The electric vehicle (EV) market has been a beacon for investors eyeing the next big thing, with stalwarts like Tesla and BYD Co. leading the charge.

However, Nio, the Chinese EV manufacturer, has stumbled, with its stock price plummeting from highs of over $62 per share to less than $5. As the downward spiral continues, investors are left wondering if this is the end of the road or an opportunity in disguise.

Mizuho Downgrades NIO

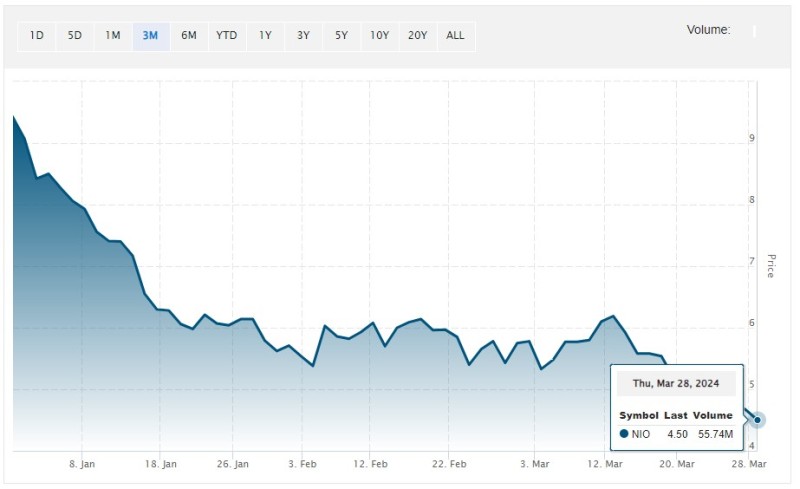

Wall Street analysts, including Vijay Rakesh from Mizuho Securities, have downgraded NIO, setting a price target of $5.50 for the next year. This pessimistic outlook has weighed heavily on NIO stock, which has seen a downward trend over the past week, dipping below $4.80 per share. The downgrade underscores concerns over Nio's near-term prospects amidst EV demand challenges and liquidity issues.

Nio's recent earnings report revealed revenue below expectations, further compounded by liquidity concerns despite a reduced net loss and modest sales growth. The announcement of the new ET9 model has heightened capital expenditure requirements, exacerbating Nio's cash bleed. While its valuation remains competitive, the company faces stiff competition from Tesla and other Chinese EV manufacturers, dampening investor sentiment.

Challenges and Competition

Rising competition in the EV market, particularly from lower-cost alternatives offered by Chinese competitors like BYD, has eroded Nio's margins. Additionally, concerns surrounding Chinese EV demand have disproportionately affected Nio compared to its peers.

With price wars and increasing competition, Nio's near-term outlook remains bleak, with investors wary of its ability to achieve significant earnings growth.

Value-Based Approach or Sell?

Despite its growth potential, Nio's profitability remains elusive, with substantial losses reported in recent quarters. While some investors may see value at current price levels, the prevailing sentiment suggests a cautious approach.

Until Nio addresses its liquidity issues and demonstrates sustainable earnings growth, the stock is likely to remain under pressure.

Conclusion

As NIO grapples with challenges in the EV sector and intensifying competition, investors are faced with a critical decision. While the stock may present value opportunities for some, the prevailing bearish sentiment suggests caution.

With uncertainties looming over Nio's future, investors must weigh the risks against potential rewards in this volatile market landscape.

Peter Smith

Peter Smith

Peter Smith

Peter Smith