TRX is climbing after Justin Sun's Nasdaq moment, but the real story is Tron beating Ethereum with $80B in USDT and crushing daily transfer volumes.

Sure, Justin Sun got his Nasdaq moment on July 24th when he rang the opening bell, but honestly? That's not why TRX holders should be excited. While everyone was watching the ceremony, Tron was busy eating Ethereum's lunch in the stablecoin game.

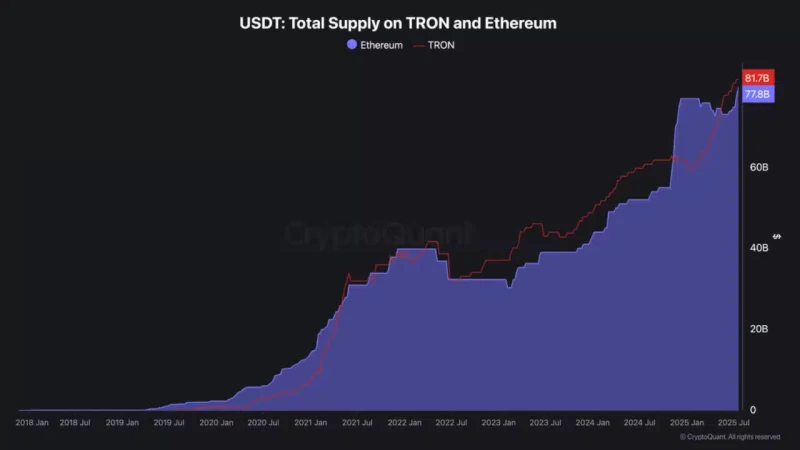

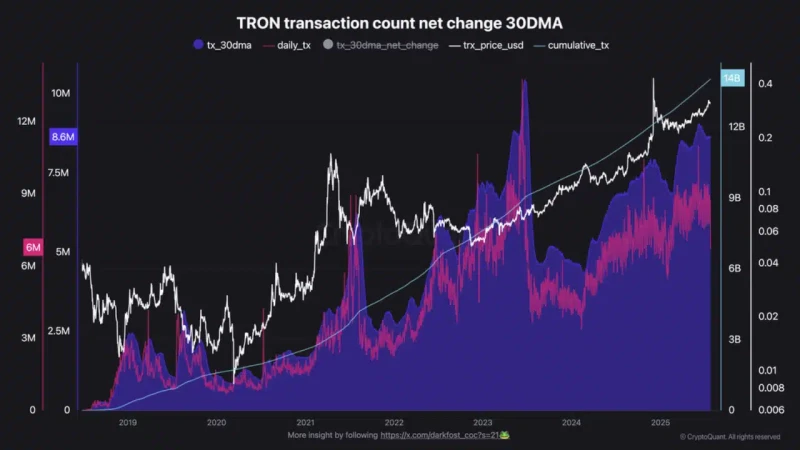

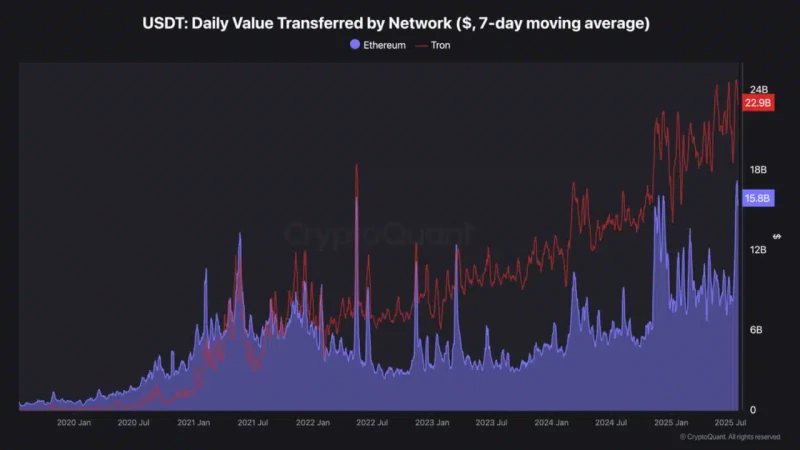

Here's what actually matters: Tron just hit $2 billion in total fees, processed over 14 billion transactions, and is now hosting more than $80 billion in USDT. The kicker? They've completely overtaken Ethereum in both stablecoin supply and daily transfers. That's not just impressive – that's a complete flip of the script.

The best part is this isn't some flash-in-the-pan pump. The growth has been steady all year, which means real people are actually using this stuff. And since most fees get paid in TRX, all this activity is directly boosting demand for the token.

Why TRX Is Actually Winning Right Now

Let's talk numbers because they're pretty wild. Tron is now handling over $20 billion in USDT transfers every single day, while Ethereum is stuck at $16 billion. Daily transactions are averaging 8-9 million – that's double what we saw in the last bear market.

But here's the thing that makes TRX holders smile: every single one of those transactions needs TRX to pay fees. More transactions = more TRX demand. It's that simple.

The network minted over $22 billion worth of USDT just in 2025 alone. Why? Because people figured out it's way cheaper and faster to move stablecoins on Tron than on Ethereum. Once you try sending USDT for pennies instead of dollars, you don't go back.

TRX Price Action Looks Solid

After the Nasdaq splash, TRX has been climbing steadily. The charts show strong buying between $0.316 and $0.318, and the money flow indicators are staying positive. That's usually a good sign that real money is coming in, not just day traders playing around.

What's cool is this isn't just hype-driven. Yeah, the Nasdaq thing got attention, but the real driver is that TRX is actually useful now. When you're processing billions in stablecoin transfers daily, that creates genuine token demand.

The cycle is pretty obvious: more USDT activity → more transactions → more TRX fees → higher TRX demand. Rinse and repeat.

What TRX Holders Should Know

This is one of those rare moments in crypto where the hype actually matches the fundamentals. You've got mainstream attention from Nasdaq plus rock-solid network growth. That combo doesn't happen often.

The stablecoin dominance is the real game-changer here. USDT is basically the oil of crypto – everything runs on it. And Tron has become the cheapest pipeline to move it around. That's not going anywhere.

With Tron beating Ethereum in stablecoin activity and fees climbing steadily all year, TRX looks like it's benefiting from actual utility, not just market buzz. For a blockchain that started as an "Ethereum killer," overtaking ETH in stablecoin transfers is a pretty big deal.

The question now is whether they can keep this momentum. Based on how steady the growth has been, this looks more like a fundamental shift than a temporary pump. People have discovered that moving USDT on Tron is way better than dealing with Ethereum's high fees, and habits like that tend to stick.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah