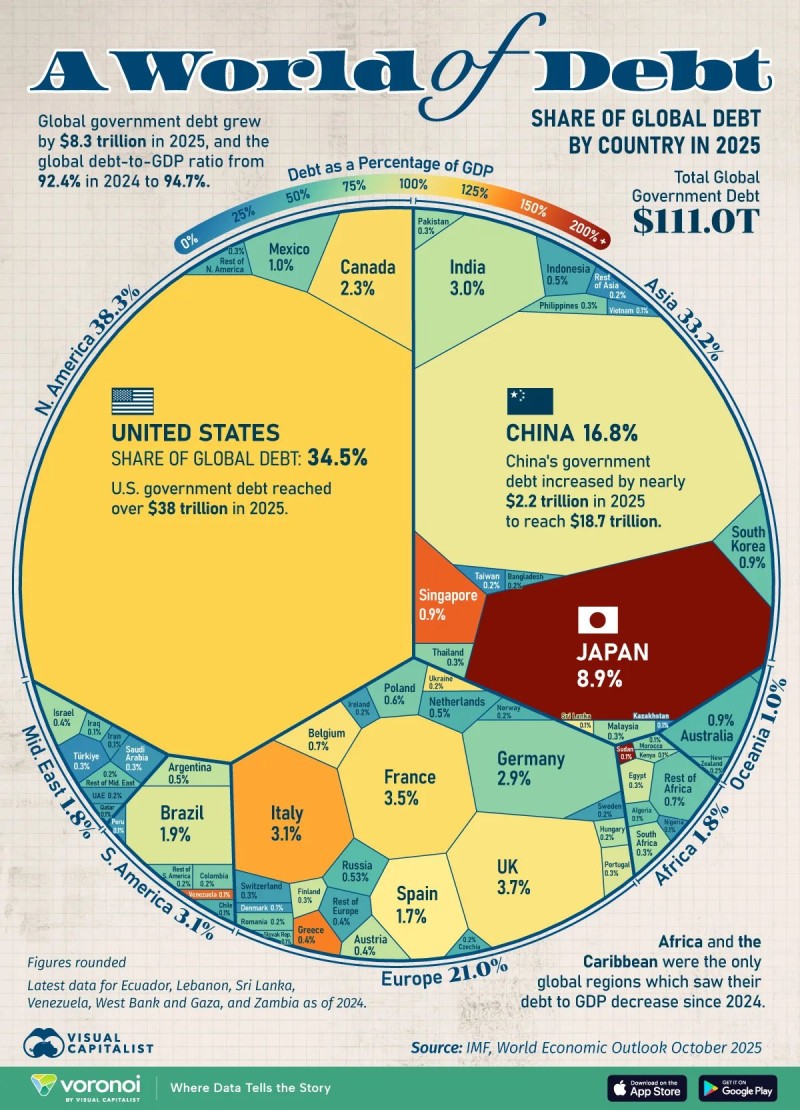

The world is drowning in debt. Government borrowing has hit an eye-watering $111 trillion, marking a new record that's raising alarm bells among economists and policymakers. Recent data based on IMF figures shows that global debt jumped by $8.3 trillion in just one year, pushing the debt-to-GDP ratio from 92.4% to 94.7%. This surge comes at a particularly bad time—economic growth is slowing, interest rates are climbing, and geopolitical tensions are mounting. What makes this situation even more striking is how concentrated the problem is: just three countries hold the majority of all government debt worldwide.

The Big Three: U.S., China, and Japan Dominate Global Debt

When you look at where all this debt is concentrated, three countries stand out dramatically.

These economic giants don't just lead the world in debt—they completely dominate it, holding nearly 60% of the entire global total between them.

- United States: 34.5% of Global Debt — America alone accounts for more than a third of all government debt on the planet. U.S. debt crossed $38 trillion in 2025, making it by far the largest sovereign debtor. When you include the rest of North America, the regional share jumps to 38.3% of the global total.

- China: 16.8% of Global Debt — China comes in second, with government debt reaching $18.7 trillion after adding $2.2 trillion in 2025 alone. The country now represents about half of all debt held across Asia.

- Japan: 8.9% of Global Debt — Despite having a smaller economy than the U.S. or China, Japan maintains the highest debt-to-GDP ratio in the world—over 200%. Decades of fiscal imbalances have kept Japan firmly among the top global debtors.

Together, these three nations hold more than 60% of all government debt worldwide. That's an enormous concentration of fiscal risk in just a handful of economies.

Where Does the Rest of the World Stand?

North America leads with 38.3% of global debt, driven almost entirely by the United States. Asia follows closely at 33.2%, with China and Japan dominating but countries like India, South Korea, and Indonesia adding smaller shares. Europe accounts for 21.0%, with the UK holding 3.7%, France 3.5%, Italy 3.1%, and Germany 2.9%. Latin America, the Middle East, and smaller regions each contribute less individually but collectively reflect widespread fiscal strain. Interestingly, Africa and the Caribbean are the only regions that have actually reduced their debt-to-GDP ratios since 2024.

This breakdown shows where fiscal pressures are building most intensely—and where governments have managed to pull back.

What's Driving Debt Higher?

Several powerful forces are pushing governments deeper into the red. Pandemic recovery spending left massive bills that countries are still paying off. Rising interest rates have made debt servicing far more expensive. Economic growth has slowed across major economies, shrinking tax revenues.

Defense budgets are climbing amid heightened geopolitical tensions. Aging populations are driving up social spending on healthcare and pensions. And large-scale investments in infrastructure and energy transitions require huge upfront costs. All of these factors make it harder for governments to reduce deficits, let alone pay down existing debt.

What This Means for Investors

For investors, a world with $111 trillion in government debt creates both significant risks and potential opportunities. On the risk side, emerging markets face higher chances of sovereign instability. Heavily indebted nations could see credit downgrades, weakening their currencies and reducing their ability to respond during economic downturns.

On the opportunity side, governments will need to issue more bonds, creating openings in fixed-income markets. Safe-haven assets like gold may see increased demand, and volatility across currency and bond markets could create trading opportunities. Understanding which countries are most vulnerable—and which are most stable—is becoming critical for building resilient portfolios.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov