Despite the worst recession in decades, it is difficult for American companies to stop buying back their own shares from the market. The habit is quite deep-rooted.

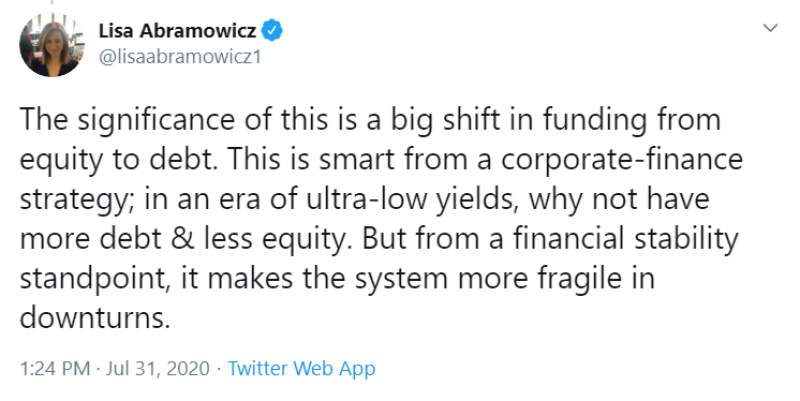

Lisa Abramowicz thinks that such strategy in a global recession only reduces financial stability. She believes that companies need to adapt their strategies to the current realities.

The slump triggered by coronavirus saps corporate earnings, which were projected to slip this year, because many US blue-chips are halting or reducing equity buying. Nonetheless, S&P 500 firms that have posted sales for the second quarter, according to figures by Credit Suisse, they decreased outstanding shares by an average of 0.3% in contrast to the previous year.

Analysts said that many companies will restart transactions quickly if conditions change. Through agreeing to drop interest rates to zero and avoid investing, the Federal Reserve lowered the funding costs of businesses, making them more interested in moving the bulk of their financings into debt.

Lisa believes that if companies are really cheap to borrow money, why not borrow tons, buy back shares, and get rid of the pesky obligations that come with shareholder votes and dividends. With a certain yield, debt is a preferred financing option.

Throughout recent years buybacks have been a hot policy issue and have centred on this spring's parliamentary review on stimulus programmes. Joe Biden and Donald Trump have criticized the trend and found out that massive schemes had also diverted free cash from companies.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi