Growth in Trading Volumes on Decentralized Exchanges

Since this year, operation in the decentralized finance (DeFi) industry has continuously been growing. Despite the recent decrease in value of about $9 billion, the overall locked value in DeFi protocols has again crossed $11 billion. This illustrates how much operation and emphasis the market offers, which earns buyers a high price for their cryptocurrencies.

DeFi Pulse is reportedly keeping $11.13 billion of assets loaded into different DeFi protocols, based on the data supplied by the market research portal. At the same time, Uniswap is in the first place in terms of the number of funds frozen on smart contracts.

Decentralized Exchanges Overtake Centralized Ones

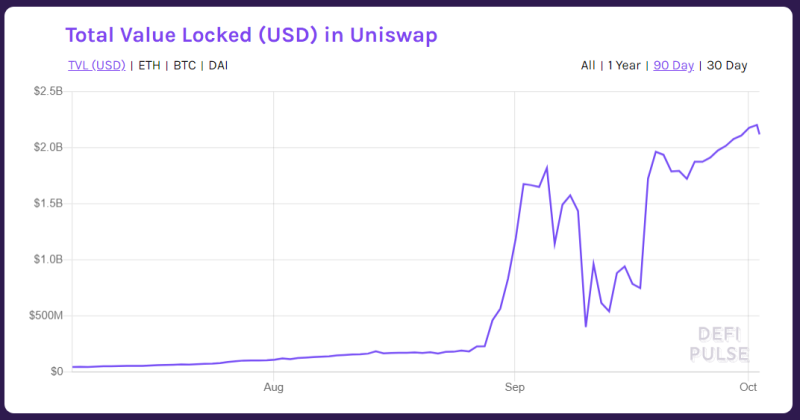

According to DeFi Pulse, Uniswap, Maker and Aave are the three top DeFi protocols with the greatest properties. The market leads with 18.58, the world's first decentralized currency exchange (DEX), Uniswap, with a total network volume of about US $2.07 billion. Maker and Aave have lending channels of about 1.95 billion dollars and 1.53 billion dollars, respectively.

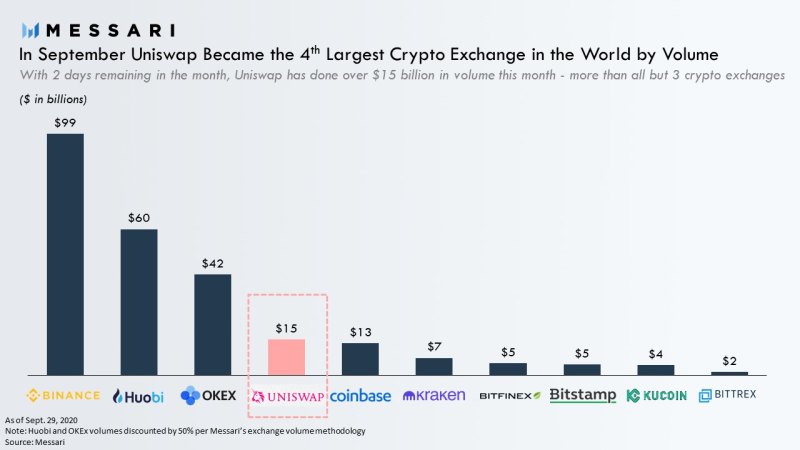

Messari analytical agency also compared trading volumes on different cryptocurrency exchanges. It turned out that Uniswap overtakes mastodons such as Coinbase and Kraken in terms of volume.

Valuation for nascent protocols is more art than science. This is especially true for Uniswap, given that it doesn’t yet have an economic model.The above is purely illustrative and one of many ways to frame valuation. Messari @MessariCrypto via Twitter

The decentralized demand for finances has expanded tremendously in previous months and primarily in 2020. It has taken the industry nearly two and a half years to hit TVL (total value locked) $1 billion. But within a year, the assets found in the protocols could rise to an estimated $10 billion.

Uniswap's Background

Uniswap has evolved into a decentralized multi-billion dollars exchange from a simple proof of concept funded by an Ethereum Foundation grants and created by an unexploited Ethereum creator in just three years.

It funds hundreds of millions of dollars a day and is actually one of the world's biggest crypt trade. It has contributed over 60 million dollars to its more than 40,000 single suppliers of liquidity, who contributed $2 billion of capital to create liquidity for their trade.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov