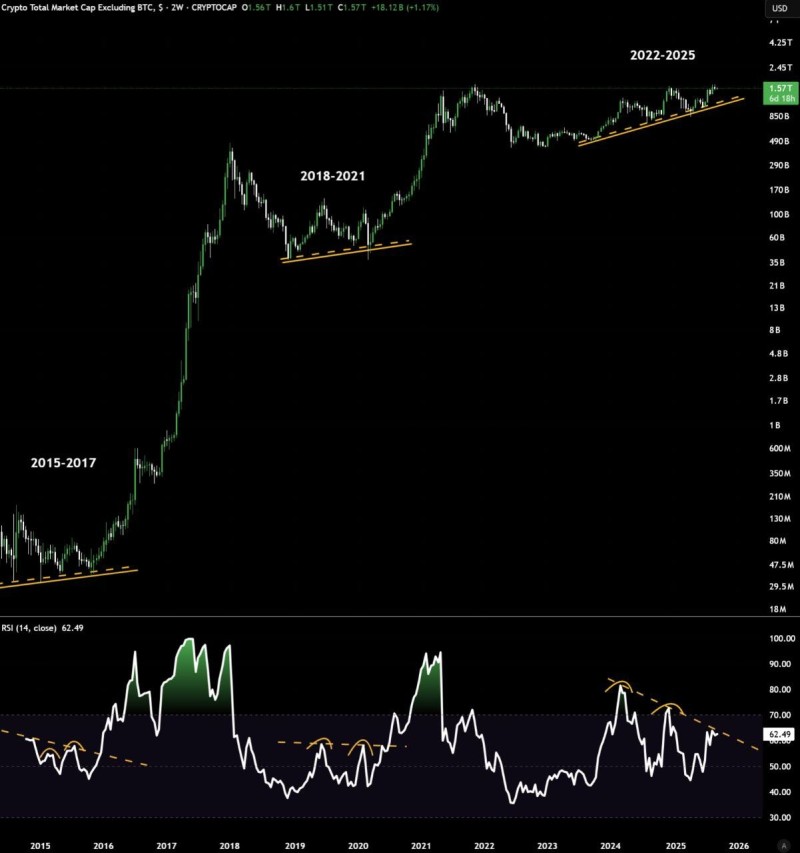

The altcoin market appears to be following a well-established playbook. Over the past two years, the total cryptocurrency market capitalization excluding Bitcoin has been building a solid foundation above $1.5 trillion. This formation bears a striking resemblance to the patterns we witnessed before the explosive rallies of 2017 and 2021.

Current Market Structure

Market analyst @ItoShimotsuma points to this recurring pattern as evidence that altcoins could be positioning for another significant expansion phase, provided current support levels hold and key resistance barriers are broken.

The 2-week timeframe reveals three distinct cyclical phases:

- 2015–2017: A gradual base formation that preceded the first major altcoin surge

- 2018–2021: Another rising support pattern that led to multi-trillion dollar valuations

- 2022–2025: The present base sitting above $1.5T with a series of higher lows

Price Targets and Levels

Support zones remain crucial. The rising trendline around $1.5T represents the most important level to maintain. Should this fail, secondary support sits between $1.3T and $1.35T.

Resistance levels tell the breakout story. Initial resistance at $1.7T serves as the first hurdle. A successful break could propel the market toward $2.1T, with the ultimate target being the previous cycle high near $2.4T.

Momentum indicators are approaching key levels. The RSI currently sits at 62, testing a descending resistance line. Historical data shows that RSI breakouts from similar setups have coincided with major market expansions.

Market Fundamentals

Several factors are aligning to support altcoin strength. The macro environment shows improving conditions with softer inflation readings and anticipated rate cuts boosting risk appetite. Within crypto, ecosystem development continues with Layer-2 scaling solutions, attractive staking yields, and growing DeFi activity drawing fresh capital.

Liquidity conditions are also improving as stablecoin supply expands and ETF optimism creates deeper markets beyond Bitcoin.

Potential Outcomes

The bullish scenario unfolds if current support holds. A break above $1.7T accompanied by RSI momentum could open the path to $2.1T and potentially the $2.4T cycle high, following the pattern of previous rallies.

The bearish alternative involves a support breakdown. A decisive fall below the rising trendline could pull altcoin market cap back to $1.3T, postponing any broader advance and warranting increased caution.

Usman Salis

Usman Salis

Usman Salis

Usman Salis