Morgan Stanley maintains its Overweight rating on NIO (NYSE), citing positive cash flow impacts from an Rmb3.3 billion investment into NIO China.

NIO Stock Sees Positive Outlook from Morgan Stanley

On Monday, Morgan Stanley reiterated its Overweight rating on NIO Inc. (NYSE), keeping a price target of $6.10. The investment firm’s analyst emphasized the positive financial impact stemming from NIO China’s recent significant funding. The boost, according to Morgan Stanley, is likely to strengthen NIO’s cash flow, contributing positively to its stock price.

NIO China, a key subsidiary of NIO Inc., recently received an investment of Rmb3.3 billion from various investors, including Hefei Jianheng New Energy Automobile Investment Fund Partnership, Anhui Provincial Emerging Industry Investment Co., Ltd., and CS Capital Co., Ltd.. In addition, NIO Inc. has committed to contributing Rmb10 billion to its Chinese subsidiary. This capital infusion will be made in stages, with 70% of the investment expected by November 2024 and the remainder by December 2024.

Once the deal is completed, NIO Inc.’s stake in NIO China will shift slightly to 88.3%, down from its previous 92.1% ownership. Furthermore, there remains an opportunity for NIO Inc. to increase its stake to 90.5% by investing an additional Rmb20 billion by December 2025.

The Strategic Role of NIO China in NIO’s Growth

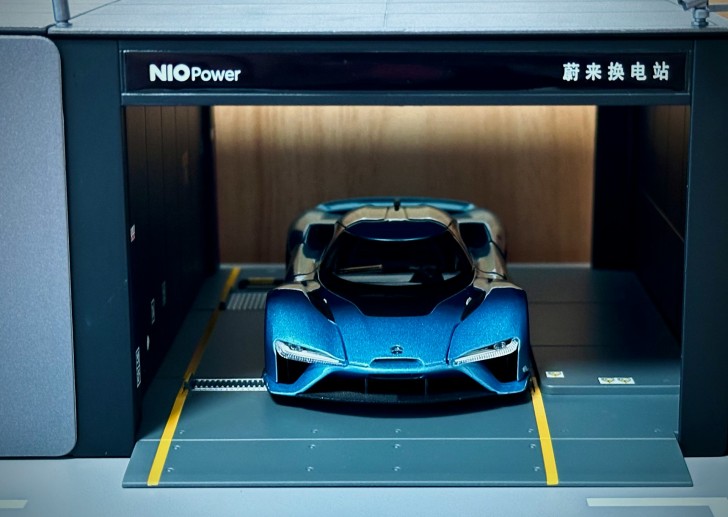

Since its inception in 2020, NIO China has played a vital role in NIO Inc.’s growth strategy, overseeing essential operations such as vehicle research and development, supply chain management, sales, and services, and managing NIO Power. The latest investment in this subsidiary is seen as a strategic move that will likely enhance NIO China’s competitive position and contribute positively to NIO Inc.'s overall financial health.

NIO’s financial outlook has been reinforced by several positive signals in the market. JPMorgan reiterated its Overweight rating, citing robust sales momentum and product positioning, especially after the launch of NIO’s first SUV under its mass-market brand ONVO. During Q2 2024, NIO’s revenue reached RMB 17.4 billion, marking a 98.9% year-over-year increase.

Moreover, Citi reaffirmed its Buy rating for NIO shares, especially after the launch of the ONVO L60 model, predicting sales of 8,000 units per month. This, combined with competitive pricing strategies, cash discounts, and government subsidies, is expected to drive further order conversions and increase NIO’s sales forecasts.

NIO’s Market Performance and Financial Strength

Recent financial data reflects NIO's impressive market performance. As of Q2 2024, NIO achieved 30.94% revenue growth over the last twelve months and a 98.89% quarterly growth. These numbers align with the company’s strategic investments and growth in the electric vehicle market.

NIO’s market capitalization currently stands at $13.71 billion, and recent market movements saw its stock price jump by 22.56% in the past week, likely driven by the investment news. The company also benefits from strong cash reserves, holding more cash than debt, which provides flexibility for future expansion plans.

Conclusion

As NIO Inc. continues to secure significant investments and expand its market presence, financial analysts remain bullish on the company’s prospects. With Morgan Stanley, JPMorgan, and Citi backing the stock, NIO is well-positioned to capitalize on the growing electric vehicle market, driven by strategic investments in its key subsidiary, NIO China.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah