The latest Bank of America's survey was published today. The Market Ear news agency cites the summary of it, which states that most investors since February assume that the market will continue to be bullish. More than a third of investors believe the bearish time is over.

1. Most bullish FMS since Feb’20; we do not think positioning is dangerously bullish 2. We say “peak Policy” theme to cause Sept volatility - but needs disorderly rise in rates 3. Investors say it’s no longer a “bear market rally”....many expect W shaped recovery (37%) or U (31%) 4. US tech (59%) most crowded trade, top tail Covid 19 second wave 5. Asset allocation still skewed towards US growth stocks, but green shoots for inflation assets 6. Contrarian risk on vaccine and higher rates - play via long small cap short tech, risk off political volatility best played via short healthcare stocks themarketear.com

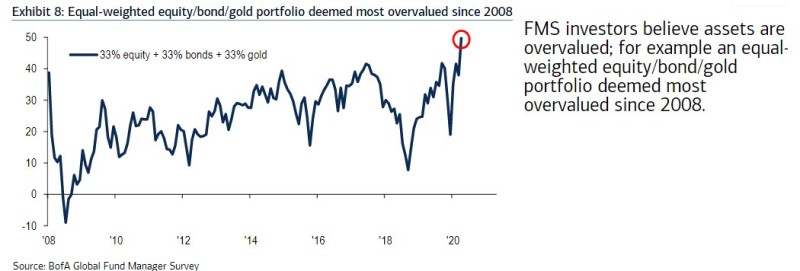

Meanwhile, Jeroen Blokland, the head of Multi Asset Robeco, also talks about data from a Bank of America's survey. He reports that the number of fund managers surveyed who believe all asset classes are overheated is about 50%, which is at its highest since 2008.

The percentage of global fund managers who believe most asset classes are overvalued has risen to the highest level since 2008. Source Bank of America. Jeroen Blokland via Twitter

Thus, it turns out that fund managers are confident that the market is already quite overheated at the moment, but at the same time they still believe that it will continue to grow further.

Apparently, this may be due to the policy of the Federal Reserve and central banks of other countries to counter the economic decline. They continue to cut interest rates and to increase the inflow of money into the markets, so further growth can be expected as long as this strategy continues.

Usman Salis

Usman Salis

Usman Salis

Usman Salis