Pavel Durov's arrest has sparked significant changes for Toncoin (TON), with trading volumes surging despite a drop in Total Value Locked (TVL).

Pavel Durov’s Arrest Sparks Changes for Toncoin

On August 24, 2024, the arrest of Telegram’s founder, Pavel Durov, by French authorities led to unexpected ripple effects on both Telegram and its associated cryptocurrency, Toncoin (TON). Durov's arrest, allegedly linked to illegal activities on Telegram, has been widely viewed as an attack on free speech, inadvertently driving up interest in Telegram and Toncoin. This phenomenon, often referred to as the Streisand Effect, has caused significant shifts in the performance of TON, both positive and negative.

Following the news of Durov’s arrest, both Telegram and Toncoin witnessed remarkable activity spikes. By August 26, 2024, just two days after the incident, daily transactions on the Toncoin blockchain skyrocketed by 192%, hitting 2.8 million transactions. This surge marked the highest transaction volume recorded for Toncoin in 2024 and the second-highest in the blockchain’s history. Alongside this, the number of daily active addresses also surged by 215%, reaching an all-time high of 888.9K.

Impact on Trading Volumes and Exchanges

Trading volumes on decentralized exchanges (DEXs) dealing with Toncoin mirrored these increases, witnessing an 849% jump to an all-time high of $167.9 million. Despite these spikes, the Toncoin market did experience some downturns. The Total Value Locked (TVL) in decentralized applications (dApps) tied to Toncoin dropped by 39%, falling to $312 million. This decline, while partially attributed to the market’s reaction to the arrest, might also reflect users withdrawing and liquidating assets in anticipation of further volatility.

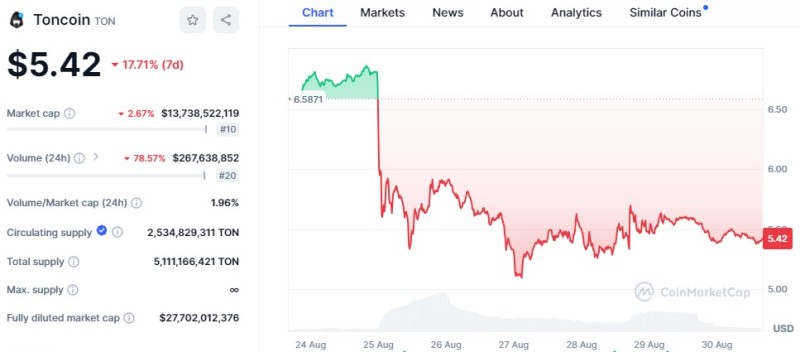

Toncoin’s market capitalization saw a 24% decline, reaching $12.9 billion by August 27. However, the situation wasn’t entirely bleak. Despite the initial drop, net trading volumes on major exchanges like Binance shifted positively. On the day of Durov's arrest, the net volume for TON on Binance fell from -$37.83 million to -$57.26 million but rebounded to $41.57 million by August 28, marking a substantial swing of nearly $100 million. Similar patterns were observed on other leading exchanges such as OKX and Bybit, where TON also saw a shift from negative to positive net volumes.

Future Outlook for Telegram and Toncoin

The arrest of Pavel Durov has undeniably cast a spotlight on Telegram and Toncoin, leading to a mix of challenges and opportunities. While the surge in activity may indicate growing interest, the future remains uncertain. The ongoing investigation and regulatory scrutiny will likely continue to influence TON’s market performance. Investors and users alike are keeping a close eye on these developments, as any further legal actions could have significant ramifications for both Telegram and Toncoin. The regulatory environment remains a key factor, making TON a potentially risky investment until the legal situation stabilizes.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah