Tron cryptocurrency encounters significant selling pressure as data shows a substantial 10.45 billion TRX sell wall forming, potentially limiting upward price movement despite founder Justin Sun's optimistic all-time high predictions.

Tron (TRX) Price Dips 1.26% Amid Emerging Sell Wall

Tron (TRX) has registered a 1.26% decrease in price over the last 24 hours, bringing it to a trading value of $0.2441. This downward movement coincides with a notable development in the Tron ecosystem that suggests challenging times ahead for the cryptocurrency. According to data from IntoTheBlock, a substantial sell wall has emerged on-chain, potentially creating a significant barrier to TRX's upward price momentum.

A sell wall occurs when multiple holders place numerous sell orders at the same price level, creating resistance that can discourage potential buyers. This concentrated selling pressure often serves as a psychological and practical barrier to price appreciation, as buyers may be reluctant to purchase the asset when they observe strong resistance ahead.

Tron (TRX) Faces 10.45 Billion Token Resistance Level

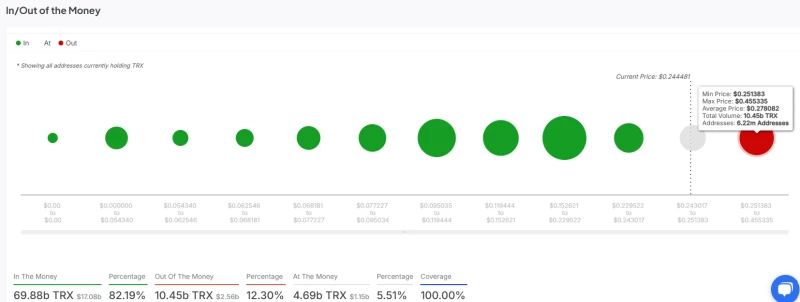

IntoTheBlock's Global In/Out of the Money data provides detailed insight into this developing situation. The data reveals that approximately 10.45 billion TRX tokens are currently positioned as a barrier to TRX's upward price movement. This massive volume of tokens has an average price of $0.2781, with a distribution ranging between a maximum of $0.4553 and a minimum of $0.2514.

The implications of this sell wall are particularly significant when considering TRX's current market price of $0.2441. At this price level, approximately 6.22 million addresses are presently experiencing losses on their TRX holdings. This large concentration of potentially discouraged investors could intensify selling pressure, further reinforcing the resistance to price growth for TRX in the near term.

Tron (TRX) Trading Volume Plummets 33.99% Amid Market Caution

The market's response to these developments has been notable, with TRX's trading volume experiencing a substantial decline. According to CoinMarketCap data, trading volume has plummeted by 33.99% to $480.99 million in the last 24 hours. This significant reduction in trading activity suggests that buyers have become increasingly cautious about committing their capital to TRX.

The dramatic drop in trading volume indicates that many market participants may be adopting a wait-and-see approach, reluctant to engage with TRX while facing the prospect of strong selling pressure ahead. This buyer hesitation could further compound the challenges TRX faces in achieving price growth in the short term, as decreased demand typically makes it difficult for an asset to break through established resistance levels.

Tron (TRX) Founder's ATH Prediction Faces 45% Gap Challenge

Despite these concerning on-chain metrics, Tron founder Justin Sun has recently expressed strong optimism about TRX's price potential. Sun has boldly predicted that TRX will reach a new all-time high (ATH) before the end of June this year. This prediction stands in stark contrast to the current market sentiment and technical indicators.

It's worth noting that TRX has actually shown resilience over a slightly longer timeframe, posting a 2.44% increase over the past seven days despite the current sell wall concerns. However, market observers are keenly watching to see how TRX might overcome the present obstacles to fulfill Sun's ambitious price prediction.

The cryptocurrency's current all-time high of $0.4407 was achieved in December 2024. With approximately 70 days remaining until the end of Q2, TRX faces the challenge of closing a roughly 45% price performance gap to reach this milestone. This would require significant buying pressure to overcome the substantial 10.45 billion TRX sell wall that currently stands in its path.

As the second quarter progresses, the interplay between these competing factors—the substantial sell wall resistance versus the positive momentum from Sun's prediction and community support—will likely determine TRX's price trajectory in the coming months. Investors and traders will be closely monitoring both on-chain metrics and market sentiment for signs of which force will ultimately prevail.

Peter Smith

Peter Smith

Peter Smith

Peter Smith