The S&P 500 index has demonstrated unprecedented volatility recently, with price swings that exceed even Bitcoin's movements, raising concerns among investors about market stability.

S&P 500 Records Six Consecutive Days of 6%+ Swings

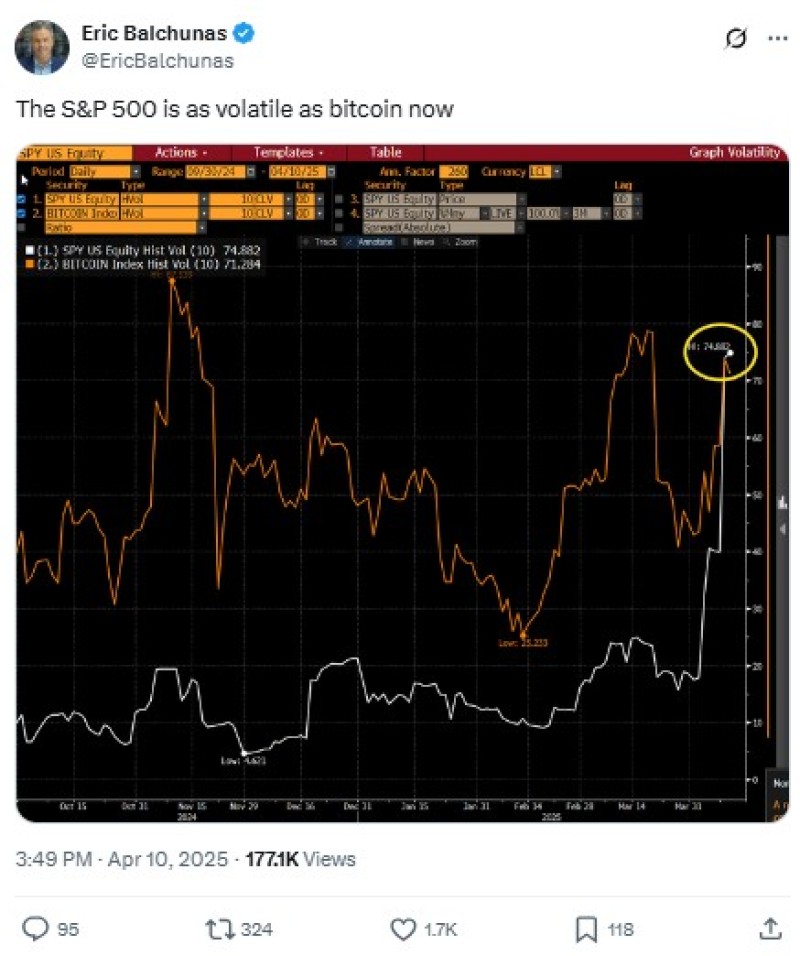

The S&P 500, traditionally regarded as a benchmark of stability in the U.S. stock market, has been showing behavior more often linked to highly speculative assets. According to Bloomberg's Eric Balchunas, the index is now displaying greater volatility than Bitcoin, which has long faced criticism for its price unpredictability.

This unusual market behavior has manifested in six consecutive trading days with swings exceeding 6%, creating an environment of extreme uncertainty for investors accustomed to the relative stability of large-cap equities. Earlier today, the index plummeted to an intraday low of 5,115, representing a 6.14% drop before recovering somewhat. Despite the partial recovery, the index still closed down approximately 3.5% for the day.

S&P 500 Down 14% From February Peak Despite Wednesday's Rally

The recent market turbulence has taken a significant toll on the S&P 500's performance, with the index now down in five out of the last six trading sessions. Despite experiencing a substantial rally on Wednesday that provided temporary relief to investors, the index remains approximately 14% below its February peak.

This persistent downward pressure suggests deeper structural concerns within the market that weren't fully addressed by the single-day recovery. The rapid succession of volatile trading days has created an environment where long-term investment strategies are increasingly difficult to maintain, forcing many investors to reconsider their positions and risk tolerance levels.

S&P 500 Sells Off Despite Encouraging Inflation Data

Thursday's market action proved particularly concerning as the S&P 500 continued its downward trajectory despite the release of encouraging inflation data earlier in the day. Under normal circumstances, positive inflation numbers would typically support market stability or even prompt a rally. However, the continued selling pressure indicates that other factors are weighing more heavily on investor sentiment.

Chief among these concerns is the escalating tariff dispute between the United States and China. As tensions between the world's two largest economies continue to mount, investors remain wary of potential economic consequences that could impact corporate earnings and overall economic growth. This geopolitical uncertainty has overshadowed what would otherwise be considered positive economic indicators.

Treasury Secretary Scott Bessent has attempted to calm market fears by downplaying the severity of the recent market volatility. In public statements, Bessent claimed that he did not see "anything unusual" in the market's behavior, suggesting that the administration views the current situation as a normal market correction rather than a signal of more serious economic problems.

However, the contrast between Bessent's reassurances and the historical nature of the market's movements has done little to alleviate investor concerns. With the S&P 500 demonstrating volatility patterns more commonly associated with speculative cryptocurrencies and meme stocks, many market participants are questioning whether traditional risk assessment models remain valid in the current environment.

The continued volatility in the S&P 500 serves as a reminder that even well-established markets can experience periods of extreme unpredictability, challenging conventional wisdom about the relationship between risk and return across different asset classes. As investors navigate this unusual landscape, the distinction between traditionally "safe" investments and speculative assets appears increasingly blurred.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah