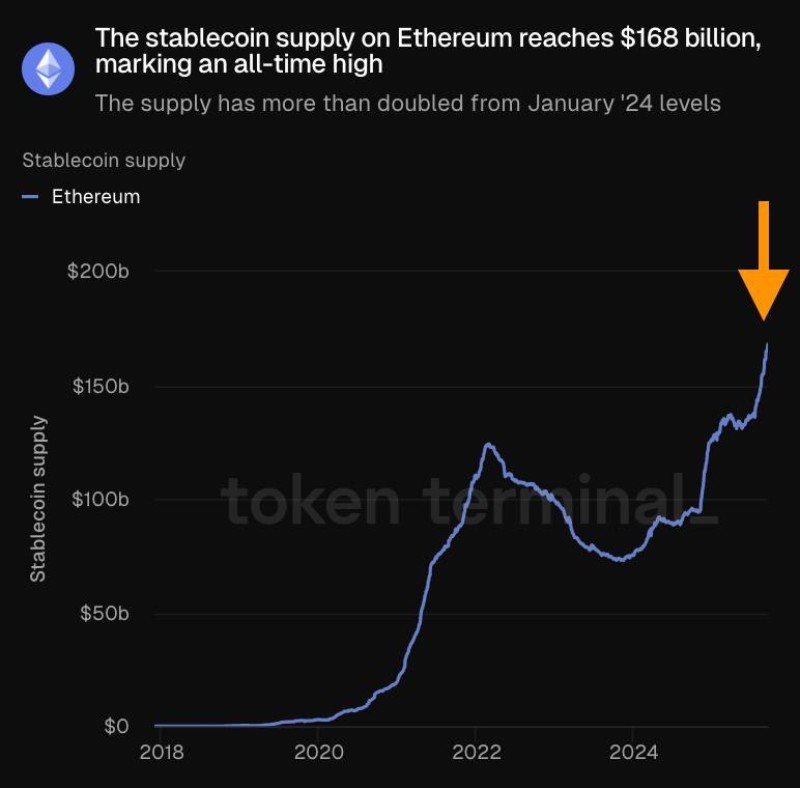

Ethereum's stablecoin ecosystem just crossed into uncharted territory. The network now hosts $168 billion in dollar-pegged assets, according to data from Litest, representing more than a 100% surge since January 2024. This isn't just growth - it's a complete transformation of how the crypto world handles value storage and transfers.

The numbers tell a compelling story. After spending years stuck between $120-140 billion, Ethereum's stablecoin supply broke free in early 2024 and hasn't looked back. The chart shows a classic parabolic curve that would make any trader take notice, with the steepest acceleration happening in recent months.

Why This Explosion Matters

Stablecoins aren't just digital dollars - they're the lifeblood of crypto trading, DeFi protocols, and cross-border payments. When supply jumps this dramatically, it signals serious capital flowing into the ecosystem. People are parking more money in crypto-native dollars, which means they're either trading more actively, hedging their positions, or moving value across borders without traditional banking rails.

The timing couldn't be more interesting either. While traditional markets grapple with inflation concerns and policy uncertainty, crypto users are doubling down on stablecoins as their preferred store of value within the digital economy. Ethereum has essentially become the Federal Reserve of decentralized finance, and these numbers prove it.

This surge reinforces Ethereum's stranglehold on the stablecoin market and positions it as the undisputed infrastructure layer for digital dollars. With liquidity at record highs, we're likely seeing the foundation being laid for the next major bull run in DeFi and possibly ETH itself. The question isn't whether this trend continues - it's how high these numbers can climb before the end of 2025.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah