- Enterprise Product Partners (Ticker: EPD)

- Cheniere Energy (Ticker: LNG)

- Chevron (Ticker: CVX)

- Kinder Morgan (Ticker: KMI)

- Williams Cos (Ticker: WMB)

- Phillips 66 (Ticker: PSX)

- NuStar Energy (Ticker: NS)

- Magellan Midstream Partners (Ticker: MMP)

- Exxon Mobile Corp (Ticker: XOM)

- EOG Resources (Ticker: EOG)

- Conclusion

The energy sector suffers from the global crisis. Energy stocks have seen a great plunge as the crude oil price are going down. The price of the 'black gold' is likely to remain at the current level for the rest of 2020. However, there are some interesting offers that you can watch for. We are talking about companies with manageable debts and cash flow.

While crude oil prices have rebounded from their historical lows, investors can purchase energy stocks at a great discount. Let’s take a look at the industry today and highlight some interesting options to add to your portfolio. Here is the list of the best energy stocks that you can consider.

Enterprise Product Partners (Ticker: EPD)

This company is an energy infrastructure operator. It has a great management team and a long history of success. The cash payments to the investors, aka dividends, have significantly increased in the last fifteen years. The company is the owner of one of the greatest energy infrastructure assets in the United States. The debt to EBIDTA is lower in contrast to its competitors. The company has got some benefits from the growing export of propane and ethane. The company had a revenue uptrend until 2019 when it showed a revenue slope.

Financial Information

Yahoo Finance fair price indicator says that the stock is undervalued. This is true as the whole industry currently is not in the best shape. However, Enterprise Product Partners looks good when compared to its peers. This means that adding this stock to your portfolio may bring you some rewards in the future. Even so, you should always bear in mind that investing in the energy sector right now is riskier than ever. Anyway, we add this the company into the Top energy stock list.

Market capitalization: 37.707B

PE Ratio: 8.12

EPS: 2.12

Current ratio: 1.12

Cheniere Energy (Ticker: LNG)

The company is one of the biggest players in the market of US-produced natural gas liquefiers. It can be undoubtedly included in the list of the best oil and gas stocks. Cheniere Energy production can be further loaded to a ship and transported to any country. The greatest advantage of natural gas is that it can replace carbon and thus decrease carbon emissions. The demand for liquefied natural gas will grow as countries across the world will pay more attention to environmental problems. According to the experts, the current financial crisis will not hold back the global energy revolution. This revolution includes a rising demand for natural gas to minimize carbon emissions. Such countries as China and India have a particular need in this replacement of carbon as they already have some significant environmental problems these days.

Financial Information

Cheniere Energy stock is considered to be undervalued by Yahoo Finance fair price indicator, which is not surprising, considering the whole industry suffering from the ongoing crisis. However, companies,such as LNG, have great future prospects and their services will be in demand. The price of the stock is slightly above halfway to its ATH, at $70.00 per share.

Market capitalization: 12.25B

PE Ratio: 14.06

EPS: 3.46

Current ratio: 1.08

Chevron (Ticker: CVX)

This company is one of the world-leading oil producers. This is one of the best oil and gas stocks to consider. They have managed to hold onto their sizable dividend yield of 5.4% during the hard times for the entire energy sector. Despite increasing their production in the first quarter, they have announced another round of expenditures cut. Chevron has enough cash to weather the crisis. According to analysts, the company represents a good asset for any portfolio that includes stocks from an energy sector. The balance sheet strength is a distinctive advantage of CVX. Their annual revenue has reached $160 billion by 2018, but the company failed to surpass this level in 2019.

Financial Information

Chevron has an overbought label, according to Yahoo Finance fair price indicator. However, we think that this big-name company has greater potential in the nearest future. The price of the stock is halfway to its highs. Chevron looks attractive for the investors not only because this company has a long history, but also because they managed to hold onto their dividend yield during crisis.

Market capitalization: 159.123B

PE Ratio: 41.47

EPS: 2.06

Current ratio: 1.01

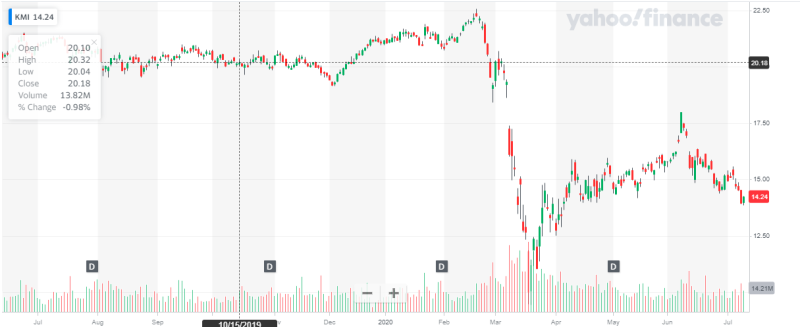

Kinder Morgan (Ticker: KMI)

Kinder Morgan is a pipeline operator that has managed to increase its dividend yield by 5% within the first trimester of 2020 despite a net loss of $306 million. This is one of the best energy stocks you can consider. It is worth mentioning that the company had a net income of $506 million in the first quarter of 2019. According to the officials, the cash flow the company has accumulated in 2019 allows it to fund dividend payments in 2020. By doing this, they want to hold current investors and attract new ones. A dividend yield of 6.8% makes the stock very attractive when compared to the other key players of the sector. As for the revenues, the company reached its top level in 2018 by hitting $14 billion mark. However, its revenue dropped from that position in 2019.

Financial Information

Kinder Morgan is considered to be near its fair value by Yahoo Finance fair price indicator. You shouldn’t expect anything more at the moment. However, when the crisis ends, the stock may ride a tiger again. The price is way too far from its highest readings. Moreover, the company’s dividend policy may attract new investors or, at least, hold current ones even during this period of crisis.

Market capitalization: 32.204B

PE Ratio: 24.51

EPS: 0.58

Current ratio: 0.55

Williams Cos (Ticker: WMB)

This company is focused on natural gas pipelines and other energy connected assets. The majority of the activity of the company is in the Northeast of the United States where it provides services to the developers of the Marcellus Basin gas producers. According to analysts, the demand for natural gas will increase in the nearest future as it will substitute carbon to minimize carbon emission and thus to protect the environment. Wiliams Cos has reported losses in the first quarter of 2020. Like the majority of other energy sector's players, they have hit their revenue growth highs in 2018 but retreated from it in 2019.

Financial Information

Williams Cos's stock price is considered to be overvalued by Yahoo Finance fair price indicator. The company has great prospects as it operates in the field of natural gas, which is in demand even during the crisis. The price of the stock is far below its highest levels meaning there is plenty of space to grow in the future. This is one of the best energy stocks to buy now.

Market capitalization: 22.505B

PE Ratio: 171.76

EPS: 0.11

Current ratio: 0.74

Phillips 66 (Ticker: PSX)

This company focuses on motor oil and gas stations across the United States and Canada. Phillips 66 has reported losses in the first quarter along with the majority of its rivals. They have suspended their share repurchases and secured their new two billion USD loan facility. They have also completed one billion USD in bond issuances. Phillips 66's net debt to capitals is 34% but it is not terrible as the chemicals business is in demand, especially in Asian countries. A revenue record was hit in 2018.

Financial Information

Phillips 66's stock price is considered to be undervalued by Yahoo Finance fair price indicator. The motor oil and gas station sector suffers greatly from this crisis, but Phillips 66 has a diversified business producing various chemicals as well. This helps them to keep grounded. This is one of the best energy stocks to invest in if you want to diversify your portfolio.

Market capitalization: 26.663B

PE Ratio: 73.83

EPS: 0.83

Current ratio: 1.11

NuStar Energy (Ticker: NS)

This company operates 10,000 miles of pipelines across the US and owns 75 storage facilities in the country. Their main operational field is located in the middle of the US. Their total storage capabilities are 75 million barrels. They remain in demand for the foreseeable future. The company’s revenue hit the record in 2016, but was below $1.6 billion in the consecutive years. Earnings were below 0 in 2019.

Financial Information

NuStar Energy's stock price is considered to be overvalued by Yahoo Finance fair price indicator. However, the current chart situation shows that the price is far below its highest level. Despite now not being the best time for the energy sector, NuStar Energy’s facilities are sought after. This stock looks promising and this is a good candidate for your portfolio. NuStar can be included in the list of the best energy companies to invest in.

Market capitalization: 1.469B

PE Ratio: N/A

EPS: -1.10

Current ratio: 0.76

Magellan Midstream Partners (Ticker: MMP)

This company operates with refined products such as diesel, jet fuel, and gasoline as well as oil pipelines. Magellan Midstream Partners facilities are connected to main US refineries. Analysts expect the company to find its second wind when the local economies start to reopen. The cars are going to return on the roads which will increase the demand for the production of Magellan Midstream Partners. The debt situation in the company is better in contrast to its main rivals. The company’s revenue has hit the record in 2018 when it went over a $2.8 billion mark. However, the revenue plunged below this level just one year later.

Financial Information

Magellan Midstream Partner's stock price is near fair value according to Yahoo Finance. The company is likely to improve its position once local economies will abolish all current restrictions. MMP is a good candidate for any portfolio including as this is one of the best natural gas stocks.

Market capitalization: 9.232B

PE Ratio: 8.53

EPS: 4.81

Current ratio: 0.38

Exxon Mobile Corp (Ticker: XOM)

It is one of the biggest companies in the industry, not only in the United States, but in this entire world. The dividend yield of 7.5% and its strong balance sheet makes this company a good option for any portfolio. The first quarter losses reached $610 million, which is not surprising as the global economic environment is still 'polluted' by the crisis. Exxon has decreased their expenditures by $10 billion in 2020, which is equal to 30% of its budget. The company’s revenue hit $280 billion mark in 2018, but retreated from it a year ago.

Financial Information

Exxon Mobile Corp's stock is considered to be close to its fair value by the fair value Yahoo Finance indicator. The company’s shares are attractive because of the high dividend yield. However, you should always keep in mind that energy stocks are of a higher risk during the economic crisis. Anyway, if you are in you can pay attention to this company as this is one of the best oil and gas stocks for any portfolio.

Market capitalization: 180.428B

PE Ratio: 16.00

EPS: 2.66

Current ratio: 0.78

EOG Resources (Ticker: EOG)

This is a gas and oil company based in Houston, Texas, the US. EOG Resources has a strong balance sheet and a net debt-to-capital ratio of 10%, which is superior to the giants of this industry, such as Chevron and Exxon Mobil. The dividend rate is 3% and the company is likely to hold its positions for, at least, this year. The company managed to generate $1.7 billion of cash flow in the first trimester of 2020. EOG Resources hit its top revenue level in 2018, but retreated from the peak one year later.

Financial Information

EOG Resources stock is considered to be undervalued by the Yahoo Finance fair price indicator. This situation is normal as the price reflects the global energy market crisis. However, as we have already mentioned energy stocks are sold with great discounts currently and you can add them to your portfolio at a great price.

Market capitalization: 26.425B

PE Ratio: 12.50

EPS: 3.63

Current ratio: 1.51

Conclusion

Those are the stocks that can be added to the list of the most promising assets for every investor’s portfolio in 2020. Even so, bear in mind that investing in the energy market is risky these days as no one really knows when and how the global economy will recover from this massive crisis.

Peter Smith

Peter Smith

Peter Smith

Peter Smith