XRP has broken through key resistance and gained 4.8% in the past day, with bulls now targeting a move to $2.6. While whale accumulation continues, a massive $60 million transfer to Coinbase has some traders on edge.

XRP Price Breaks Key Resistance After Multiple Rejections

XRP finally did what many thought was impossible – it broke through that stubborn resistance level that had been holding it back. This wasn't just any ordinary breakout either. The same resistance zone had rejected XRP's advances three times before, sending the price tumbling each time.

Now trading at $2.39, XRP is sitting at a 3-week high. If it can hold above this level and string together some solid green candles, analysts are eyeing a run to $2.6. But here's the catch – right when things were looking good, someone moved 24.54 million XRP (worth about $60 million) to Coinbase. That's the kind of move that usually means selling is coming.

XRP Whales Keep Accumulating Despite Price Surge

Here's where things get interesting. Despite XRP hitting these new highs, the big players aren't rushing for the exits. According to Santiment data, there are now 2,742 whale wallets holding at least 1 million XRP each – just one short of the all-time record of 2,743.

These whales control a whopping 47.32 billion XRP tokens. What's telling is that even with XRP at these elevated levels, they're not selling. That's usually a good sign that the smart money believes there's more upside ahead.

XRP Market Sentiment Flips from Bearish to Bullish

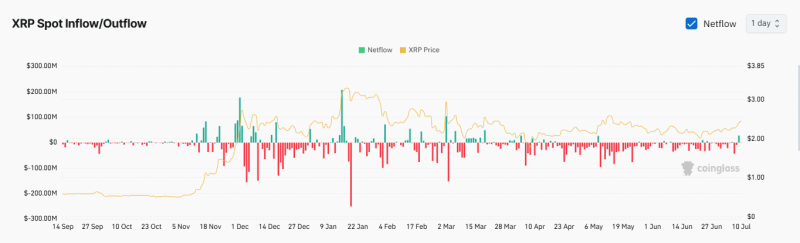

The mood around XRP has completely changed in just a couple of days. On July 9th, spot traders were dumping $27.76 million worth of XRP. But the very next day? They bought $2.45 million worth instead, according to CoinGlass data.

That's not just a small shift – it's a complete 180. And these buyers aren't keeping their XRP on exchanges either. They're moving it to private wallets, which tells us they're thinking long-term, not looking for quick flips.

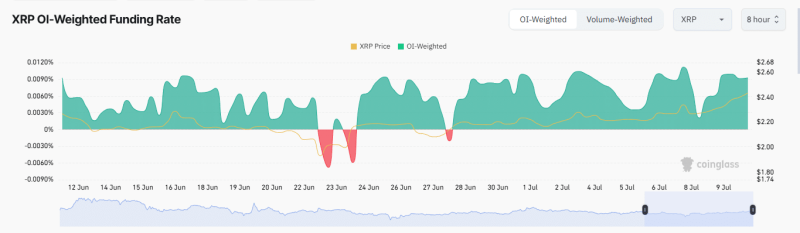

The futures market is telling the same story. The Open Interest Weighted Funding Rate has stayed positive at 0.0091% since June 28th. When this rate stays positive, it means traders are willing to pay extra to hold long positions – basically betting on higher prices.

So while that $60 million transfer to Coinbase might cause some short-term jitters, the bigger picture looks pretty bullish. Whales are accumulating, spot traders have turned buyers, and futures traders are betting on more upside. If this keeps up, that $2.6 target might be closer than many think.

Usman Salis

Usman Salis

Usman Salis

Usman Salis