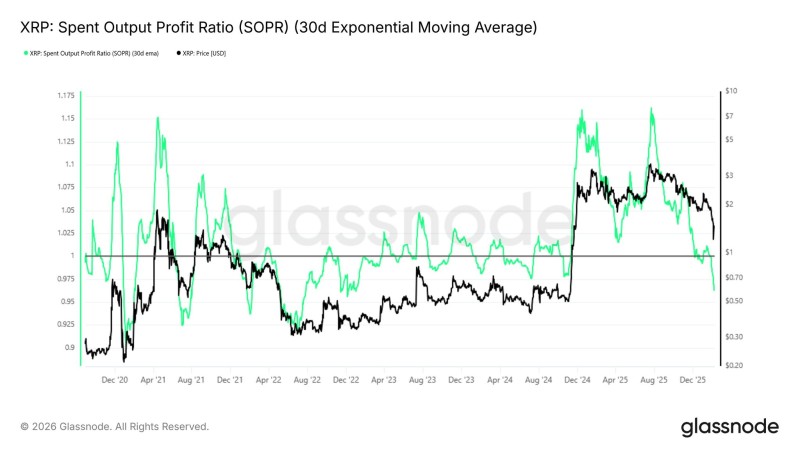

⬤ XRP on-chain behavior is drawing attention as profitability metrics drift toward equilibrium. Recent analysis shows retail traders appear to be selling at a loss while long-term holders show no signs of distribution—all as XRP exchange supply drops rapidly. The chart reveals XRP's 30-day EMA SOPR tracking around the 1.0 breakeven zone and sliding lower toward the end of the period, a classic consolidation signature rather than a cycle top or bottom signal.

⬤ SOPR measures whether coins being moved are sold at profit or loss. Readings near 1.0 mean holders are exiting close to their entry price—neither winning nor losing much. Analysts frame this as an accumulation and consolidation regime, not a tipping point. With exchange supply shrinking, sell-side inventory may be tightening. This mirrors earlier narratives around XRP whale accumulation waves and long-term holder buying, both centered on holder conviction and supply redistribution patterns.

⬤ "Long-term holders aren't selling," recent data suggests, reinforcing the idea that distribution pressure remains muted even as weaker hands capitulate. The chart's historical context shows that extended periods near breakeven often accompany sideways price action rather than immediate trend reversals. Additional on-chain metrics, including shifts in network activity, help illustrate how different participant groups behave during these consolidation windows.

⬤ Why it matters: When SOPR hovers around 1.0 and exchange supply falls, it typically signals a market waiting for its next catalyst while ownership migrates toward stronger, longer-horizon holders. These conditions don't guarantee a breakout, but they do suggest the market is stabilizing internally. If demand returns while supply remains locked off exchanges, the setup could favor upside volatility. For now, XRP appears to be in a holding pattern—coiling, not cracking.

Peter Smith

Peter Smith

Peter Smith

Peter Smith