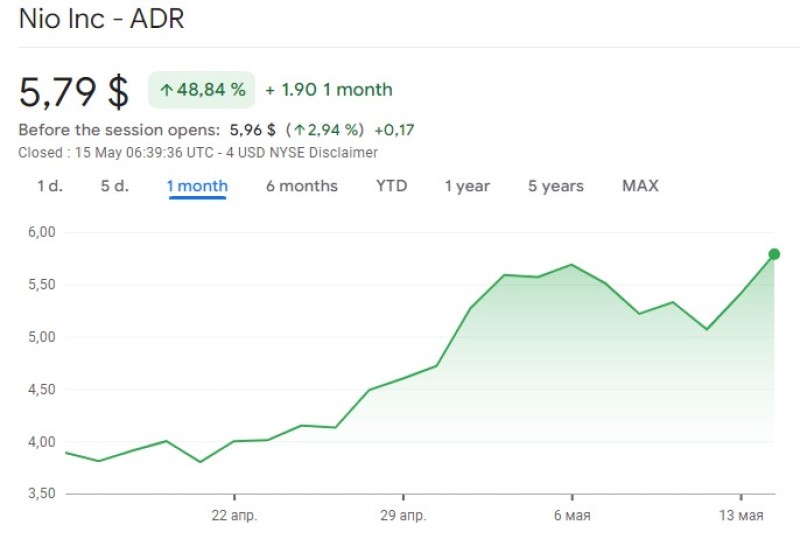

NIO Inc. (NYSE: NIO) has seen a 32% share price boost in the last thirty days, but investor confidence remains shaky amid concerns about future growth prospects.

NIO Inc.'s Recovery Journey

NYSE: NIO shareholders witness a 32% surge in share price over the last month, signaling a potential turnaround. However, questions loom regarding the sustainability of this momentum, especially considering the substantial losses suffered over the past year.

Despite the recent rally, NIO's price-to-sales (P/S) ratio stands at 1.5x, raising eyebrows among investors. While this figure might appear favorable compared to industry standards, deeper scrutiny is warranted to understand its implications fully.

Impact of Revenue Growth

NIO's revenue growth trajectory remains a point of contention. With growth rates trailing behind industry peers, concerns persist about the company's ability to maintain momentum. However, recent years have seen commendable revenue surges, hinting at underlying potential.

Analysts predict a promising outlook for NIO, forecasting a 26% annual revenue growth over the next three years. Despite outpacing industry projections, skepticism lingers, reflected in the company's subdued P/S ratio.

Interpreting NIO's P/S Ratio

The discrepancy between NIO's P/S ratio and its growth forecasts raises questions about market sentiment. While optimistic about future prospects, investors remain cautious, signaling underlying uncertainties.

Amidst the optimism, investors are urged to remain vigilant of potential risks. Identifying warning signs and understanding the market's sentiment are crucial steps in making informed investment decisions amidst NIO's evolving narrative.

In conclusion, NIO experienced a notable share price surge, yet investor confidence remains tempered. As the company navigates through challenges and opportunities, a nuanced understanding of its growth trajectory is essential for investors navigating the volatile market landscape.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah