In may 2020, a total of €881.6 billion of new debt securities were issued by Eurozone residents. The amount of aid amounted to €546.2 billion, and total emissions - €335.4 billion. The annual debt of securities issuers increased from 4.4% in April of 2020 to 5.8% in May of 2020.

Debt securities

The annual growth rate of the remaining debt securities rose from 9.9% in April of 2020 to 17.3% in the following month. As for securities with long-term debt, the average growth rate in April of 2020 rose from 3.9% to 4.9% in May of 2020.

The average growth rate of fixed interest-rate long-term debt securities issued rose from 4.9% in April to 5.9% in May. The average rate of adjustment for outstanding debt securities at long-term variable rates was -1.2% in May, down from -2.1% in April.

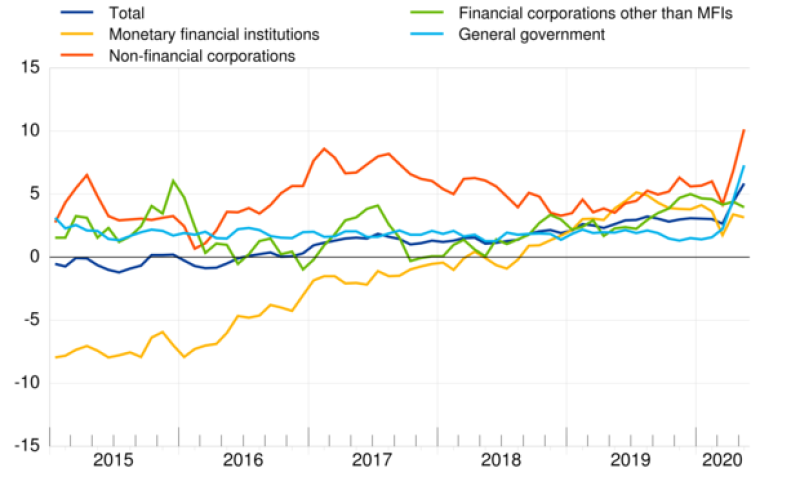

About the sector overview, annual growth rates for non-financial issuing debt securities have risen from 6.8% in April to 10.1% in May. This growth for the Monetary Financial Institutions (MFIs) sector was 3.2% in May, compared to 3.4% in April.

The annual growth rate of debt securities issued by non-MFI financial companies dropped from 4.4% in April of 2020 to 4.0% in May of 2020. This growth trend has gone up for the government from 4.5% in April to 7.3% in May.

In May 2020, the new issuance of euro area residents listed shares amounted to €4.7 billion. Redemptions totaled €10.4 billion and net disbursements ended up being €5.7 billion.

The annual turnover trend in the total sum of traded stock generated by Euro Area citizens was 0.0 percent in May of 2020, the same as in April, except the increase in valuations. The average equity exchange rate of non-financial companies was -0.1% in May of 2020, up from 0.0% in April.

In May of this year, the corresponding exchange rate for MFIs was at 0,0% compared to 0.1% in April. This exchange rate for financial corporations other than MFIs was 0.1 percent in May, compared to 0.0 percent in April.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi